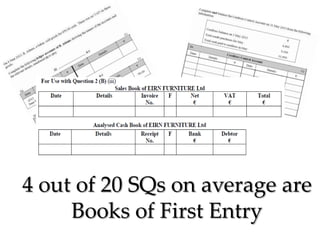

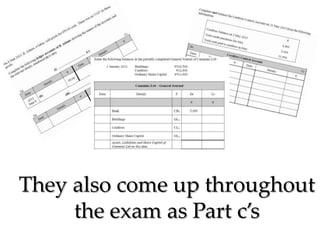

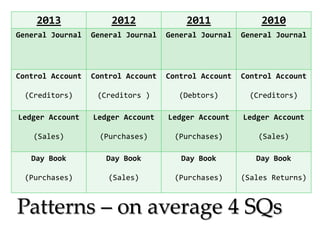

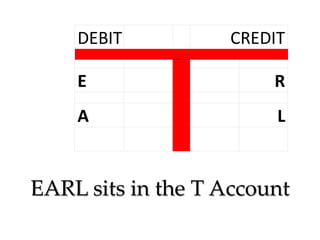

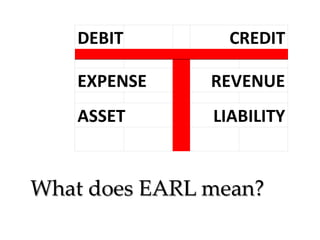

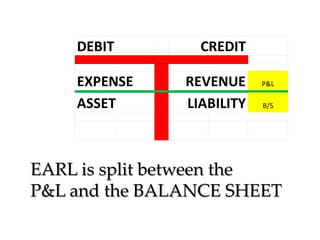

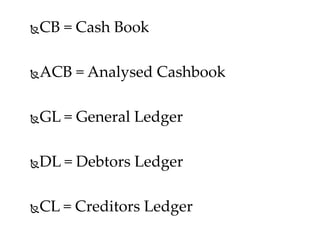

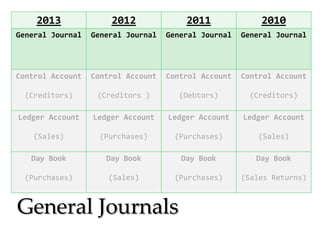

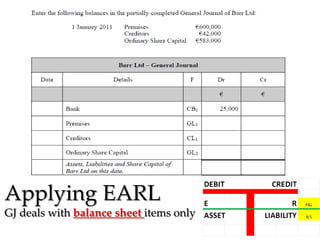

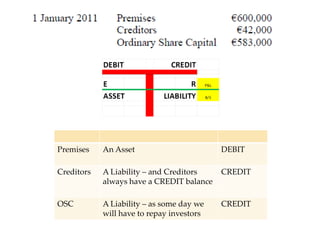

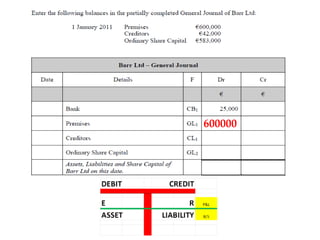

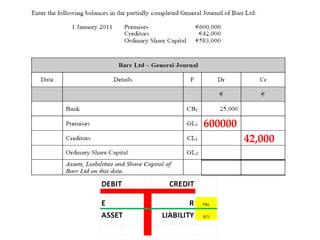

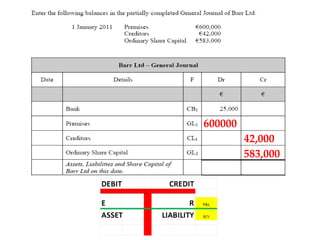

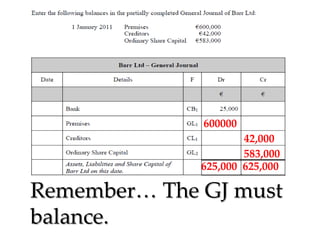

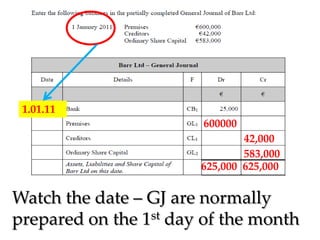

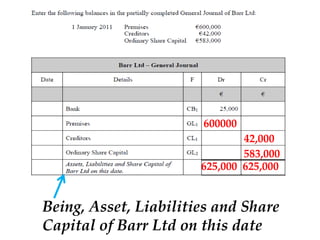

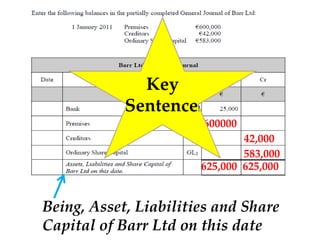

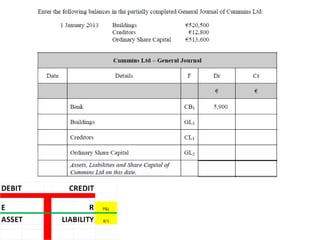

