This document provides answers to 18 questions about governmental accounting. It discusses topics like the purpose and accounting of special revenue funds, debt service funds, capital projects funds, and internal service funds. It also covers the differences between the accrual and modified accrual bases of accounting, requirements for major and non-major funds, component units, and reconciliation between fund-level and government-wide financial statements. Key financial statements for different fund types are identified. The role of the budgetary comparison schedule in required supplementary information is explained. Presentation of long-term assets, infrastructure, and debt on the government-wide statements is summarized.

![Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements

18-11

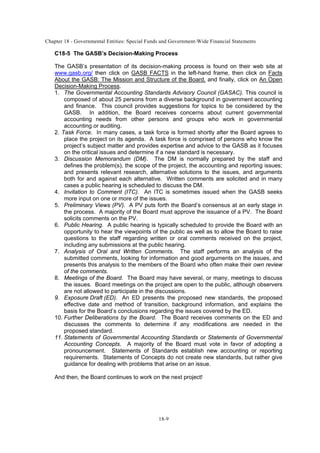

E18-2 Multiple-Choice Questions on Governmental Funds [AICPA Adapted]

1. d

2. b

3. a

4. c

5. c

6. b

E18-3 Multiple-Choice Questions on Proprietary Funds [AICPA Adapted]

1. b

2. d

3. d

4. b

5. c

6. c Prepaid insurance would be reported as an asset.

7. b

8. c

9. c](https://image.slidesharecdn.com/smadvaccbaker9echap18-150204183312-conversion-gate01/85/Solution-Manual-Advanced-Financial-Accounting-by-Baker-9th-Edition-Chapter-18-11-320.jpg)

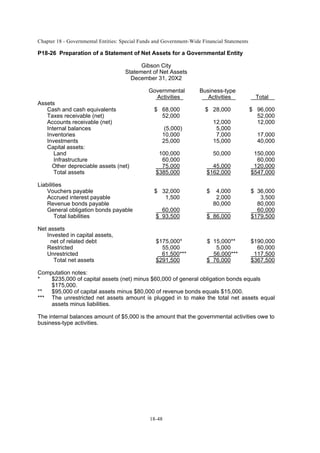

![Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements

18-20

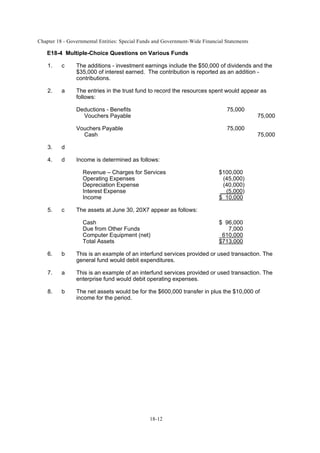

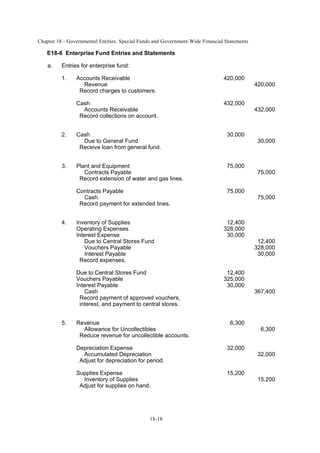

E18-8 (continued)

c. Augusta

MUD Enterprise Fund

Statement of Revenue, Expenses, and

Changes in Fund Net Assets

For Fiscal Year Ended December 31, 20X1

Revenue:

Revenue from Services $413,700

Expenses:

Operating $328,000

Depreciation 32,000

Supplies 15,200 375,200

Operating Income $ 38,500

Nonoperating Expense:

Less: Interest on Capital-Related Debt 30,000

Change in Net Assets $ 8,500

Net Assets, January 1 130,000

Net Assets, December 31 $138,500

[Note that interest expense on capital-related debt is a non-operating expense.]](https://image.slidesharecdn.com/smadvaccbaker9echap18-150204183312-conversion-gate01/85/Solution-Manual-Advanced-Financial-Accounting-by-Baker-9th-Edition-Chapter-18-20-320.jpg)

