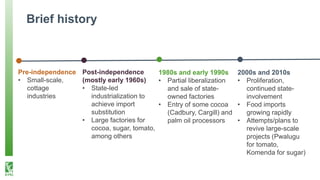

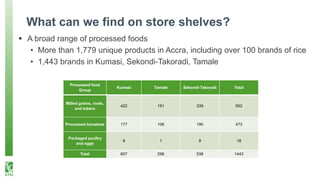

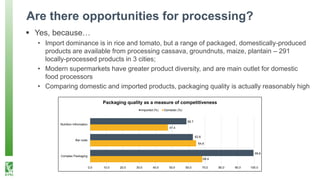

Ghana has experienced various phases of agro-processing development from pre-independence small cottage industries to current proliferation of factories and food imports. Key challenges include low productivity, poor quality crops, and infrastructure issues. However, opportunities exist due to urbanization, income growth, and diet changes. A study found over 1,700 unique processed foods in Ghanaian cities, with imports dominating rice and tomato paste but many domestic products available, showing potential to expand local processing.