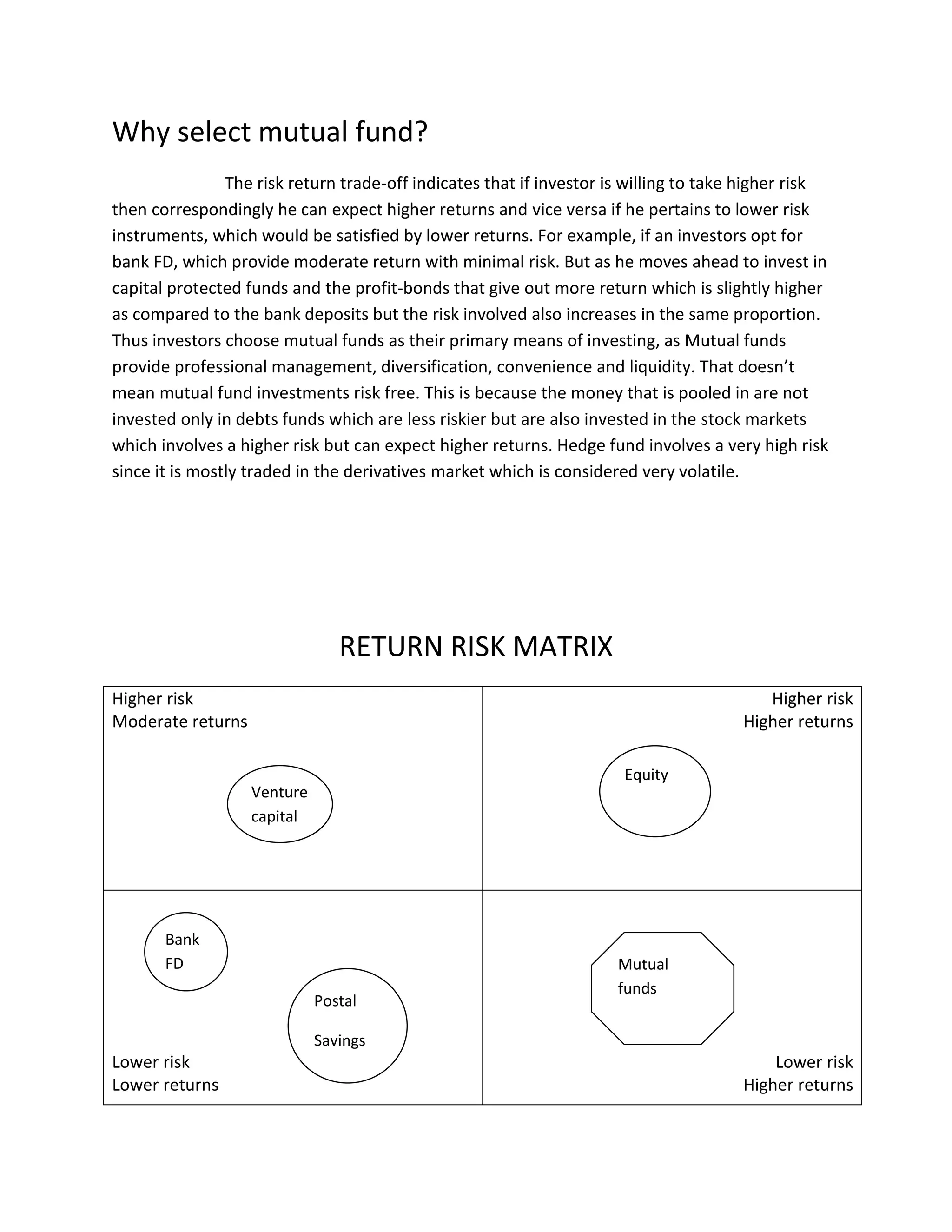

This document provides an overview of mutual funds in India. It discusses what mutual funds are, their advantages such as professional management, diversification and liquidity. It also discusses disadvantages like costs and lack of control. Finally, it outlines the different types of mutual fund schemes in India such as open-ended and close-ended funds. Open-ended funds allow buying and selling at net asset value anytime, while close-ended funds have a fixed maturity period of 3-15 years.