an9725r wv.us taxrev forms 2008/

•

0 likes•69 views

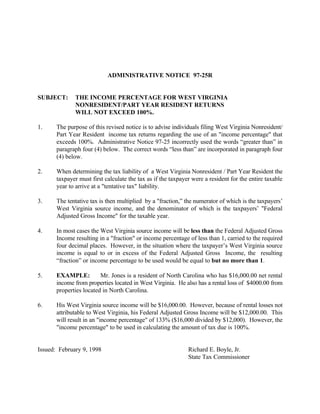

This administrative notice clarifies how to calculate the income percentage for West Virginia nonresident or part-year resident tax returns. The income percentage is determined by dividing a taxpayer's West Virginia source income by their total federal adjusted gross income. In most cases, the percentage will be less than 100% but cannot exceed 100%. An example is provided where a taxpayer's West Virginia income results in a percentage of 133% of their total income, but the notice states the maximum percentage to use is 100%.

Report

Share

Report

Share

Download to read offline

Recommended

Charitable donations ppp slide show

Out Of The Ashes Devlopment Council is a non-profit organization dedicated to educating and advocating on behalf of those affected by Childhood Obesity, Domestic Violence, and Sexual Misconduct.

Cross Border Corporate and Individual Tax Planning

Peter and Harriet were invited to speak at an event hosted by Dentons law firm for Belgium investors interested in expanding their business on U.S. soil.

Recommended

Charitable donations ppp slide show

Out Of The Ashes Devlopment Council is a non-profit organization dedicated to educating and advocating on behalf of those affected by Childhood Obesity, Domestic Violence, and Sexual Misconduct.

Cross Border Corporate and Individual Tax Planning

Peter and Harriet were invited to speak at an event hosted by Dentons law firm for Belgium investors interested in expanding their business on U.S. soil.

US Expat Foreign Bank, Financial & Asset Reporting Guidance

US Expatriate Tax Presentation given in Puerto Vallarta and Melaque Mexico for Americans living there concerning filing FBAR forms, form 8938 and other required IRS foreign reporting forms by Don D. Nelson, Attorney, CPA. His website at www.taxmeless.com has a wealth of additional information

Acc 565 final exam guide

For more course tutorials visit

uophelp.com is now newtonhelp.com

www.newtonhelp.com

Please check the Details Below

ACC 565 Final Exam Guide

Question 1

Barbara sells a house with an FMV of $170,000 to her daughter for $120,000. From this transaction, Barbara is deemed to have made a gift (before the annual exclusion) of

Question 2

If a state has adopted the Revised Uniform Principal and Income Act, which of the following statements is correct?

Economic Impact Payments: What You Need to Know.

Do you know if you will get a stimulus check? The #IRS and @USTreasury announce that the distribution of economic impact payments will begin in the next three weeks with no action required for most people. For more details and the most up to date information go to www.irs.gov/coronavirus #taxes2020

Prescribed Rate Loans

Planning pays, keep your money and set up your investment with the purpose of minimizing family taxes.

Directors pension comparison

This is an excellent comparison of pension outcomes for directors put together by St James Place.

US Expat Taxes Series Overview

US Expat Taxes Explained is a summary overview of our new series about US Expatriate Tax Returns and have the components work. By Greenback Expat Tax Services

More Related Content

What's hot

US Expat Foreign Bank, Financial & Asset Reporting Guidance

US Expatriate Tax Presentation given in Puerto Vallarta and Melaque Mexico for Americans living there concerning filing FBAR forms, form 8938 and other required IRS foreign reporting forms by Don D. Nelson, Attorney, CPA. His website at www.taxmeless.com has a wealth of additional information

Acc 565 final exam guide

For more course tutorials visit

uophelp.com is now newtonhelp.com

www.newtonhelp.com

Please check the Details Below

ACC 565 Final Exam Guide

Question 1

Barbara sells a house with an FMV of $170,000 to her daughter for $120,000. From this transaction, Barbara is deemed to have made a gift (before the annual exclusion) of

Question 2

If a state has adopted the Revised Uniform Principal and Income Act, which of the following statements is correct?

Economic Impact Payments: What You Need to Know.

