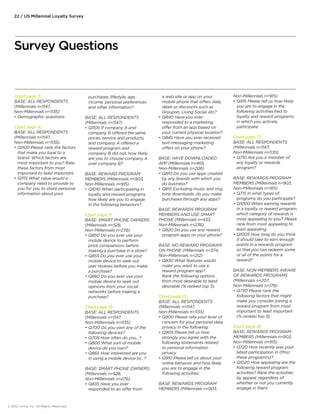

The document summarizes research from a survey of millennials (ages 19-29) and non-millennials (ages 30+) in the US regarding their attitudes towards customer loyalty programs and rewards. Some key findings from the survey include:

1) Over three-quarters (77%) of millennials participate in loyalty and rewards programs, compared to four in five (82%) of non-millennials.

2) Nearly half (47%) of millennials agree they are more likely to share personal details with brands that offer loyalty and reward incentives.

3) When introduced to the idea of a US coalition loyalty program where points can be earned across multiple partners, 74% of millennials rated this as