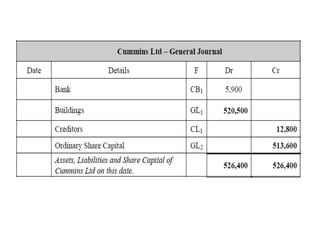

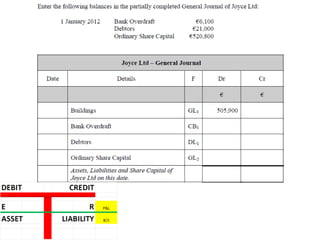

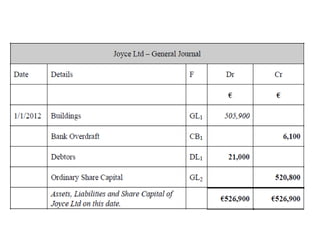

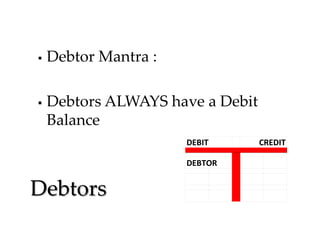

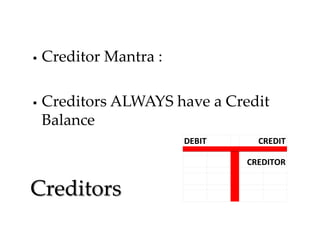

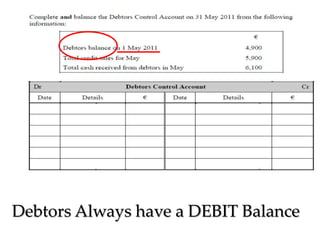

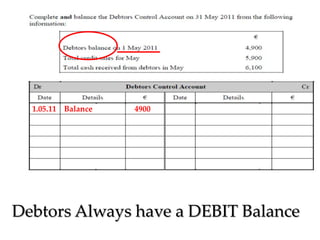

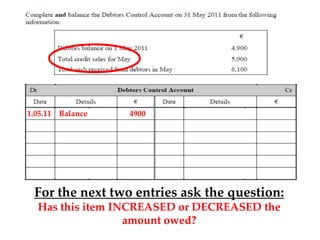

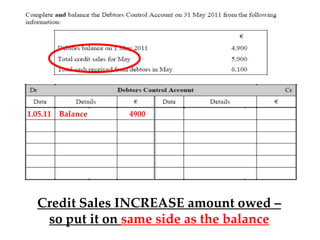

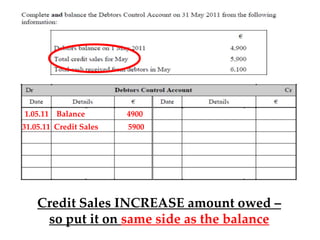

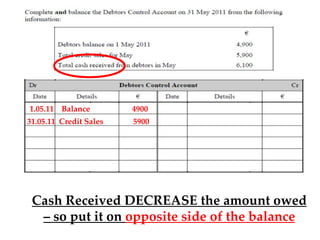

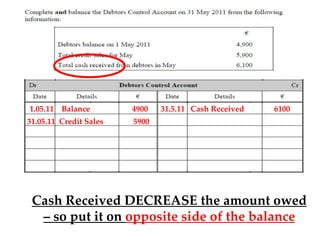

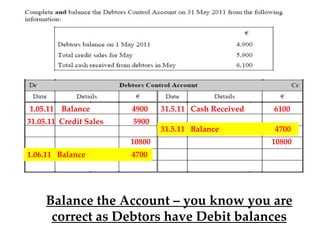

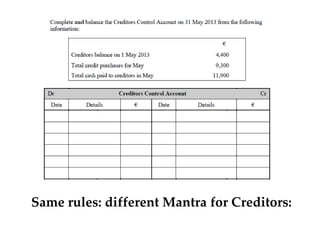

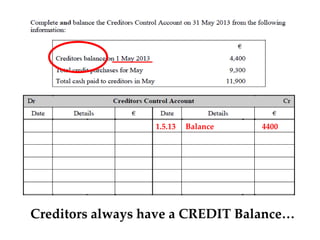

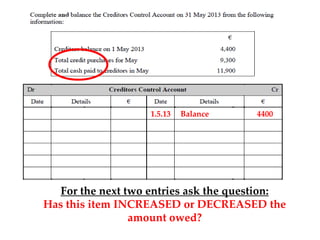

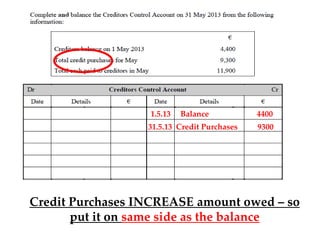

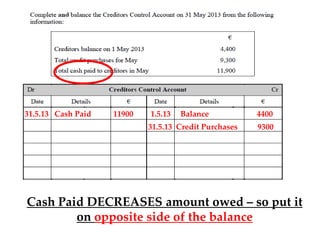

