More Related Content

PPTX

PPT

Keith quicksilver funding - amortized loans PPT

2 2amortization-110921085439-phpapp01 PDF

Amortization (how to properly pr).pdf.pdf PPTX

Unit 2 Chapter 2 Busines Finance Amortizatio Loan.pptx PPTX

427158988-Business-and-Consumer-Loan-pptx.pptx PPTX

mortgage and amortizationbusinessss.pptx PDF

Amortization Mathematics of Investment.pptx.pdf Similar to Amortization Schedules_BusinessMath.pptx

PPTX

Amortizing Loan | Finance PDF

Static Amortization Schedule PPTX

PDF

Dynamic Amortization Schedule PPTX

Simple and compound interest.dkldfkfipptx PPTX

Simple and compound interesmmmmmmmt.pptx PPTX

PDF

Amortización y Fondos de Amortización. PPTX

General Mathematics. This presentation is about Loans PPTX

General.Mathematics_Simple_Interest.pptx PPTX

basic concepts of consumer loan.....pptx PPT

PPTX

businessmath-24091qqqqqqqqqq8035709-be4dc68f.pptx PPT

Lesson: Amortization and Sinking Fund.ppt PPTX

PPTX

SIMPLE AND COMPOUND INTEREST PPT _20250505_130310_0000_115307.pptx PPTX

SIMPLE AND COMPOUND INTEREST PPT _20250505_130310_0000_115307.pptx PPT

PPTX

Bus math lesson 6 interest PPTX

9A.-SIMPLE-INTEREST-MATH-OF-FINANCE-with-exercises.pptx More from MarkVincentDoria

PPTX

Profit and Loss for Business Mathematics.pptx PPTX

Ordinary_Annuities_Annuity_Due for BM.pptx PPTX

fin_alg__-_section_3.6 - Advanced Algebra.pptx PPT

business_math_powerpoint-Salary and Wages.ppt PPTX

Compound Interest for business mathematics.pptx PPT

Quadrilaterals: trapezoids and kites.ppt PPT

Volume: Prisms and Cylinders for Grade 7 PPTX

CITIZENSHIP TRAINING PROGRAM for Grade 10.pptx PPT

Graphical Method-Quadratic Equations.ppt PPT

Solving Fractional Equations - Quadratic.ppt PPTX

Commission and Sales-Salary and Wages.pptx PPT

Introduction to rational and irrational numbers [Autosaved].ppt PPT

rationalnumbers-operations in solving rational numbers.ppt PPT

Chapter 3 polygons for Mathematics 7.ppt PPT

INTEREST: Simple and Compound Interest.ppt PPT

2nd Quarter Review Quiz.ppt Recently uploaded

PDF

BÀI GIẢNG POWERPOINT CHÍNH KHÓA PHIÊN BẢN AI TIẾNG ANH 6 CẢ NĂM, THEO TỪNG BÀ... PPTX

Palta Utsav Open to All Quiz Final Set.pptx PPTX

ANTISEPTICS AND DISINFECTANTS CHAPTER NO.05.pptx PPTX

Report for Prepare Time Management in Odoo 19 POS PPTX

OXYGEN ADMINISTRATION/THERAPY ......pptx PPTX

Introduction of Carbohydrates - Dr.M.Jothimuniyandi PPTX

Redox Titration - Oxidation and Reduction PPTX

Nanomaterials and its types - Dr.M.Jothimuniyandi PPTX

Ethiopian soil types , degradation and conservation PPTX

VAGINAL IRRIGATION..................pptx PPTX

How to Add or Remove Multiple Followers in a Records PDF

Caribbean Examinations Council Literacy and Numeracy Standards PPTX

ANTI-TUSSIVE CHAPTER NO.05 PHARMACOGNOSY PPTX

ART aPPRECIATION - Lesson 1 AND 2 COVERAGE PPTX

STERILITY INDICATOR Pharmaceutical microbiology PDF

Experiment No. 2 To synthesis and submit chlorobutanol. PPTX

When UDL is no longer enough: Examining post-UDL reflections on inclusive des... PDF

Freshman Geography Chapter 7-Population of Ethiiopia PDF

Fanatics of LDM a Time Capsule By LDMMIA PPTX

Sci8-Q3-W29-Tides_Science 8 Matatag.pptx Amortization Schedules_BusinessMath.pptx

- 1.

