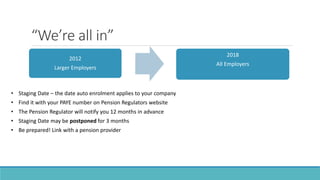

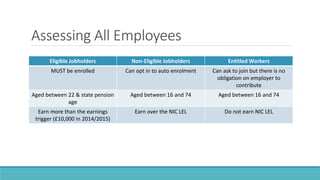

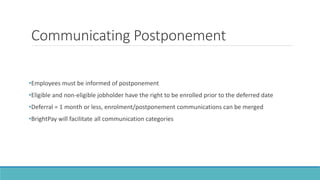

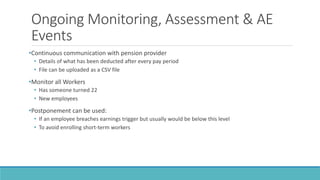

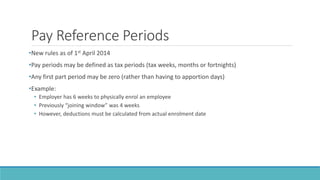

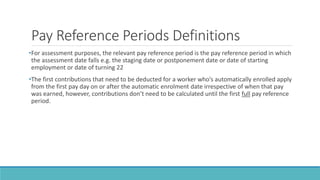

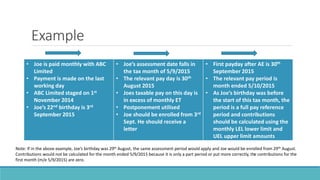

The document outlines the key details regarding auto enrolment regulations and procedures for employers in the UK, specifying their responsibilities related to employee pension contributions, staging dates, and communication requirements. It highlights the importance of assessing employee eligibility and making deductions based on specific earnings thresholds while ensuring compliance with the Pensions Regulator. Employers must inform eligible and non-eligible jobholders about their rights and options regarding pension enrolment and contributions.