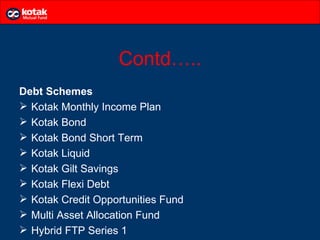

Kotak Mutual Fund is a leading mutual fund provider in India that is a subsidiary of Kotak Mahindra Bank. It offers a variety of equity, debt, balanced, and other funds that invest across different asset classes and sectors. The document discusses Kotak Mutual Fund's history, products, competitors, strengths such as size and performance, weaknesses such as manager changes, opportunities like emerging markets, and threats such as rising interest rates. It also covers the advantages of diversification and professional management that mutual funds provide investors.