Do you know if you will get a stimulus check? The #IRS and @USTreasury announce that the distribution of economic impact payments will begin in the next three weeks with no action required for most people. For more details and the most up to date information go to www.irs.gov/coronavirus #taxes2020

Prescribed Rate Loans

Planning pays, keep your money and set up your investment with the purpose of minimizing family taxes.

Directors pension comparison

This is an excellent comparison of pension outcomes for directors put together by St James Place.

US Expat Taxes Series Overview

US Expat Taxes Explained is a summary overview of our new series about US Expatriate Tax Returns and have the components work. By Greenback Expat Tax Services

What's hot (17)

US Expat Foreign Bank, Financial & Asset Reporting Guidance

US Expat Foreign Bank, Financial & Asset Reporting Guidance

Viewers also liked (7)

Schedules 1 & 2 for the IT-40: Indiana Deductions and Credits

Schedules 1 & 2 for the IT-40: Indiana Deductions and Credits

Similar to an9725r wv.us taxrev forms 2008/

California Exit Tax Planning

A comprehensive guide of practical planning solutions for business owners and individuals looking to leave California and maintain good financial standing.

This presentation and these materials are designed to provide information in regard to the subject matter

covered. This presentation and these materials are provided solely as a teaching tool, with the

understanding that Stephen Moskowitz, Moskowitz LLP, and the instructor are not engaged in rendering

legal, accounting, or other professional service and that they are not offering such advice in this

presentation and these accompanying materials.

FBAR and US Taxes for Expatriates - Intercam Presentation , Ixtapa, Mexico

All about FBARS, 8938s and US Taxation for Americans Living in Mexico

Overseas filing for us taxpayers 2017

US Fiscal obligations of US Tax Citizens living in Spain. 2017

Need to Know Seminar of the American Club of Madrid

Income Tax Basics by Burnie Maybank, South Carolina Economic Development 101,...

Burnie Maybank hosted the Nexsen Pruet Newbie Seminar on December 1, 2011. The Newbie Seminar is designed for those new to the economic development field in South Carolina or those who would like some brushing up. Covered topics included basic property, sales and income taxes, as well as Bonds, the utility tax credit and FOIA.

Similar to an9725r wv.us taxrev forms 2008/ (20)

FBAR and US Taxes for Expatriates - Intercam Presentation , Ixtapa, Mexico

FBAR and US Taxes for Expatriates - Intercam Presentation , Ixtapa, Mexico

Income Tax Basics by Burnie Maybank, South Carolina Economic Development 101,...

Income Tax Basics by Burnie Maybank, South Carolina Economic Development 101,...

ACM NTK seminar Overseas filing for us taxpayers 2017

ACM NTK seminar Overseas filing for us taxpayers 2017

More from taxman taxman

More from taxman taxman (20)

Recently uploaded

Attending a job Interview for B1 and B2 Englsih learners

It is a sample of an interview for a business english class for pre-intermediate and intermediate english students with emphasis on the speking ability.

Putting the SPARK into Virtual Training.pptx

This 60-minute webinar, sponsored by Adobe, was delivered for the Training Mag Network. It explored the five elements of SPARK: Storytelling, Purpose, Action, Relationships, and Kudos. Knowing how to tell a well-structured story is key to building long-term memory. Stating a clear purpose that doesn't take away from the discovery learning process is critical. Ensuring that people move from theory to practical application is imperative. Creating strong social learning is the key to commitment and engagement. Validating and affirming participants' comments is the way to create a positive learning environment.

Affordable Stationery Printing Services in Jaipur | Navpack n Print

Looking for professional printing services in Jaipur? Navpack n Print offers high-quality and affordable stationery printing for all your business needs. Stand out with custom stationery designs and fast turnaround times. Contact us today for a quote!

Lookback Analysis

Explore our most comprehensive guide on lookback analysis at SafePaaS, covering access governance and how it can transform modern ERP audits. Browse now!

