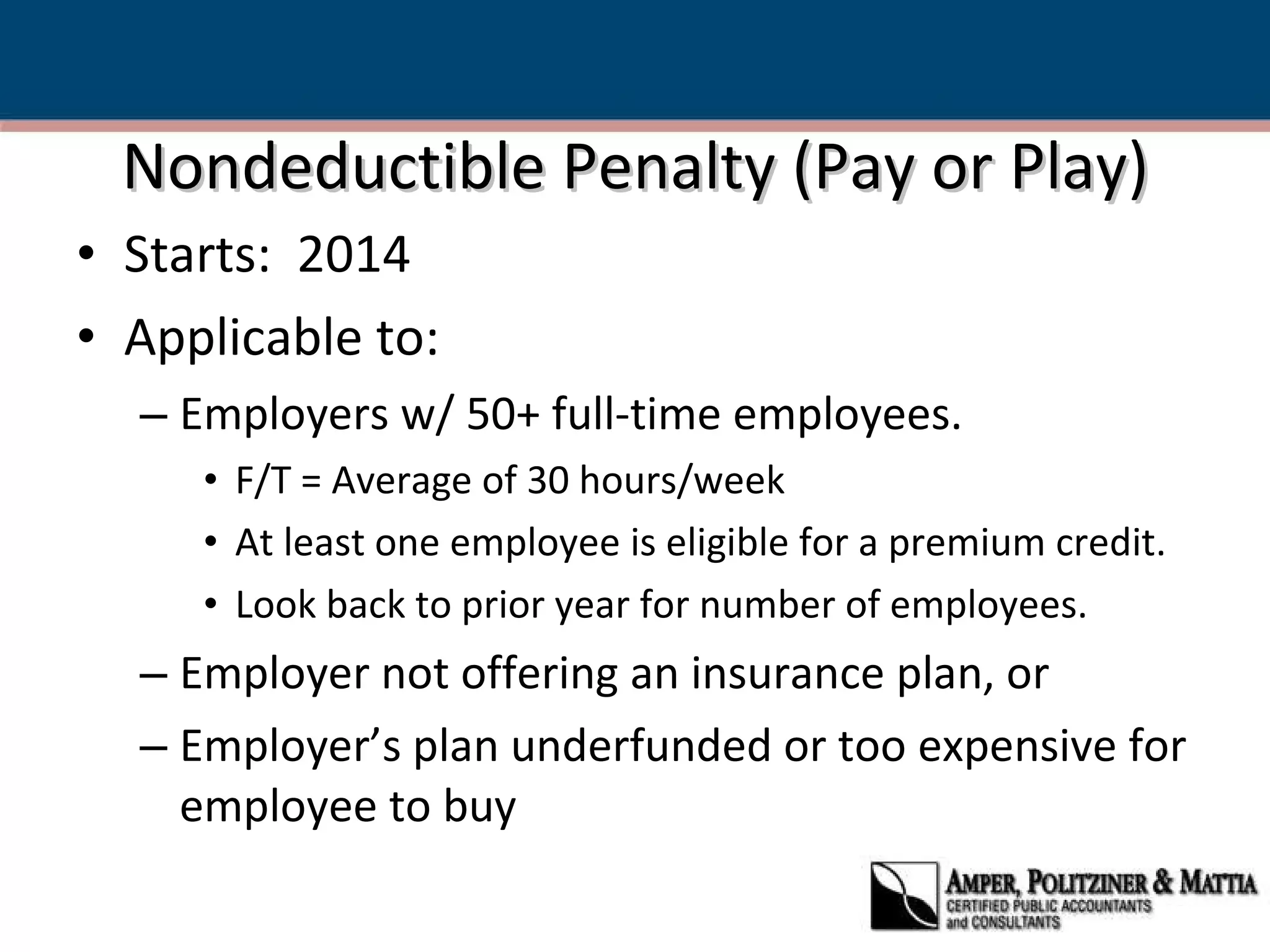

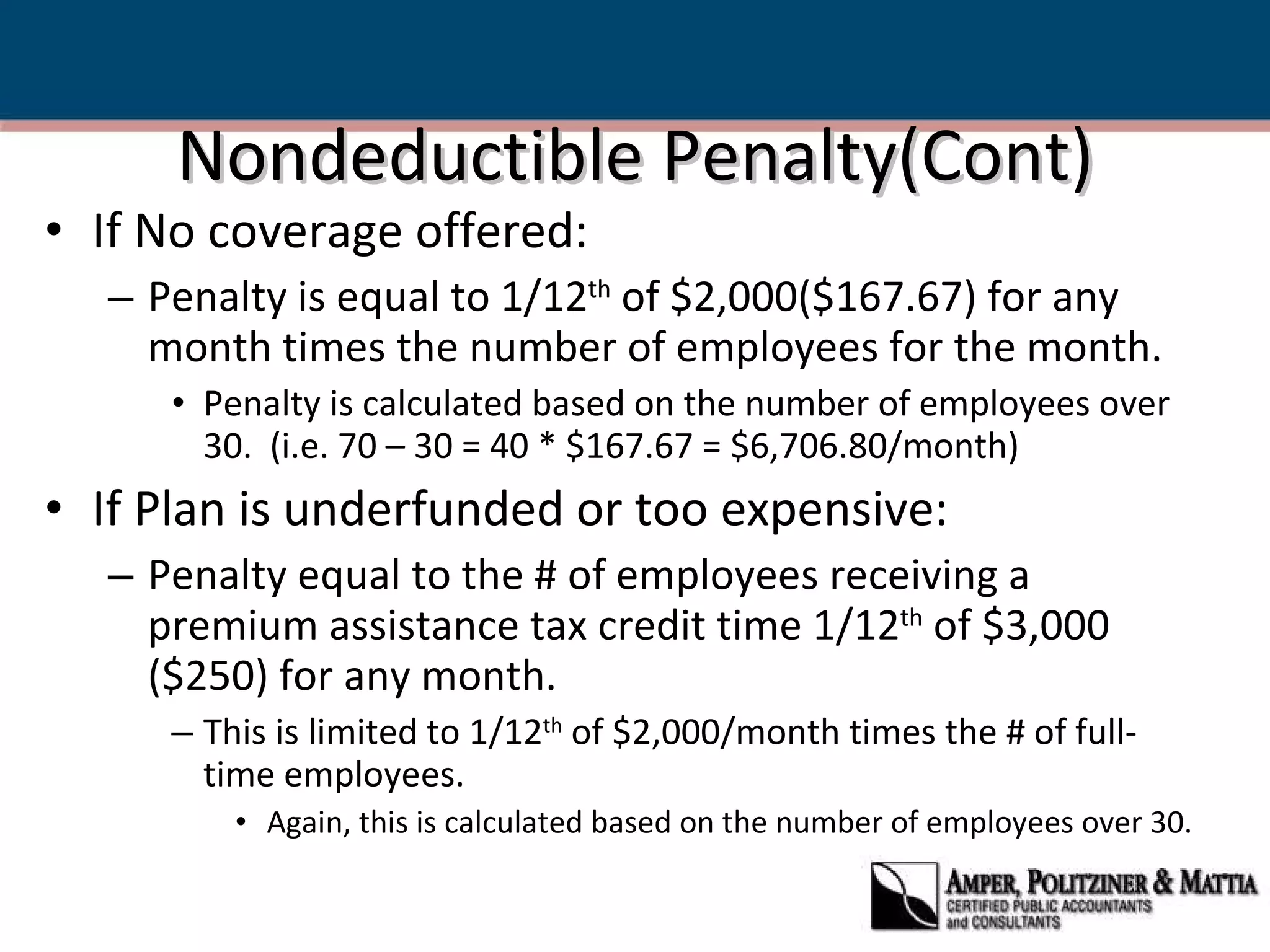

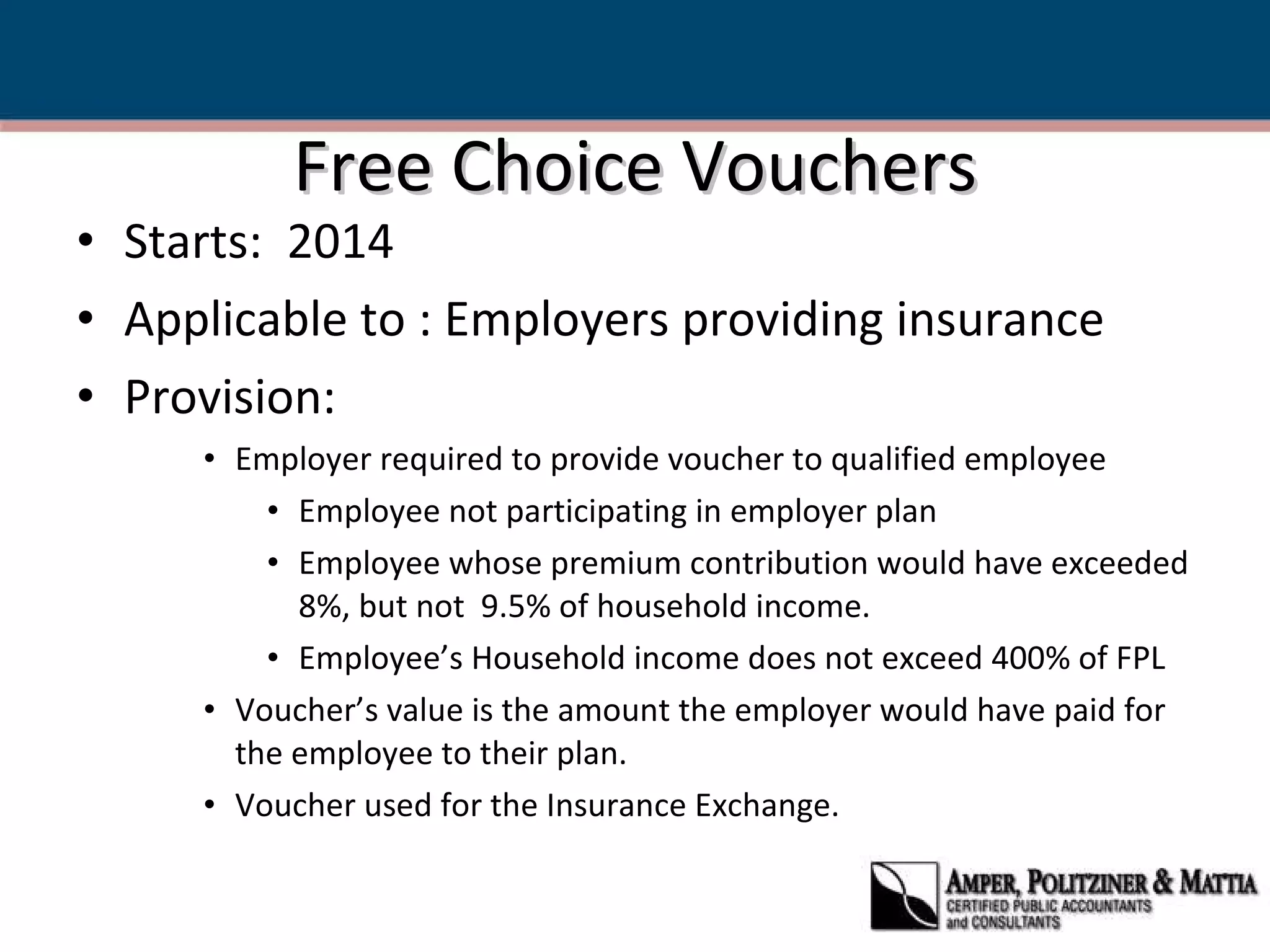

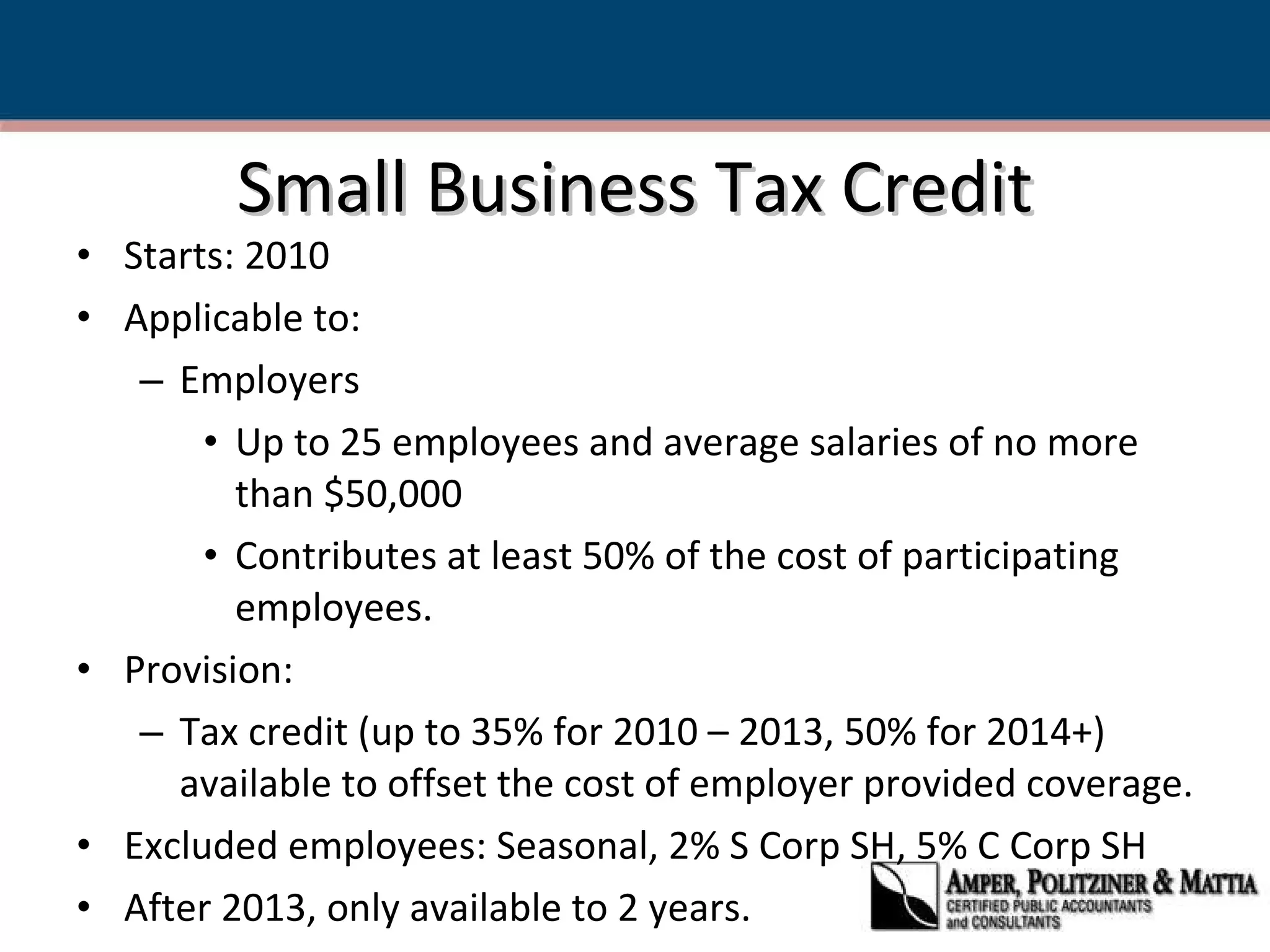

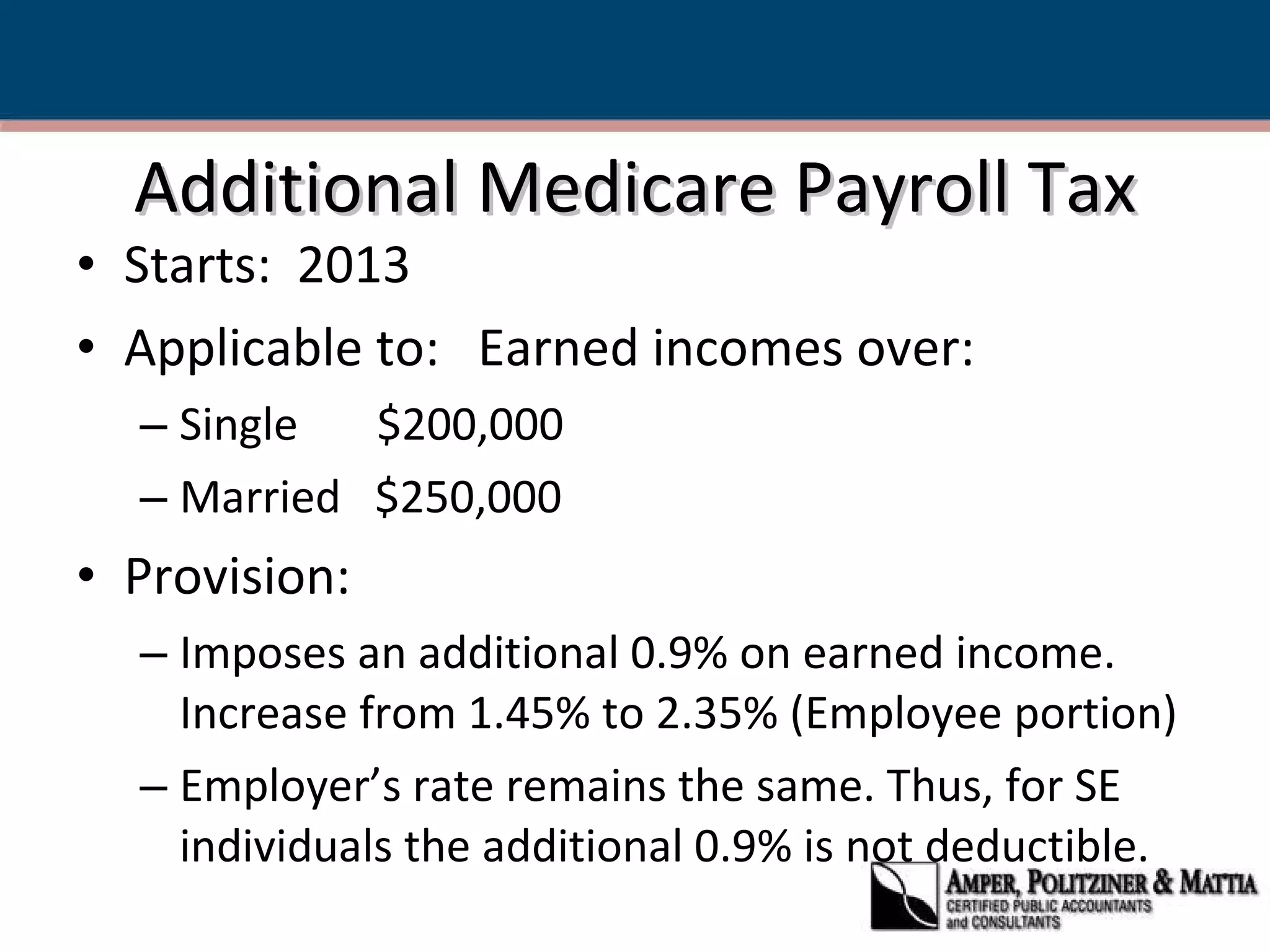

