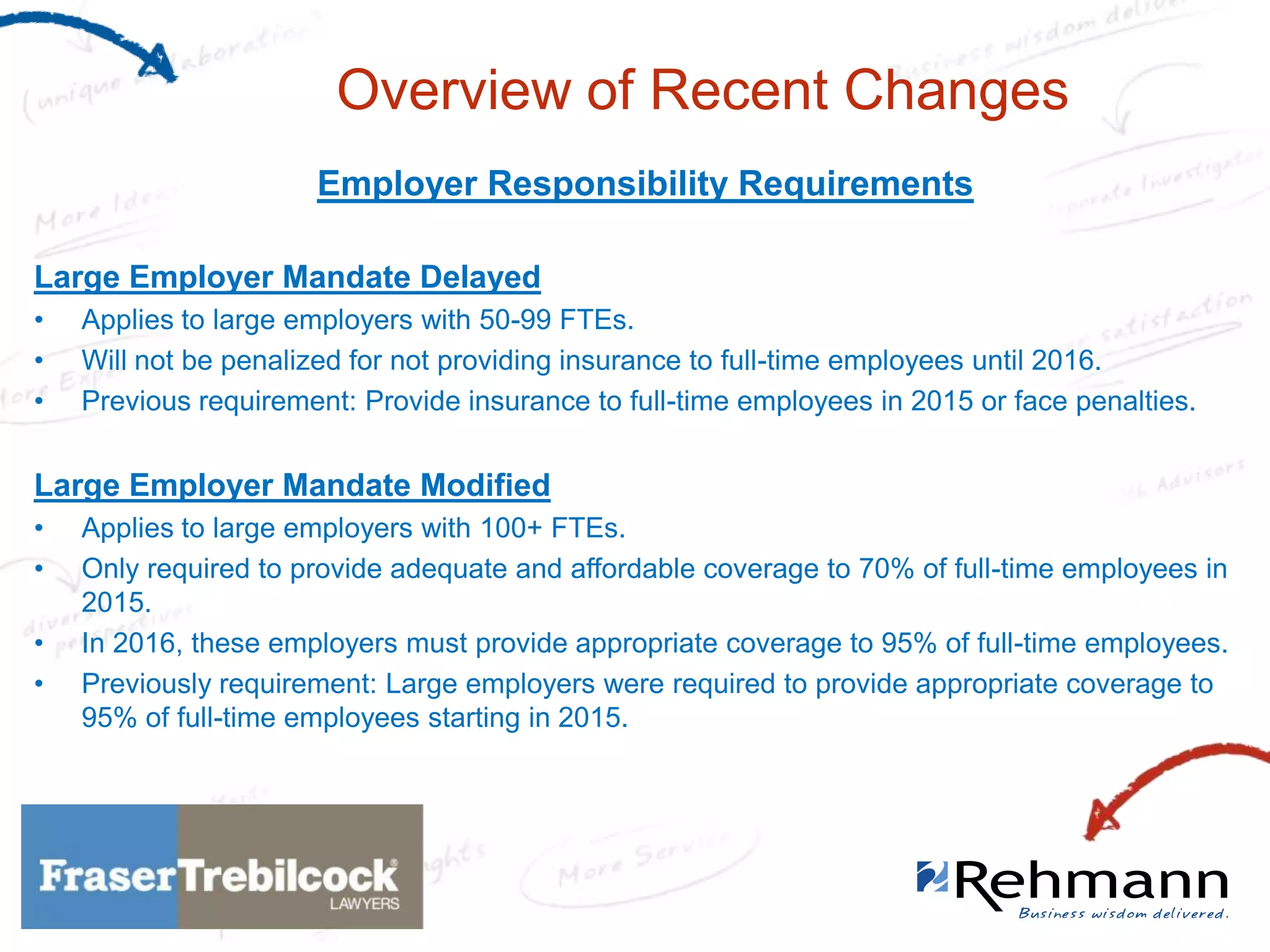

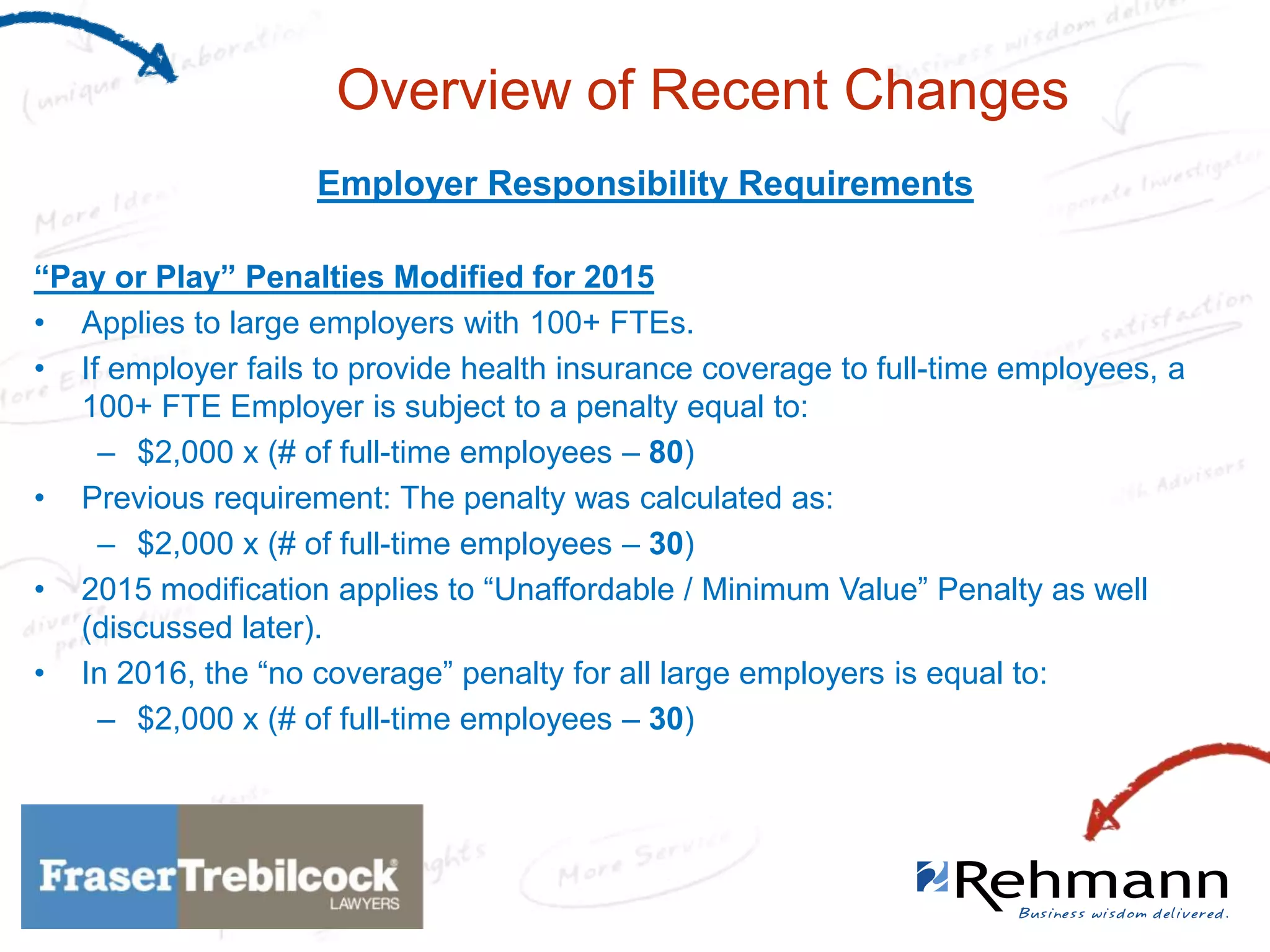

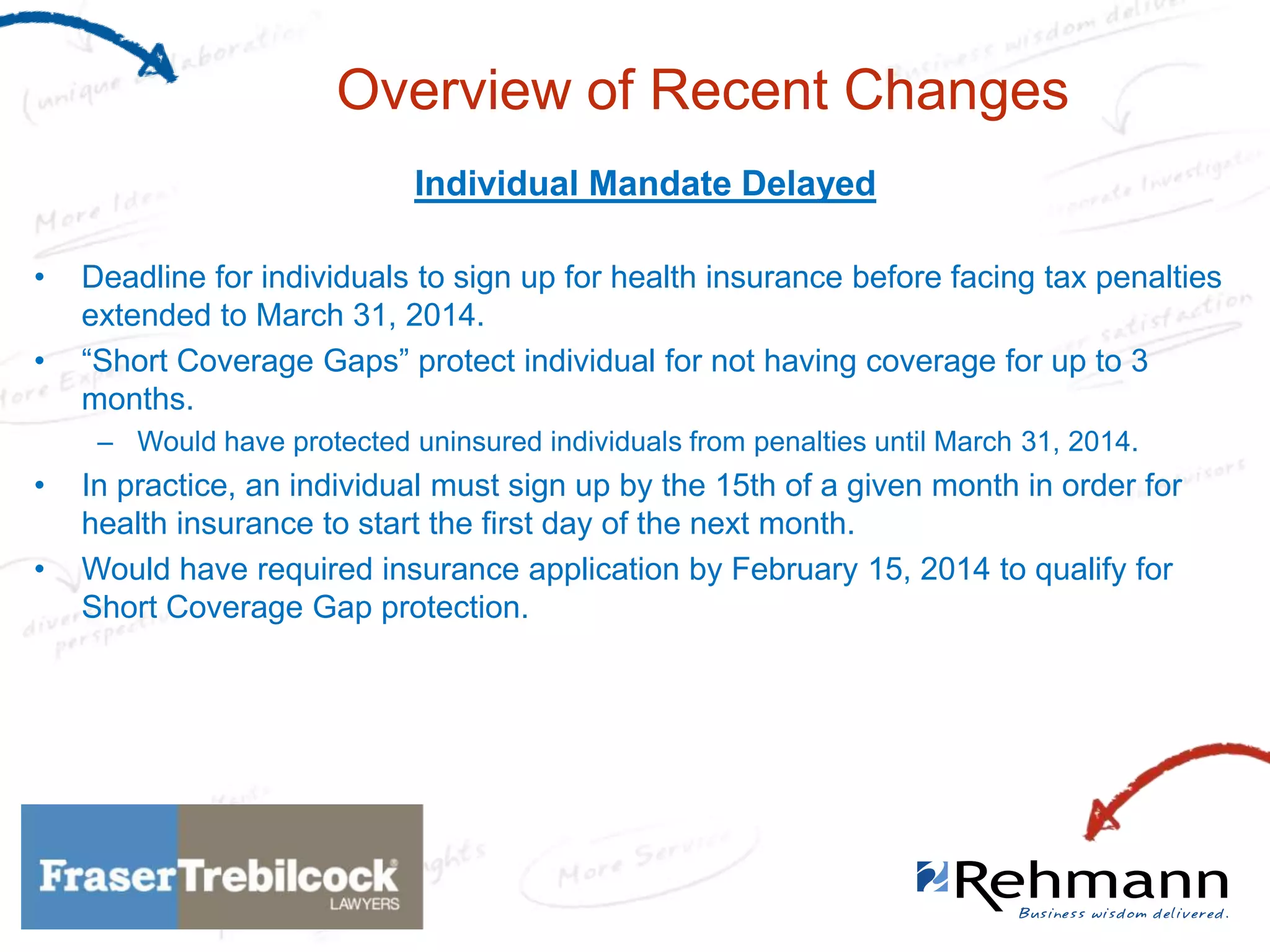