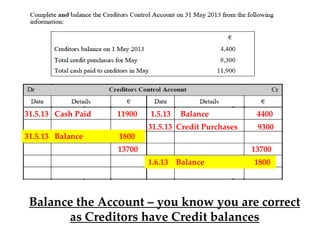

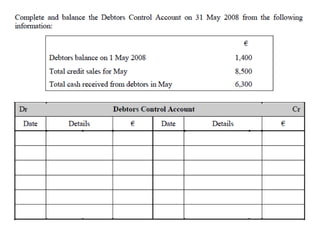

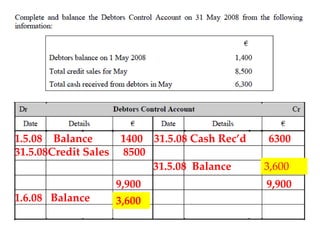

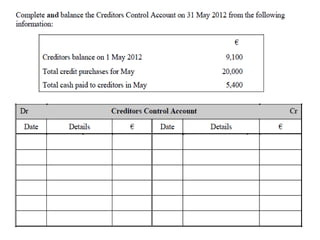

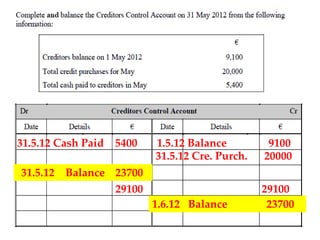

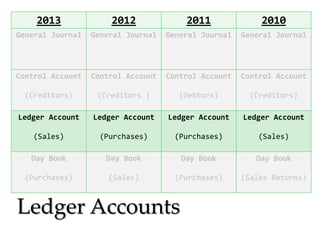

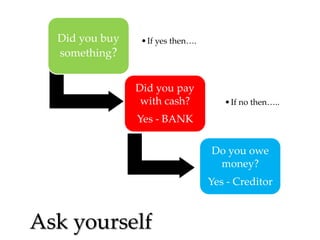

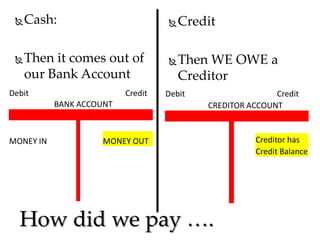

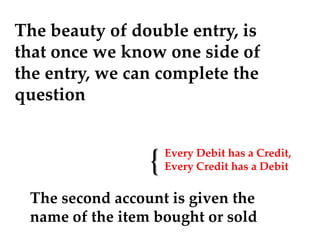

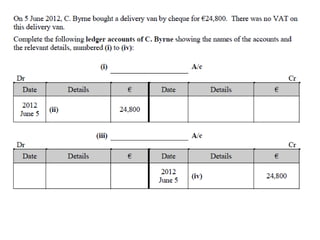

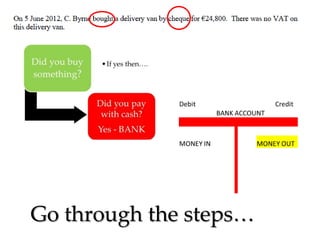

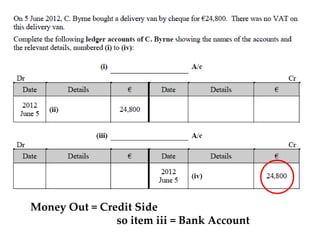

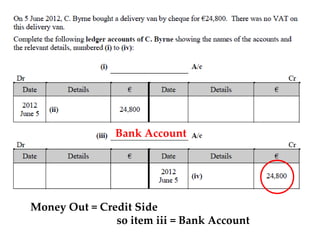

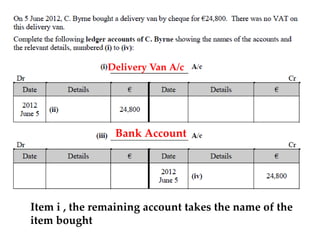

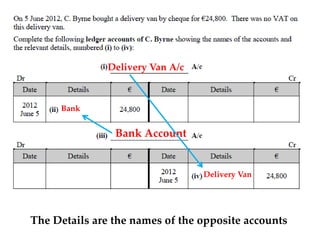

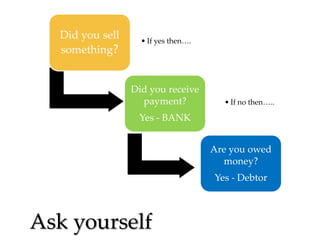

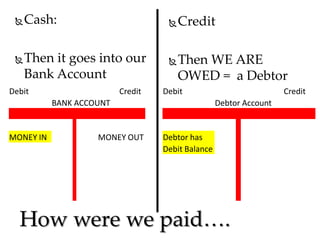

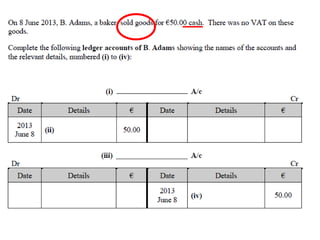

