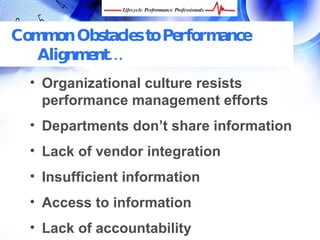

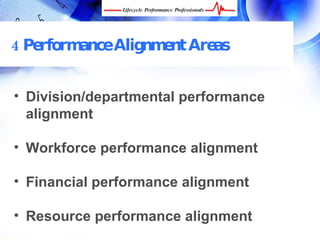

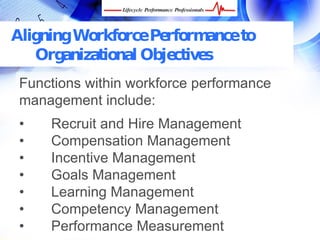

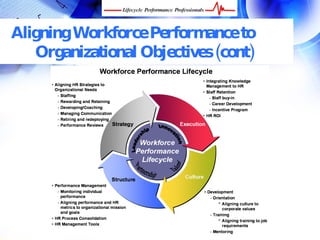

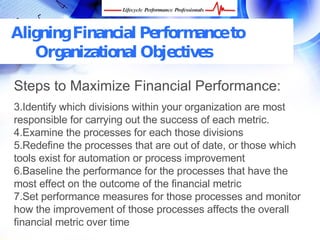

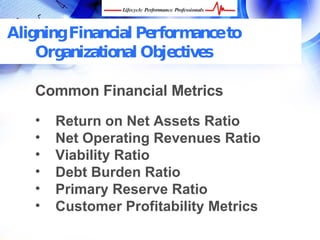

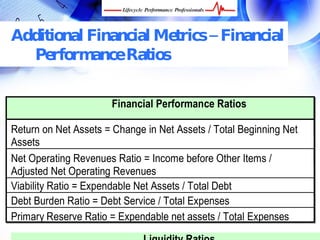

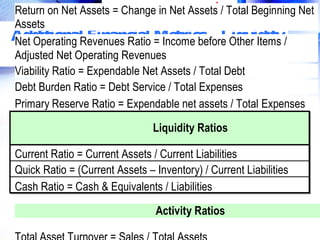

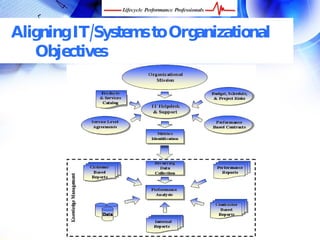

This document discusses aligning organizational performance to goals and objectives. It identifies common obstacles such as cultural resistance, lack of information sharing, and accountability. It also outlines key areas of performance alignment including business units, workforce, financials, and resources. Specific steps are provided to align each of these areas including defining goals, identifying processes, and establishing performance measures.