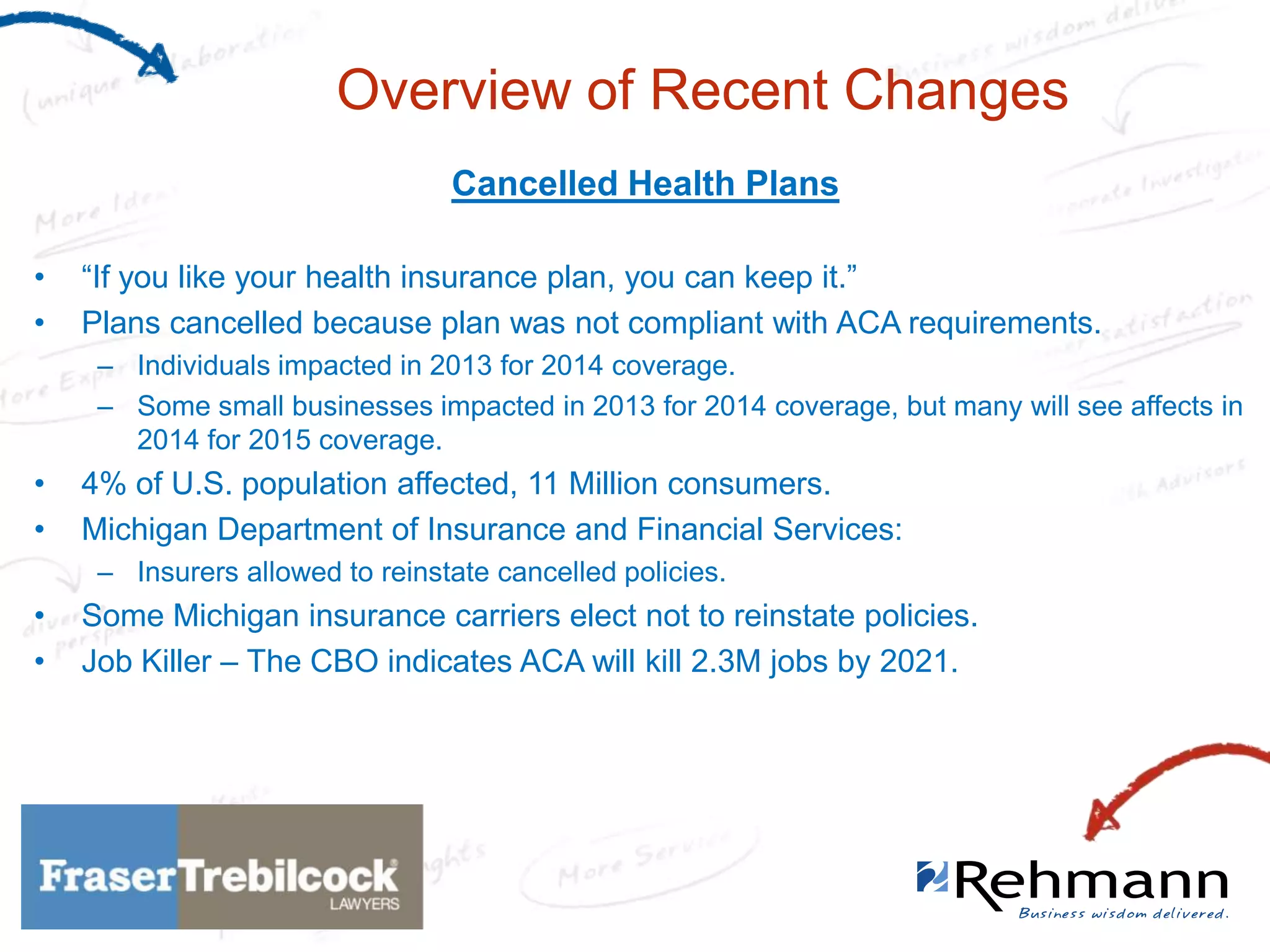

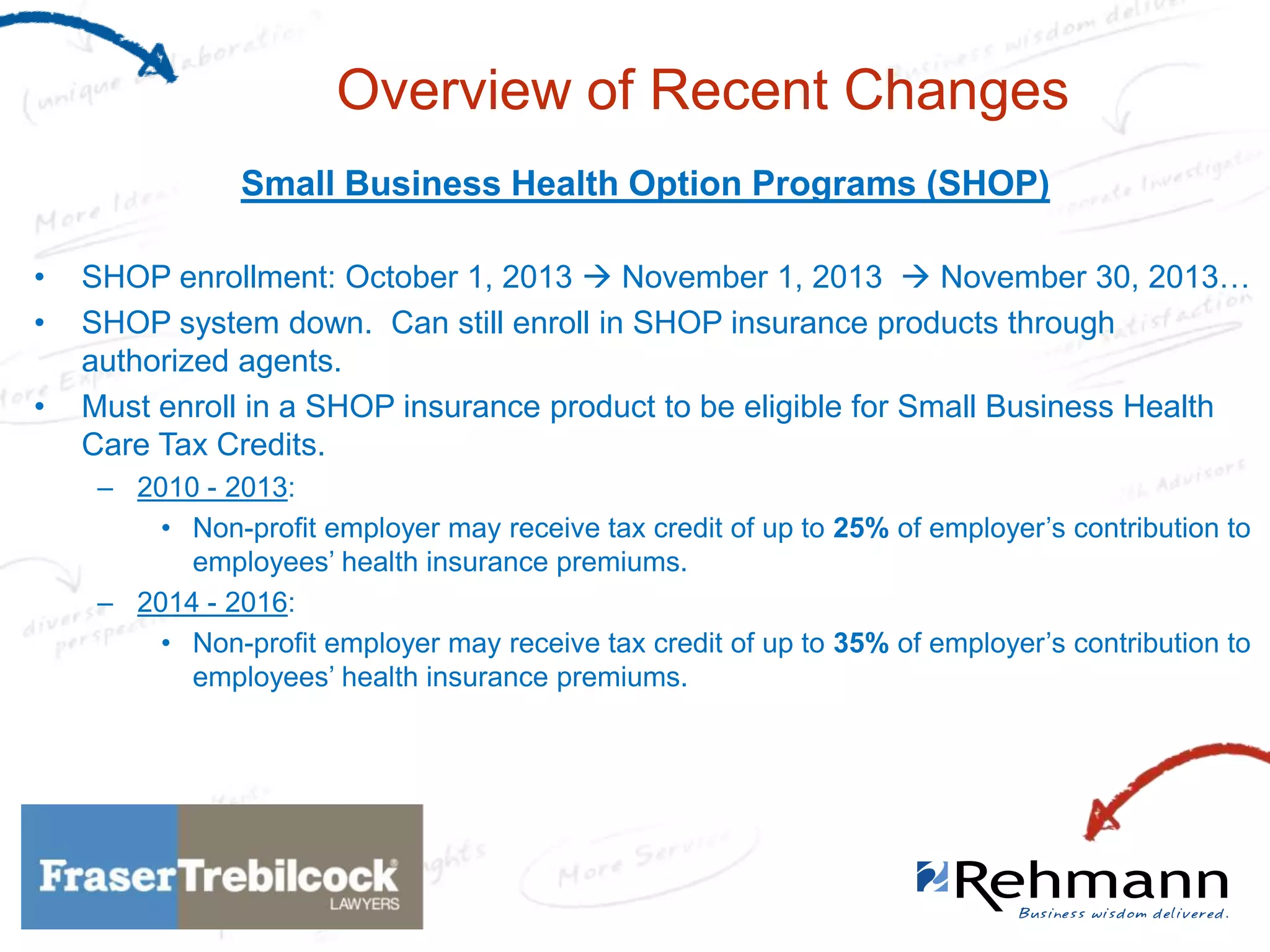