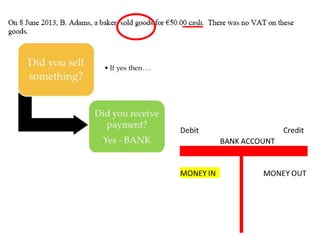

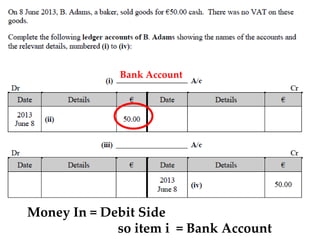

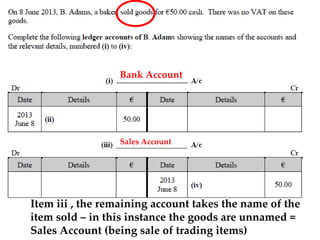

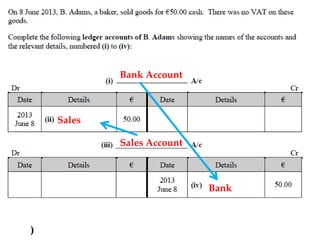

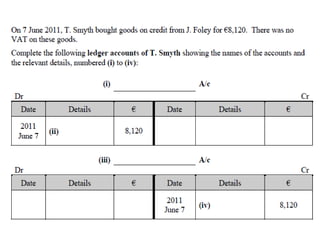

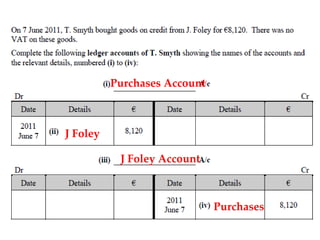

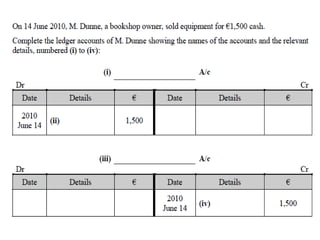

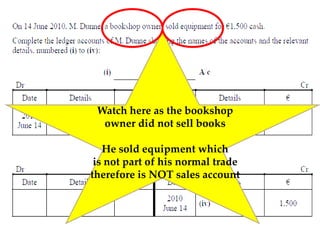

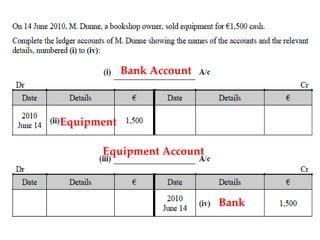

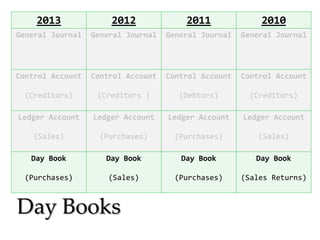

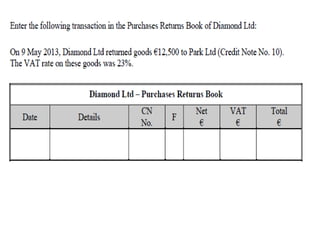

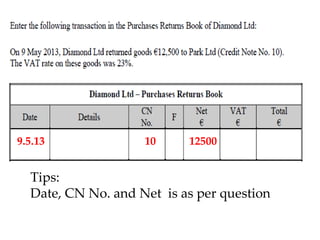

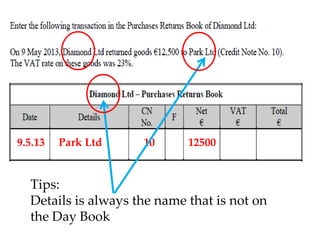

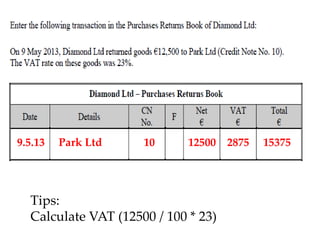

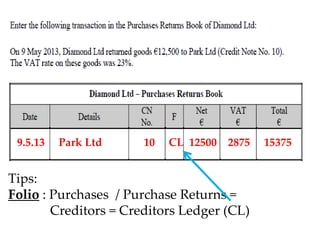

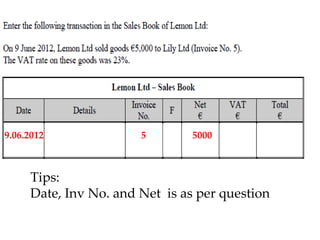

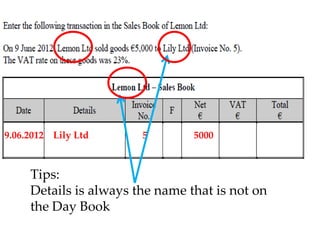

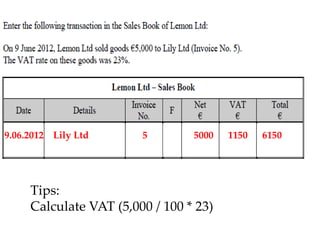