- 2.

Learning Objectives

• Understandwhat amortization means

• Learn amortization formulas

• Apply amortization in real-life Filipino business

contexts

• Compute loan payments and schedules

- 3.

- 4.

Key Terms

• Principal– Original loan amount

• Interest – Cost of borrowing

• Term – Loan duration

• Payment – Regular installment amount

- 5.

Amortization Formula

• A= P × [i(1+i)^n] / [(1+i)^n – 1]

• A = payment per period

• P = principal, i = interest rate per period, n =

number of periods

- 6.

Example: Loan Payment

•P = ₱500,000, i = 10% annually, term = 5 years

(annual payment)

• A = 500,000 × [0.10(1.10)^5] / [(1.10)^5 – 1]

• A = ₱131,366.27

- 7.

- 8.

- 9.

Full 5-Year Table

•Year 1: ₱131,366.27 (Interest: ₱50,000,

Principal: ₱81,366.27)

• Year 2: ...

• Year 5: Loan fully paid

- 10.

- 11.

- 12.

Monthly vs AnnualPayments

• Monthly: Smaller payment, more frequent

• Annual: Larger payment, less frequent

- 13.

- 14.

- 15.

- 16.

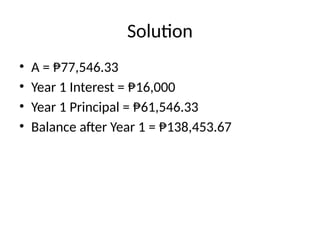

Solution

• A =₱77,546.33

• Year 1 Interest = ₱16,000

• Year 1 Principal = ₱61,546.33

• Balance after Year 1 = ₱138,453.67

- 17.

- 18.

Common Mistakes

• Notconverting interest rate properly

• Mixing monthly and annual rates

• Rounding errors

- 19.

- 20.

Thank You /Q&A

• Any questions?

• Share a personal loan example for discussion

Editor's Notes

- #1 Introduce amortization topic, explaining its importance in finance and loans.

- #2 Outline the goals for the lesson.

- #3 Give examples: housing loan, car loan, business loan.

- #4 Define and explain each term.

- #5 Explain how each variable affects payment calculation.

- #6 Solve step-by-step.

- #7 Explain why it's important to understand payment distribution.

- #8 Show how to get interest and principal for the first year.

- #9 Encourage students to practice completing the table.

- #10 Relate amortization to real-life Filipino scenarios.

- #11 Discuss how each factor changes the payment.

- #12 Compare pros and cons for borrowers.

- #13 Encourage students to see benefits of prepayments.

- #14 Connect amortization to business growth strategies.

- #15 Let students solve individually or in pairs.

- #16 Explain step-by-step solution.

- #17 Show quick calculation options.

- #18 Warn students about frequent calculation errors.

- #19 Summarize major points learned.

- #20 Invite questions and class participation.

![Amortization Formula

• A = P × [i(1+i)^n] / [(1+i)^n – 1]

• A = payment per period

• P = principal, i = interest rate per period, n =

number of periods](https://image.slidesharecdn.com/amortizationbusinessmath-250919030650-760bc22d/85/Amortization-Schedules_BusinessMath-pptx-5-320.jpg)

![Example: Loan Payment

• P = ₱500,000, i = 10% annually, term = 5 years

(annual payment)

• A = 500,000 × [0.10(1.10)^5] / [(1.10)^5 – 1]

• A = ₱131,366.27](https://image.slidesharecdn.com/amortizationbusinessmath-250919030650-760bc22d/85/Amortization-Schedules_BusinessMath-pptx-6-320.jpg)