Search Disrupted Google’s Leaked Documents Rock the SEO World.pdf

The world of search engine optimization (SEO) is buzzing with discussions after Google confirmed that around 2,500 leaked internal documents related to its Search feature are indeed authentic. The revelation has sparked significant concerns within the SEO community. The leaked documents were initially reported by SEO experts Rand Fishkin and Mike King, igniting widespread analysis and discourse. For More Info:- https://news.arihantwebtech.com/search-disrupted-googles-leaked-documents-rock-the-seo-world/

Taurus Zodiac Sign_ Personality Traits and Sign Dates.pptx

Explore the world of the Taurus zodiac sign. Learn about their stability, determination, and appreciation for beauty. Discover how Taureans' grounded nature and hardworking mindset define their unique personality.

Memorandum Of Association Constitution of Company.ppt

www.seribangash.com

A Memorandum of Association (MOA) is a legal document that outlines the fundamental principles and objectives upon which a company operates. It serves as the company's charter or constitution and defines the scope of its activities. Here's a detailed note on the MOA:

Contents of Memorandum of Association:

Name Clause: This clause states the name of the company, which should end with words like "Limited" or "Ltd." for a public limited company and "Private Limited" or "Pvt. Ltd." for a private limited company.

https://seribangash.com/article-of-association-is-legal-doc-of-company/

Registered Office Clause: It specifies the location where the company's registered office is situated. This office is where all official communications and notices are sent.

Objective Clause: This clause delineates the main objectives for which the company is formed. It's important to define these objectives clearly, as the company cannot undertake activities beyond those mentioned in this clause.

www.seribangash.com

Liability Clause: It outlines the extent of liability of the company's members. In the case of companies limited by shares, the liability of members is limited to the amount unpaid on their shares. For companies limited by guarantee, members' liability is limited to the amount they undertake to contribute if the company is wound up.

https://seribangash.com/promotors-is-person-conceived-formation-company/

Capital Clause: This clause specifies the authorized capital of the company, i.e., the maximum amount of share capital the company is authorized to issue. It also mentions the division of this capital into shares and their respective nominal value.

Association Clause: It simply states that the subscribers wish to form a company and agree to become members of it, in accordance with the terms of the MOA.

Importance of Memorandum of Association:

Legal Requirement: The MOA is a legal requirement for the formation of a company. It must be filed with the Registrar of Companies during the incorporation process.

Constitutional Document: It serves as the company's constitutional document, defining its scope, powers, and limitations.

Protection of Members: It protects the interests of the company's members by clearly defining the objectives and limiting their liability.

External Communication: It provides clarity to external parties, such as investors, creditors, and regulatory authorities, regarding the company's objectives and powers.

https://seribangash.com/difference-public-and-private-company-law/

Binding Authority: The company and its members are bound by the provisions of the MOA. Any action taken beyond its scope may be considered ultra vires (beyond the powers) of the company and therefore void.

Amendment of MOA:

While the MOA lays down the company's fundamental principles, it is not entirely immutable. It can be amended, but only under specific circumstances and in compliance with legal procedures. Amendments typically require shareholder

Digital Transformation in PLM - WHAT and HOW - for distribution.pdf

Presentation describing the Digital Transformation for PLM in the context of a Dassault Systemes portfolio.

What is the TDS Return Filing Due Date for FY 2024-25.pdf

It is crucial for the taxpayers to understand about the TDS Return Filing Due Date, so that they can fulfill your TDS obligations efficiently. Taxpayers can avoid penalties by sticking to the deadlines and by accurate filing of TDS. Timely filing of TDS will make sure about the availability of tax credits. You can also seek the professional guidance of experts like Legal Pillers for timely filing of the TDS Return.

What are the main advantages of using HR recruiter services.pdf

HR recruiter services offer top talents to companies according to their specific needs. They handle all recruitment tasks from job posting to onboarding and help companies concentrate on their business growth. With their expertise and years of experience, they streamline the hiring process and save time and resources for the company.

Improving profitability for small business

In this comprehensive presentation, we will explore strategies and practical tips for enhancing profitability in small businesses. Tailored to meet the unique challenges faced by small enterprises, this session covers various aspects that directly impact the bottom line. Attendees will learn how to optimize operational efficiency, manage expenses, and increase revenue through innovative marketing and customer engagement techniques.

Accpac to QuickBooks Conversion Navigating the Transition with Online Account...

This article provides a comprehensive guide on how to

effectively manage the convert Accpac to QuickBooks , with a particular focus on utilizing online accounting services to streamline the process.

