This document provides information about the HDFC AMC IPO that took place in July 2018. Some key details include:

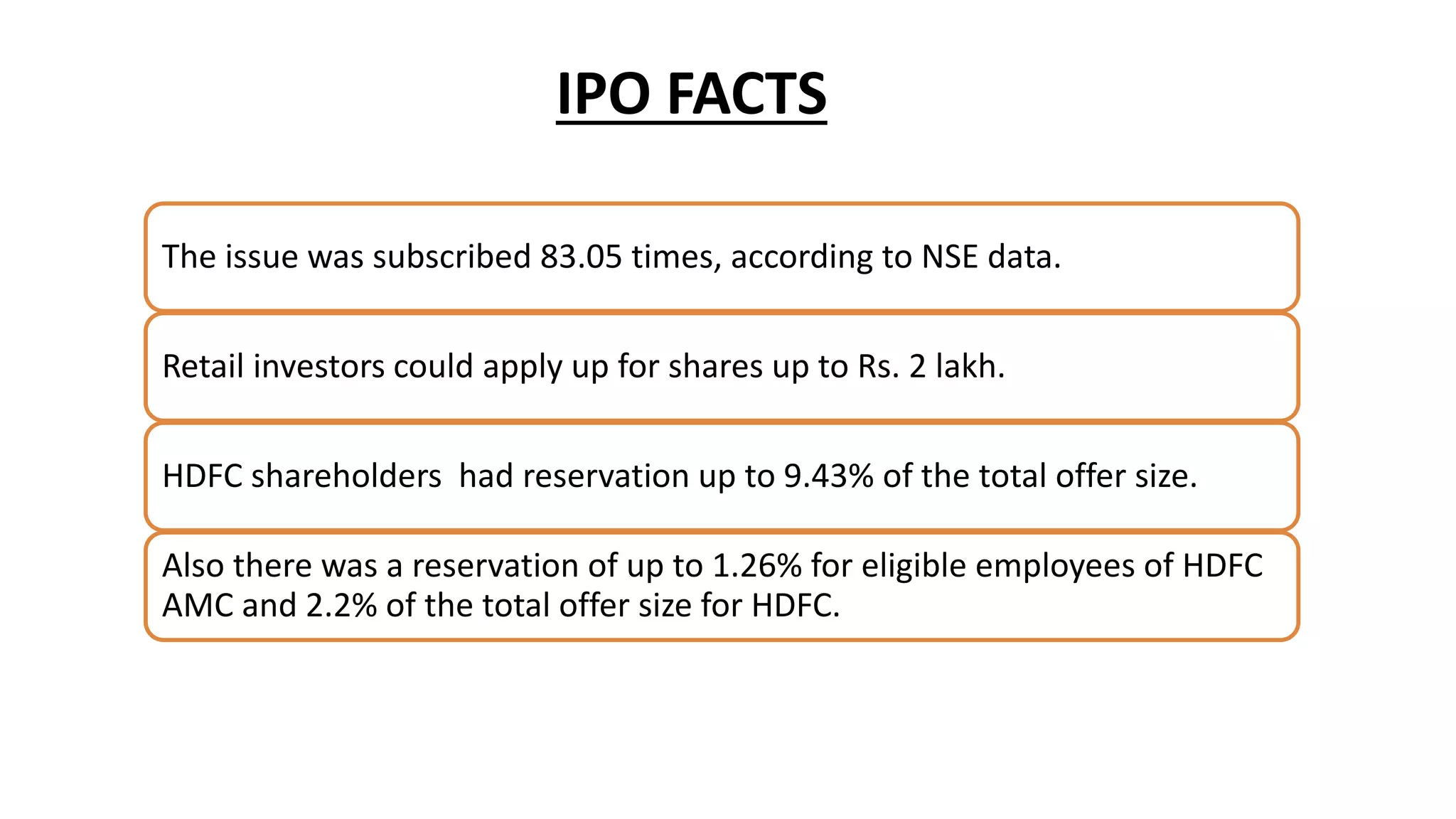

