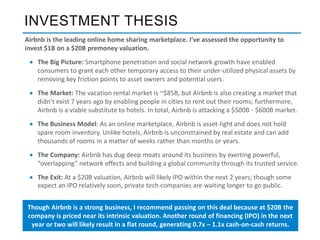

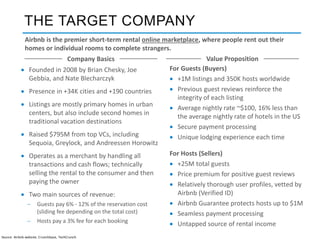

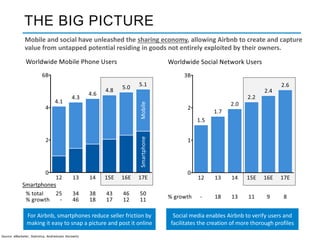

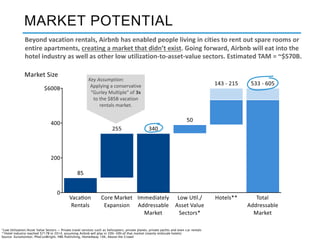

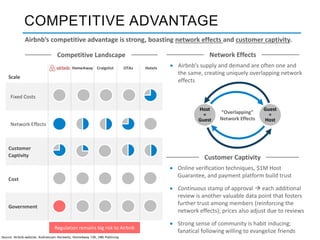

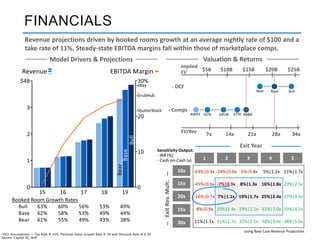

Airbnb is the leading online marketplace for short-term home rentals. The document discusses Airbnb's $1B investment opportunity at a $20B valuation. It summarizes Airbnb's business model, large addressable market across vacation rentals and new markets created, strong network effects and competitive advantages, and financial projections estimating high growth and returns. However, the author recommends passing on the deal given the high $20B valuation limits potential returns to only 0.7-1.1x on investment.