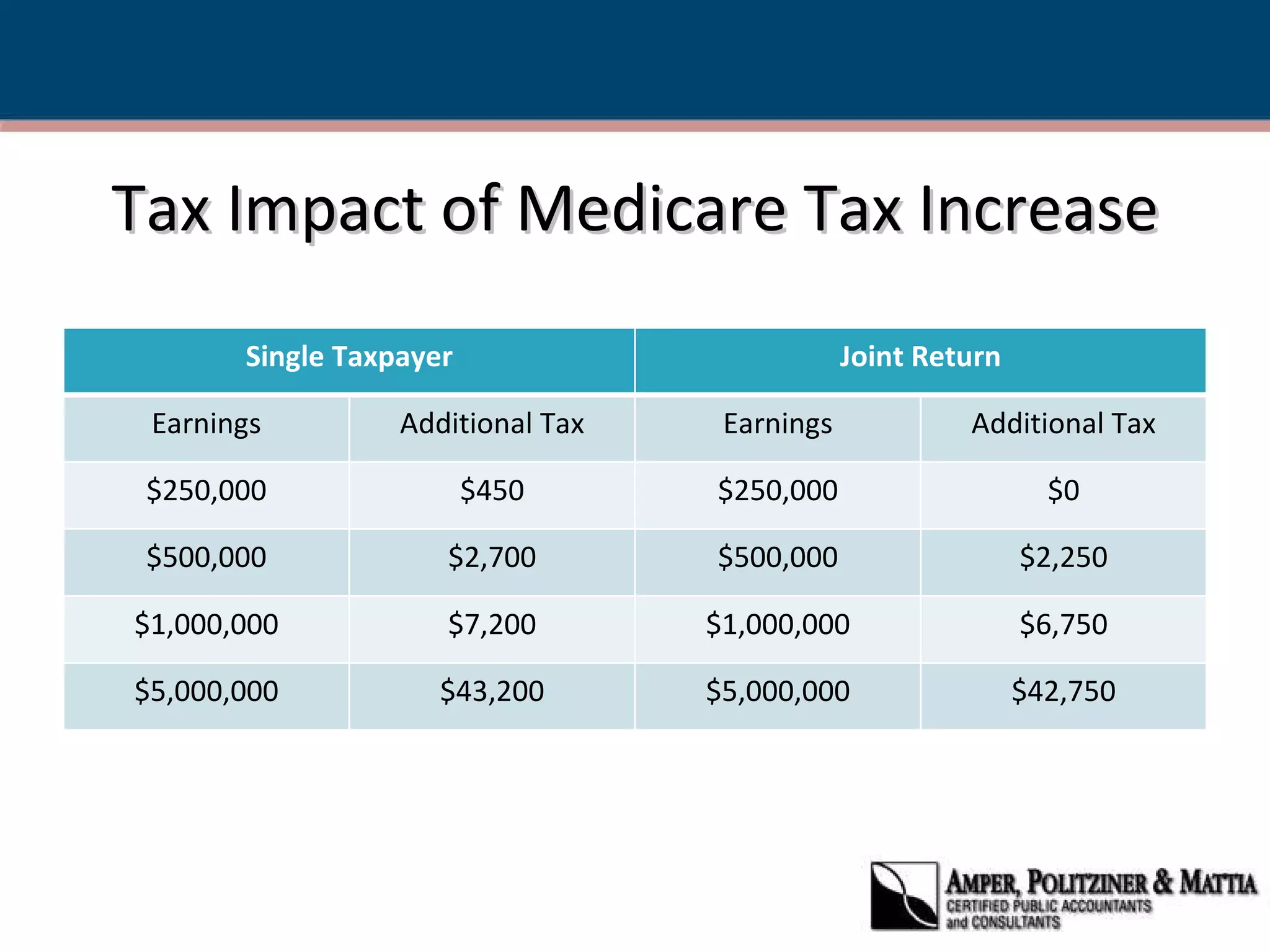

The Patient Protection Act introduces several new taxes and penalties related to health insurance. It does not mandate that individuals have insurance but will penalize those who do not starting in 2014. It also penalizes large employers who do not provide insurance or provide inadequate coverage. It provides tax credits to help low-income individuals afford coverage and gives tax credits to small employers who provide coverage. Higher income individuals and high-cost insurance plans will be taxed to help fund the overall plan.

![Contact Information Dan Gibson, CPA, EA Amper, Politziner & Mattia, LLP 750 Rt. 202 S, Suite 500 Bridgewater, NJ 08807 Phone: 908-218-5002 Email: [email_address] Sarah Anderson, CPA, MST Amper, Politziner & Mattia, LLP 750 Rt. 202 S, Suite 500 Bridgewater, NJ 08807 Phone: 908-218-5002 Email: [email_address]](https://image.slidesharecdn.com/ppacataximplicationsjune2010-12789415145082-phpapp02/75/Healthcare-Act-Presentation-35-2048.jpg)