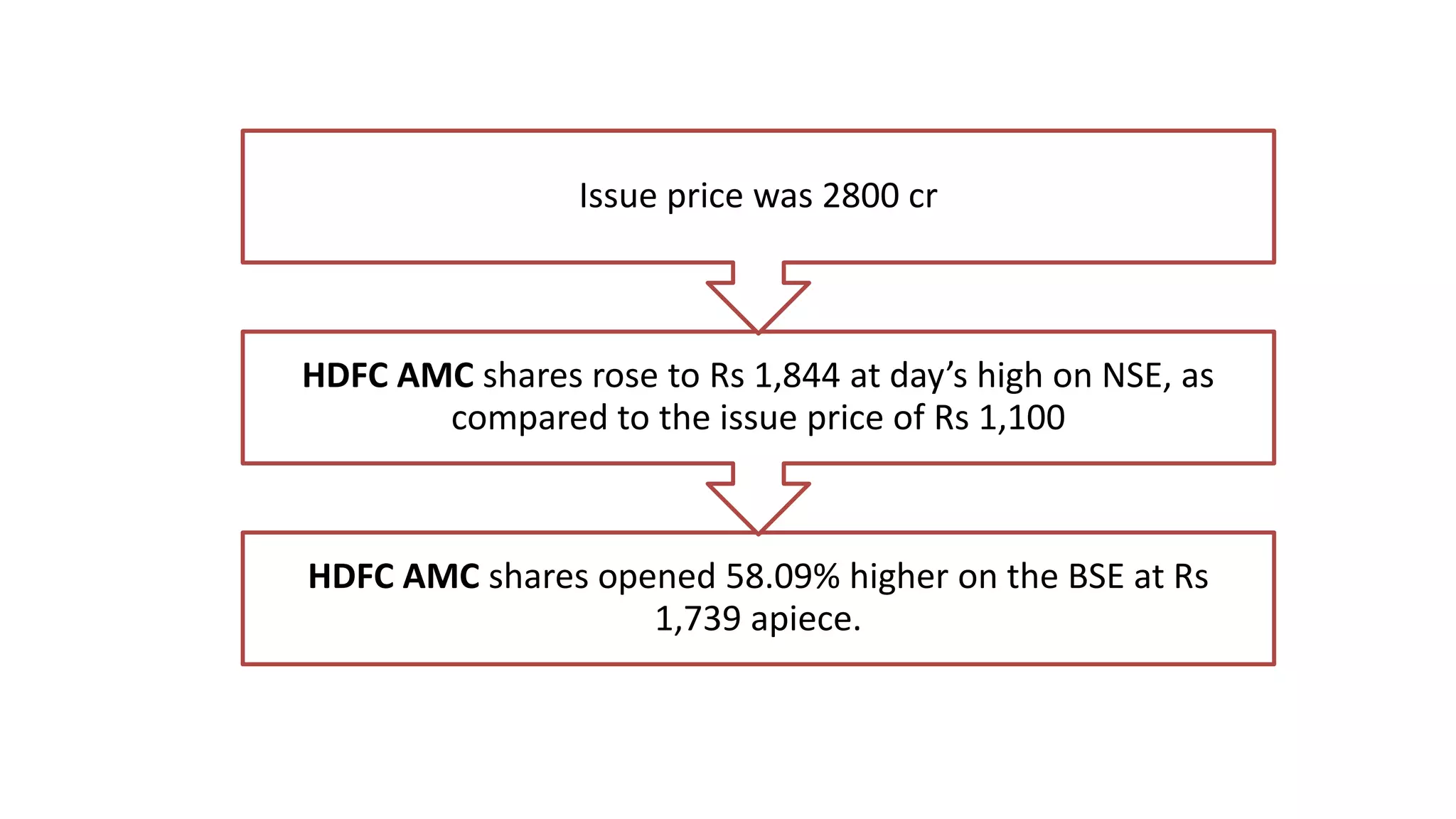

- HDFC AMC raised Rs 2,800 crore through the sale of 25.46 million shares priced at Rs. 1095-1100 per share.

