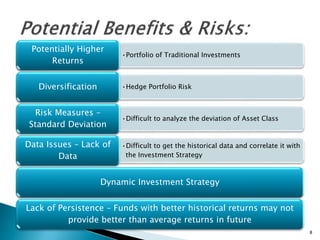

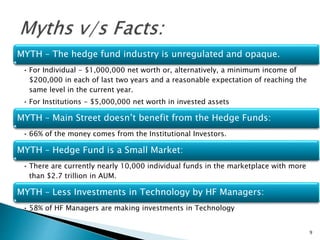

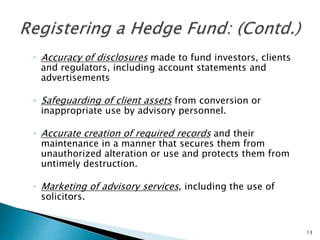

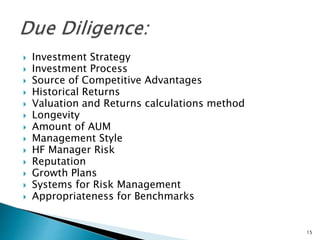

Alternative investments, including hedge funds and managed futures, aim to provide absolute returns regardless of market conditions, utilizing strategy-driven methodologies. Investors include institutional entities and high-net-worth individuals, but there are challenges in data analysis and misconceptions about the industry. Regulatory requirements apply once a hedge fund surpasses $150 million in assets under management, focusing on client asset protection, disclosure accuracy, and investment practices.