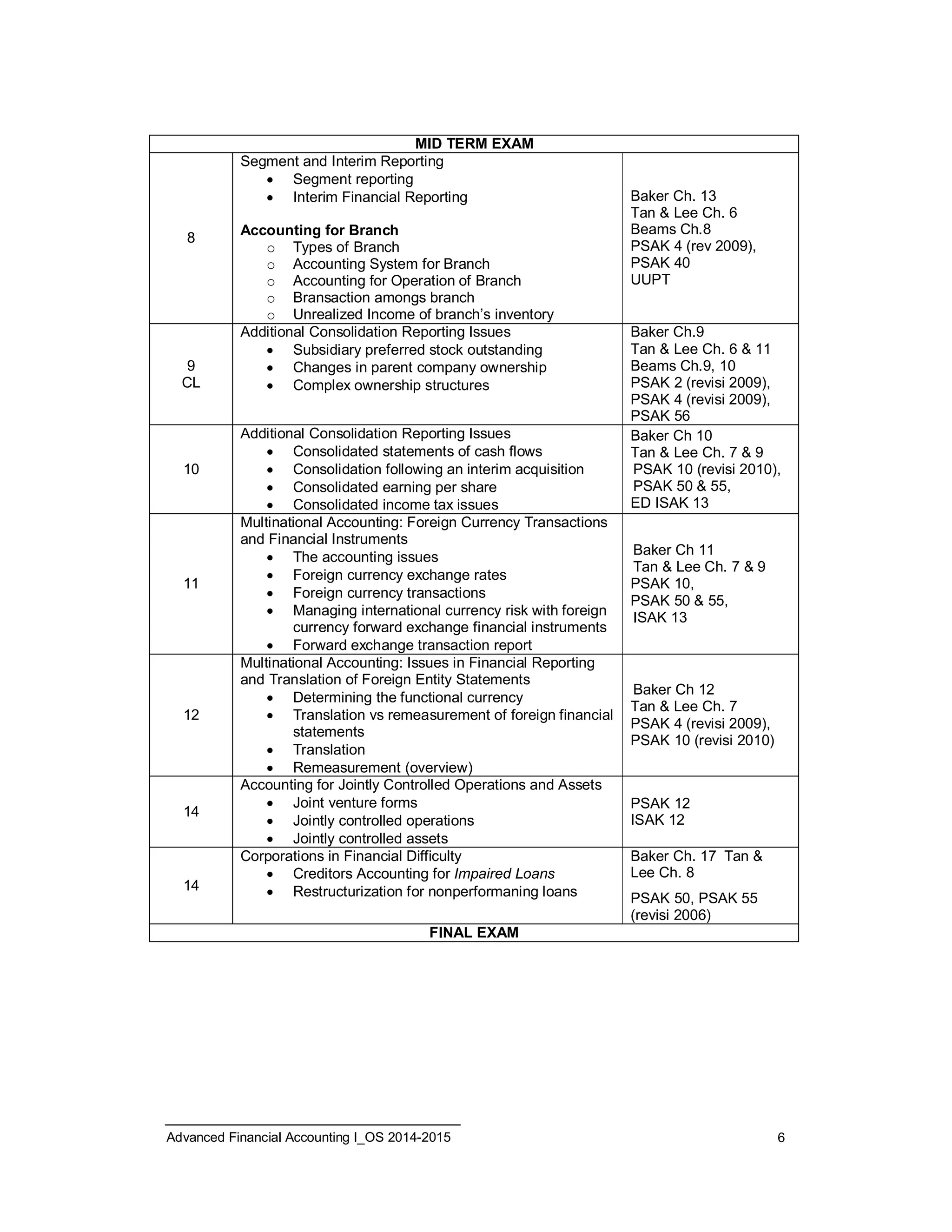

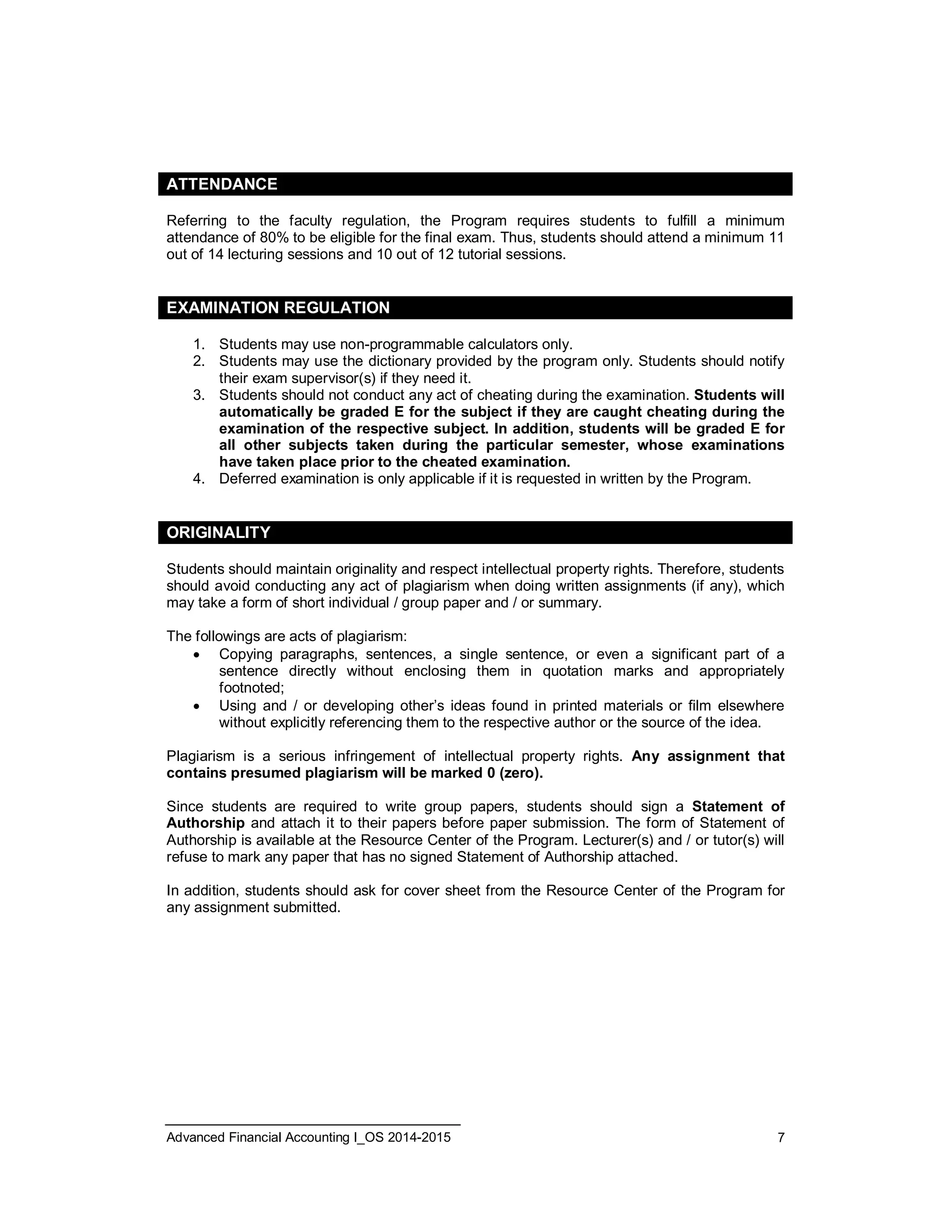

This document is a syllabus for an Advanced Financial Accounting course. It provides information on the course objectives, topics, materials, assessment, and schedule. The course aims to discuss financial accounting for business combinations, investments in other entities, and consolidated financial reporting. Specific topics include various acquisition accounting methods, equity method of accounting for investments, consolidated financial statement preparation, and issues related to subsidiaries, intercompany transactions, and multinational accounting. Students will be assessed through assignments, quizzes, exams, and group work. The syllabus outlines the lecture topics, readings, and assessment breakdown and policies.

![UNIVERSITAS INDONESIA

FACULTY OF ECONOMICS AND BUSINESS

International Undergraduate Program

SYLLABUS

[ACCT 11301] ADVANCED FINANCIAL ACCOUNTING I

Odd Semester 2014/2015

Credit: 3

Prerequisite: ACCT 11203 Intermediate Financial Accounting II

Lecturers:

Indah Melati, M.Sc. [coordinator]

International Undergraduate Program

indah.melati@gmail.com

081804975408 (mobile), (021)7272425 ext.151 (office)

Tutor:

Arfah Habib Saragih, MS.Ak.

arfah.habib.saragih@gmail.com, 085782082758

Advanced Financial Accounting I_OS 2014-2015 1](https://image.slidesharecdn.com/advancedfinancialaccountingi-141022095324-conversion-gate02/75/Advanced-financial-accounting-i-1-2048.jpg)