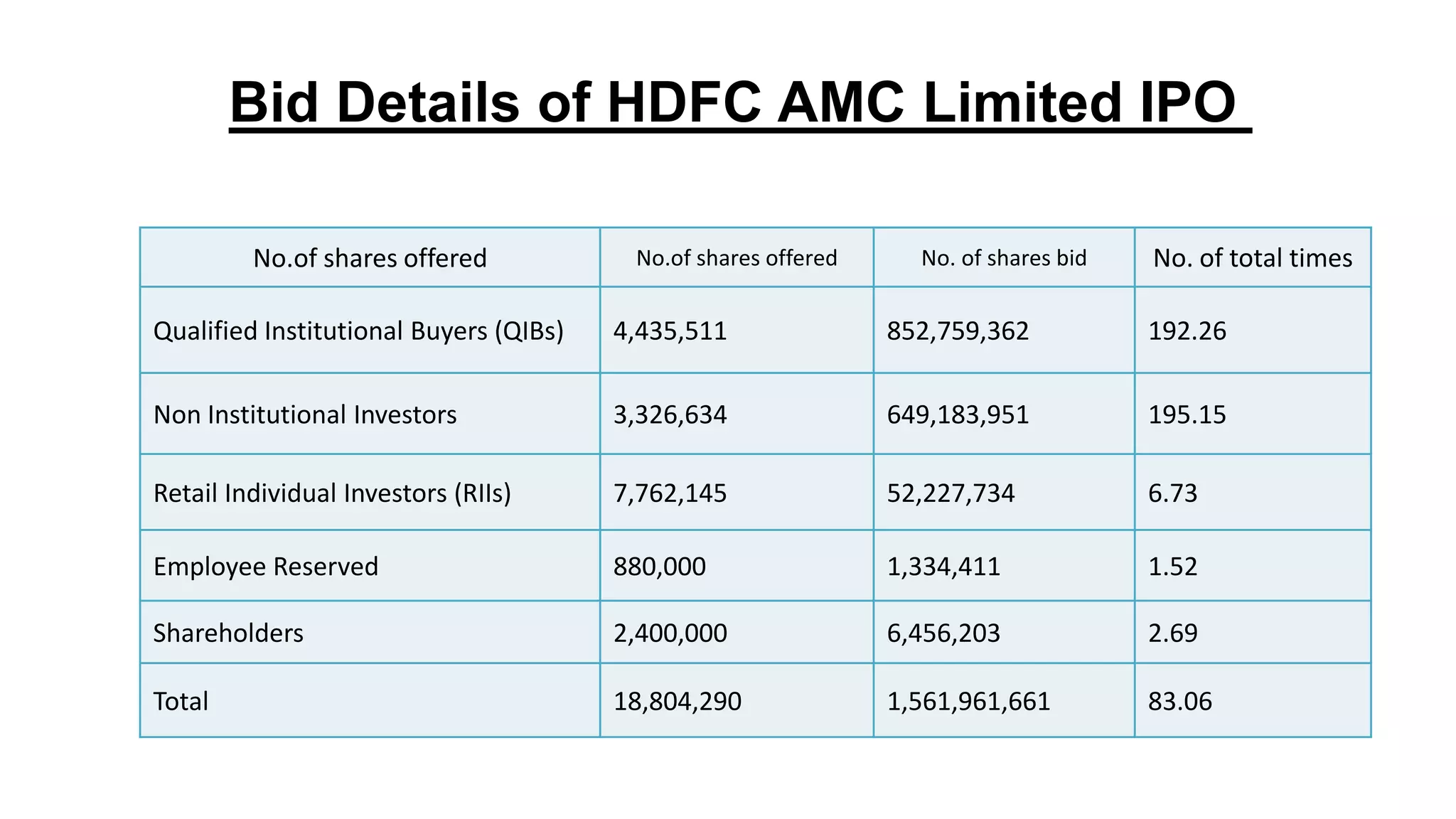

- The issue was oversubscribed 83 times with strong demand from all investor categories.

- On listing, HDFC AMC shares opened 58% higher and rose to a high of Rs. 1,844 on the first day of trading.

- A number of merchant banks served as lead managers for the IPO, including Axis Capital, Citi, ICICI Securities, and JM Financial.