Exploring Patterns of Connection with Social Dreaming

Exploring Patterns of Connection -Introduction to Social Dreaming

#Systems Psychodynamics

#Innovation

#Creativity

#Consultancy

#Coaching

Business Valuation Principles for Entrepreneurs

This insightful presentation is designed to equip entrepreneurs with the essential knowledge and tools needed to accurately value their businesses. Understanding business valuation is crucial for making informed decisions, whether you're seeking investment, planning to sell, or simply want to gauge your company's worth.

Recently uploaded (20)

Attending a job Interview for B1 and B2 Englsih learners

Attending a job Interview for B1 and B2 Englsih learners

Affordable Stationery Printing Services in Jaipur | Navpack n Print

Affordable Stationery Printing Services in Jaipur | Navpack n Print

Search Disrupted Google’s Leaked Documents Rock the SEO World.pdf

Search Disrupted Google’s Leaked Documents Rock the SEO World.pdf

chapter 10 - excise tax of transfer and business taxation

chapter 10 - excise tax of transfer and business taxation

Taurus Zodiac Sign_ Personality Traits and Sign Dates.pptx

Taurus Zodiac Sign_ Personality Traits and Sign Dates.pptx

Memorandum Of Association Constitution of Company.ppt

Memorandum Of Association Constitution of Company.ppt

Digital Transformation in PLM - WHAT and HOW - for distribution.pdf

Digital Transformation in PLM - WHAT and HOW - for distribution.pdf

What is the TDS Return Filing Due Date for FY 2024-25.pdf

What is the TDS Return Filing Due Date for FY 2024-25.pdf

What are the main advantages of using HR recruiter services.pdf

What are the main advantages of using HR recruiter services.pdf

Accpac to QuickBooks Conversion Navigating the Transition with Online Account...

Accpac to QuickBooks Conversion Navigating the Transition with Online Account...

Exploring Patterns of Connection with Social Dreaming

Exploring Patterns of Connection with Social Dreaming

Set off and carry forward of losses and assessment of individuals.pptx

Set off and carry forward of losses and assessment of individuals.pptx

an9725r wv.us taxrev forms 2008/

- 1. ADMINISTRATIVE NOTICE 97-25R SUBJECT: THE INCOME PERCENTAGE FOR WEST VIRGINIA NONRESIDENT/PART YEAR RESIDENT RETURNS WILL NOT EXCEED 100%. 1. The purpose of this revised notice is to advise individuals filing West Virginia Nonresident/ Part Year Resident income tax returns regarding the use of an quot;income percentagequot; that exceeds 100%. Administrative Notice 97-25 incorrectly used the words “greater than” in paragraph four (4) below. The correct words “less than” are incorporated in paragraph four (4) below. 2. When determining the tax liability of a West Virginia Nonresident / Part Year Resident the taxpayer must first calculate the tax as if the taxpayer were a resident for the entire taxable year to arrive at a quot;tentative taxquot; liability. 3. The tentative tax is then multiplied by a quot;fraction,” the numerator of which is the taxpayers’ West Virginia source income, and the denominator of which is the taxpayers’ quot;Federal Adjusted Gross Incomequot; for the taxable year. 4. In most cases the West Virginia source income will be less than the Federal Adjusted Gross Income resulting in a quot;fractionquot; or income percentage of less than 1, carried to the required four decimal places. However, in the situation where the taxpayer’s West Virginia source income is equal to or in excess of the Federal Adjusted Gross Income, the resulting “fraction” or income percentage to be used would be equal to but no more than 1. 5. EXAMPLE: Mr. Jones is a resident of North Carolina who has $16,000.00 net rental income from properties located in West Virginia. He also has a rental loss of $4000.00 from properties located in North Carolina. 6. His West Virginia source income will be $16,000.00. However, because of rental losses not attributable to West Virginia, his Federal Adjusted Gross Income will be $12,000.00. This will result in an quot;income percentagequot; of 133% ($16,000 divided by $12,000). However, the quot;income percentagequot; to be used in calculating the amount of tax due is 100%. Issued: February 9, 1998 Richard E. Boyle, Jr. State Tax Commissioner