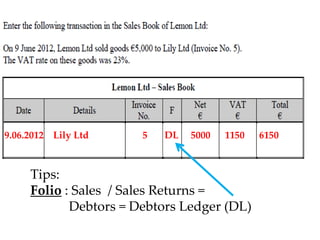

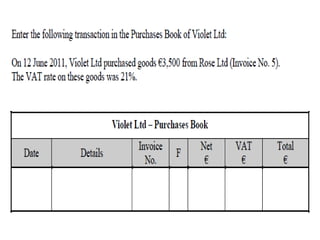

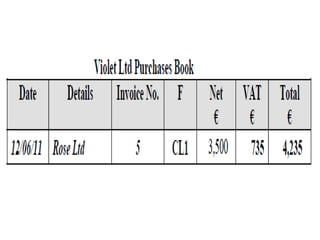

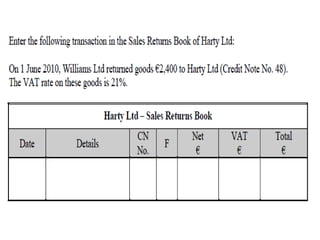

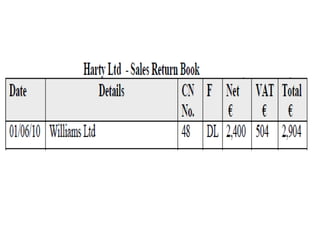

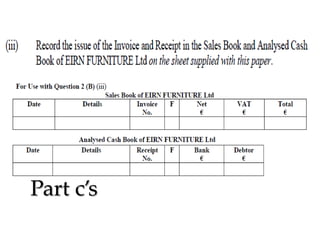

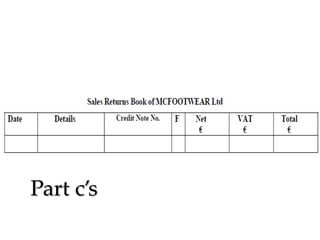

This document provides a refreshers guide to bookkeeping concepts. It discusses books of first entry like general journals, control accounts, and day books. It explains key bookkeeping principles such as debits and credits, the EARL rule, and how to complete ledger and control accounts. Examples are provided for journal entries, control accounts for debtors and creditors, and entries in the day books. The document is intended as a review for accounting students and professionals.