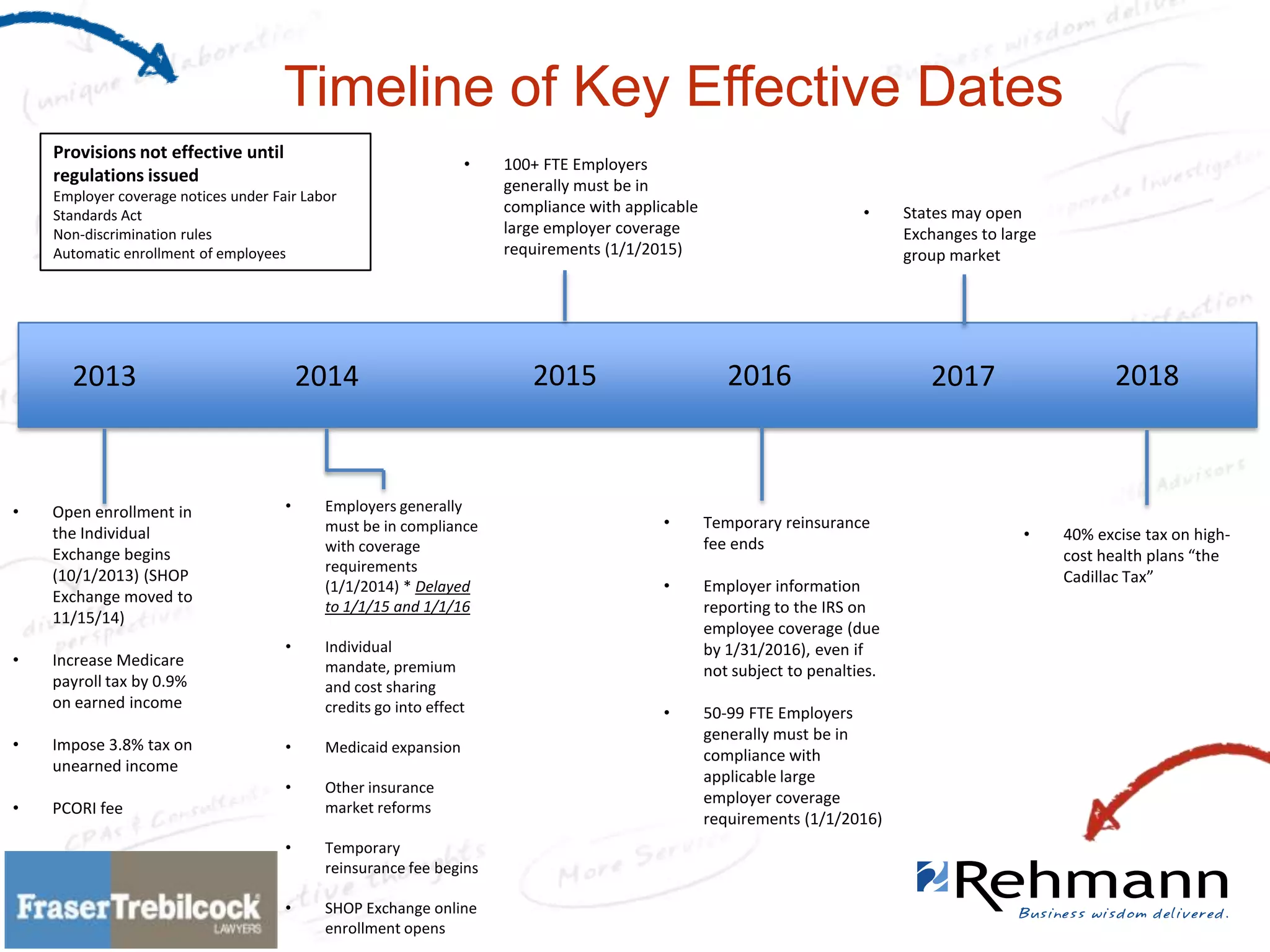

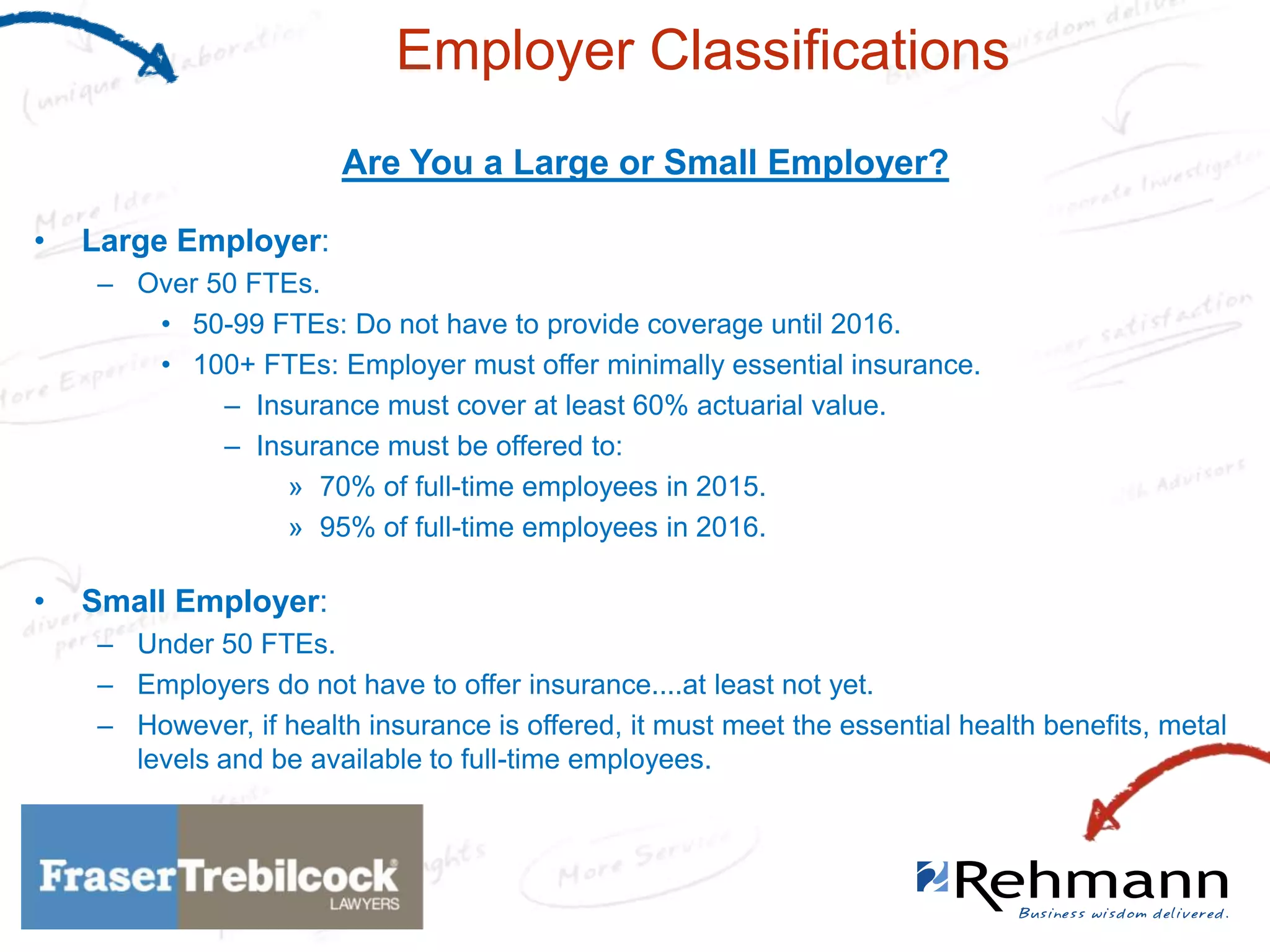

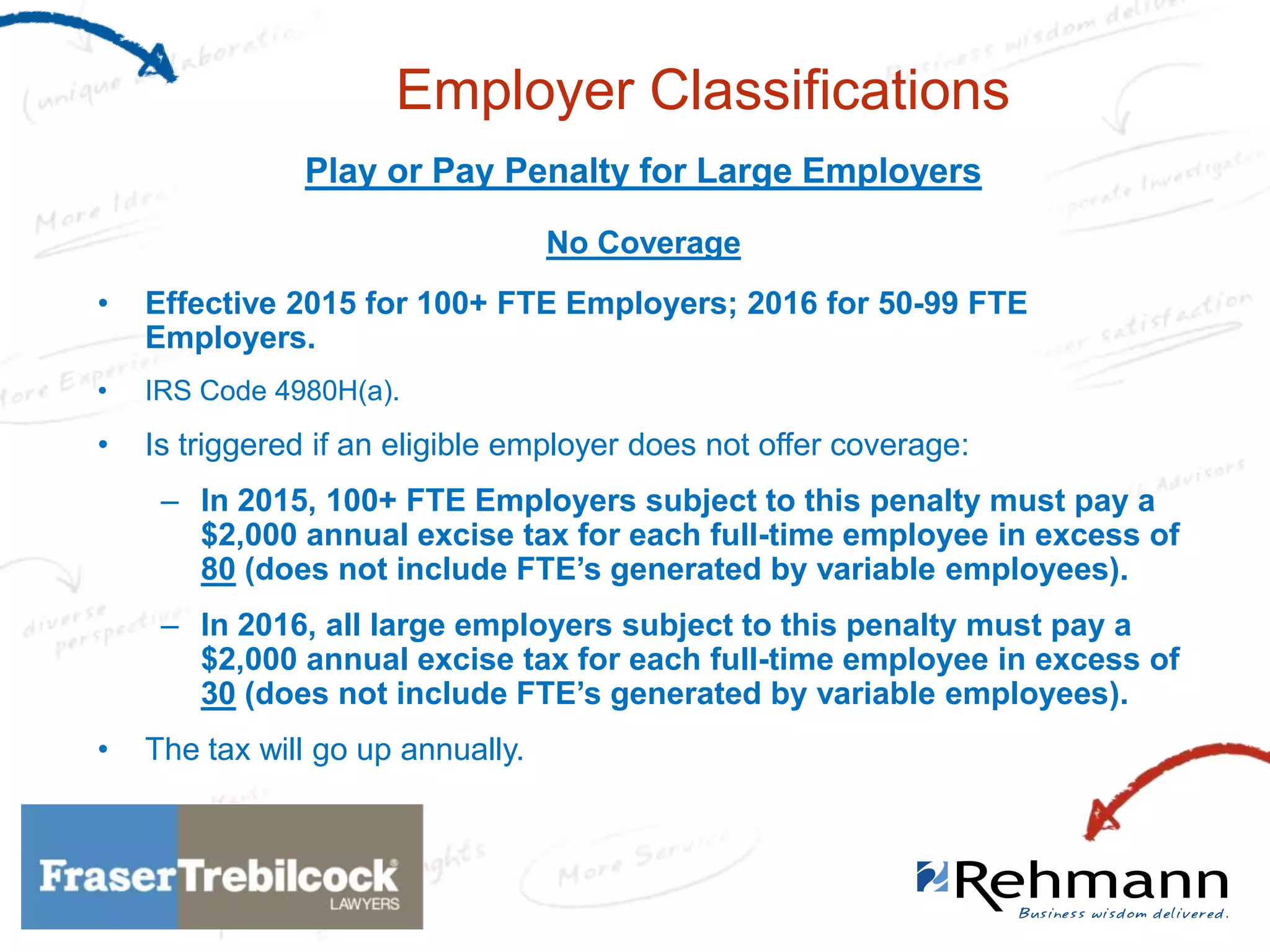

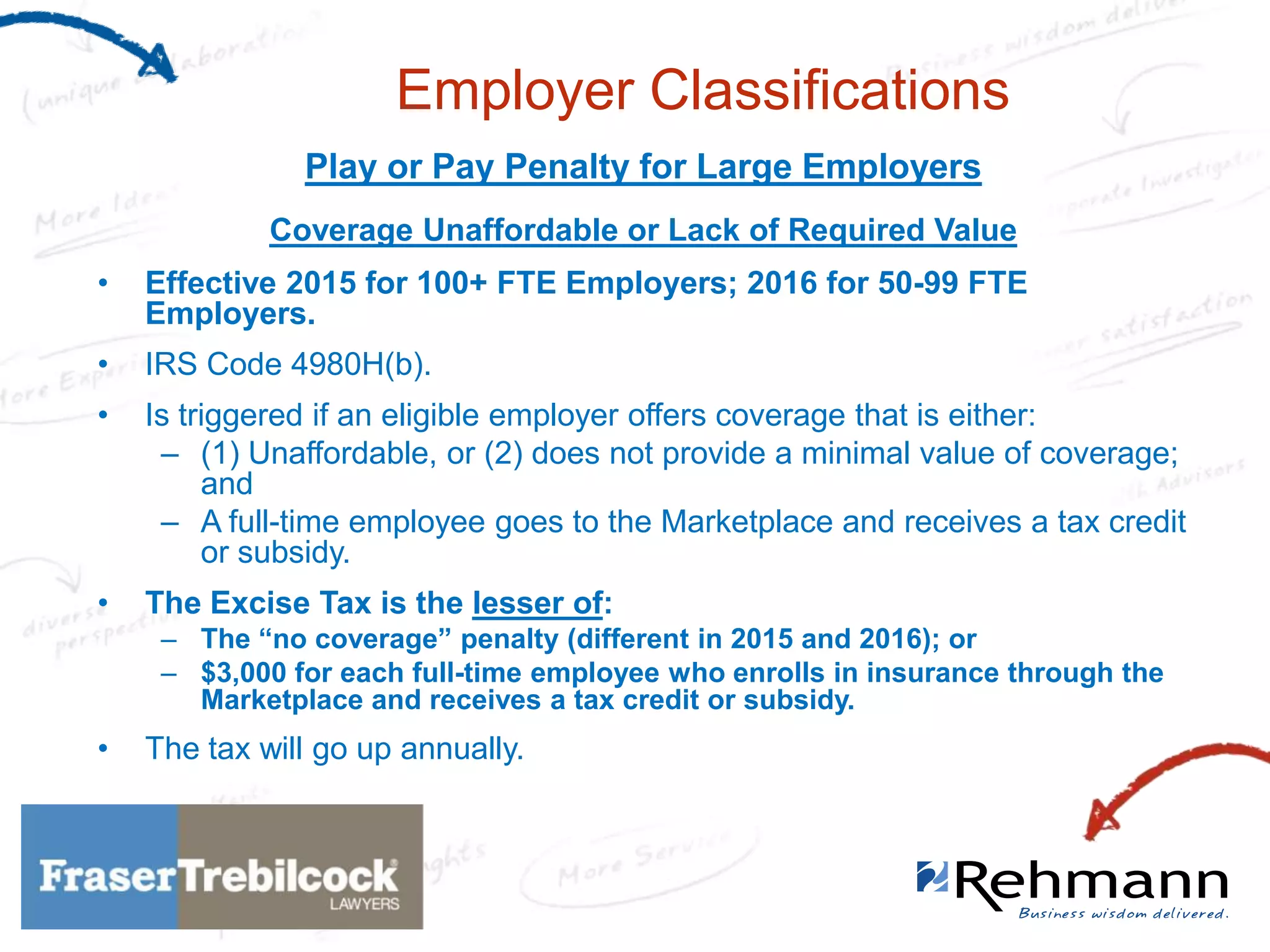

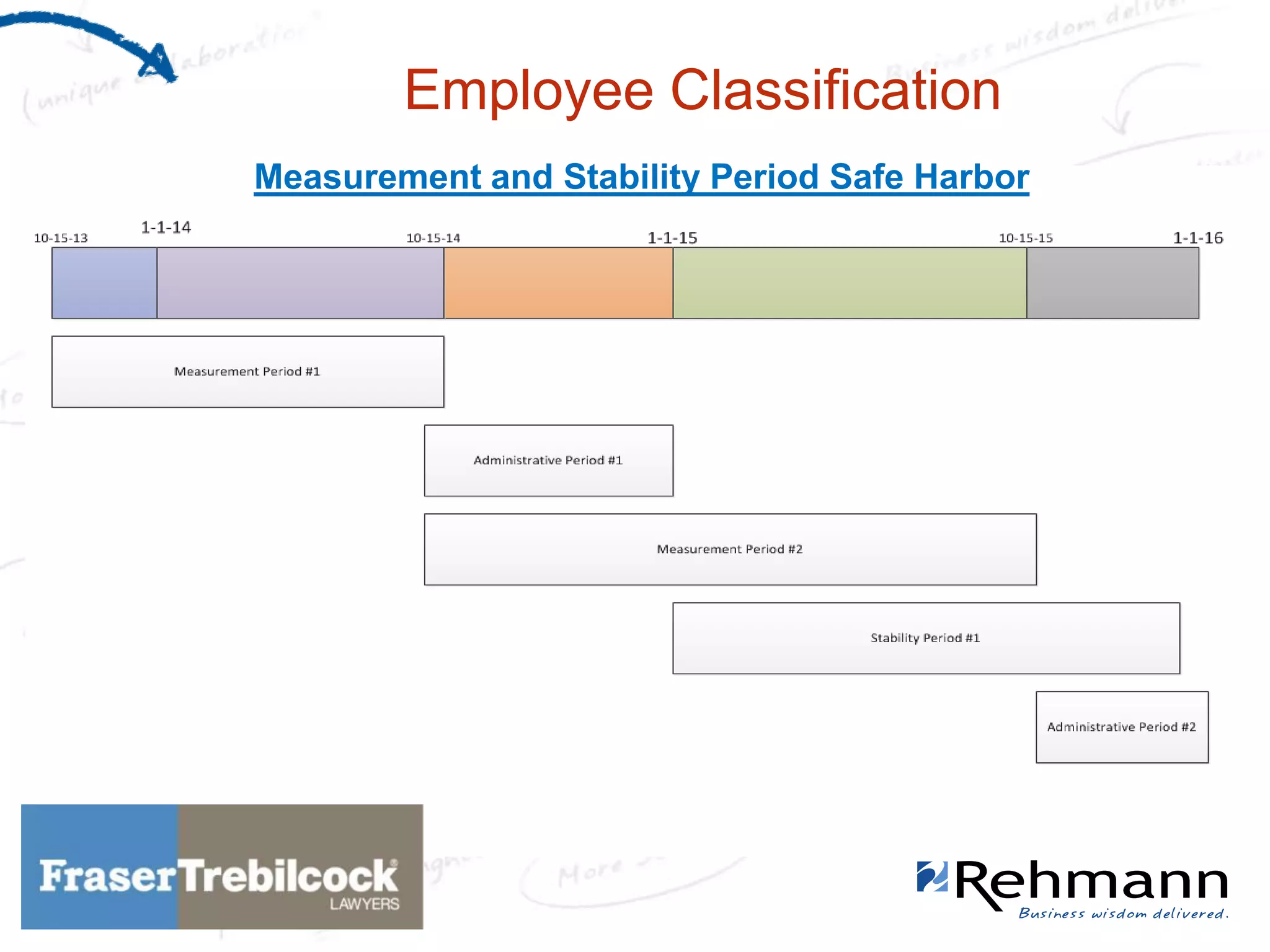

The document outlines recent changes to the Affordable Care Act (ACA), focusing on employer responsibility requirements and updated classifications for full-time employees. Modifications include delayed penalties for large employers, revised definitions for seasonal employees, and exemptions for certain types of workers. It highlights significant deadlines and compliance requirements crucial for non-profits and governmental units, as well as the tax implications of ACA provisions.