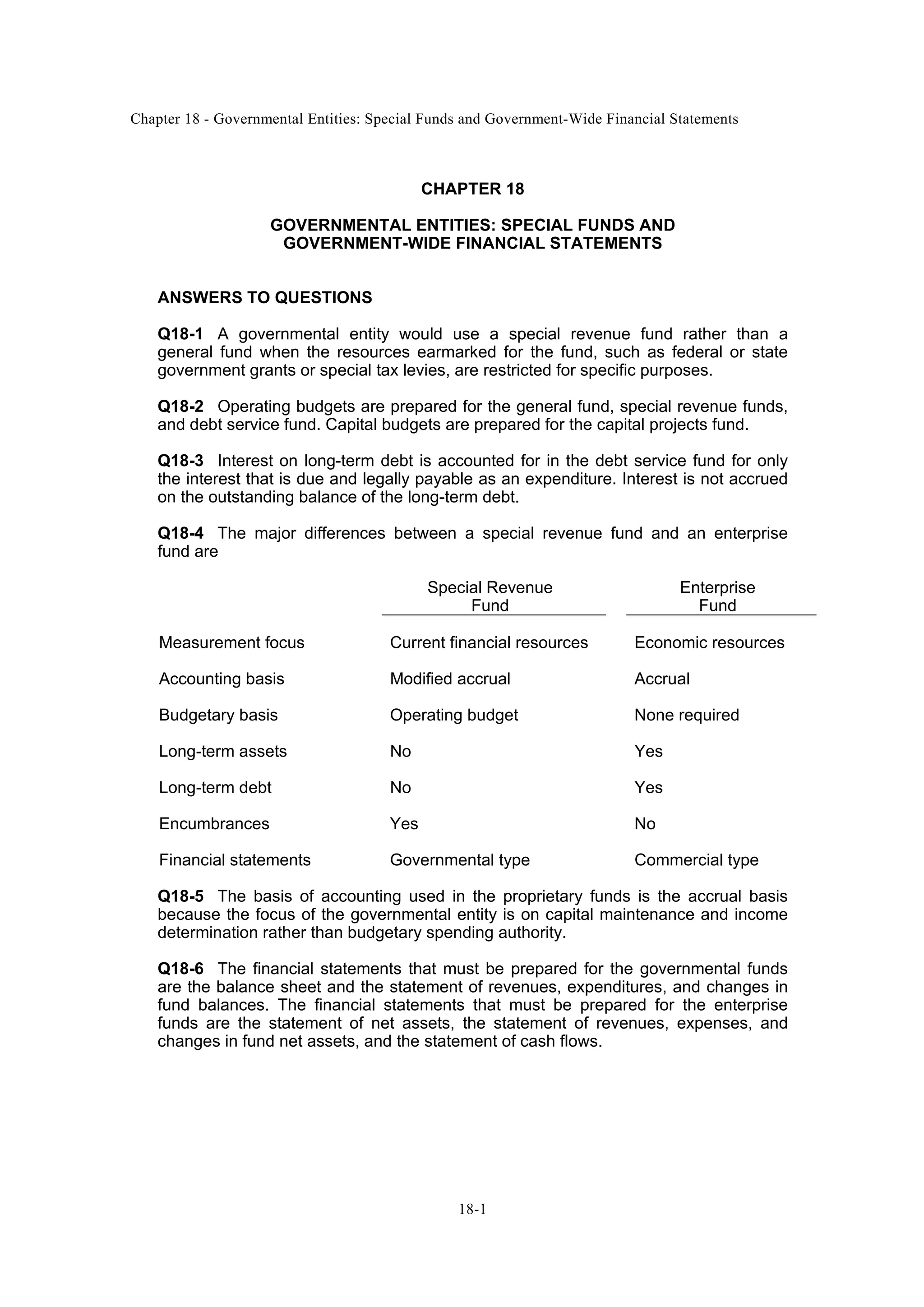

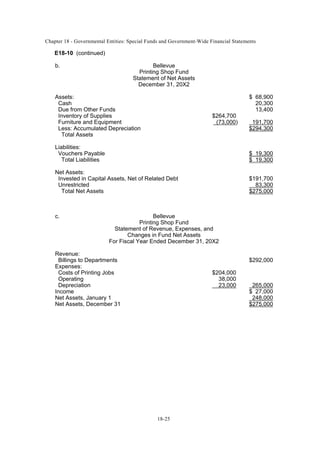

![Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements

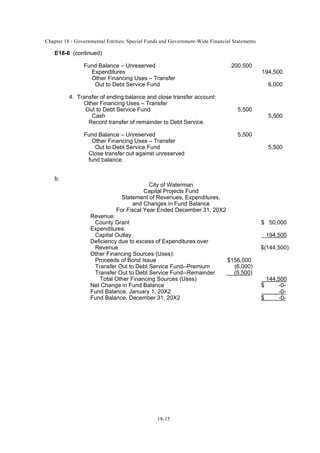

18-21

E18-8 (continued)

d.

Augusta

MUD Enterprise Fund

Statement of Cash Flows

For the Year Ended December 31, 20X1

Cash Flows from Operating Activities:

Cash Received from Customers $ 432,000

Cash Payments for Goods and Services (325,000)

Cash Paid to Internal Service Fund for Supplies (12,400)

Net Cash Provided by Operating Activities $ 94,600

Cash Flows from Noncapital Financing Activities:

Cash Received from General Fund for Noncapital Loan $ 30,000

Net Cash Provided by Noncapital

Financing Activities 30,000

Cash Flows from Capital and Related Financing

Activities:

Interest on Capital-Related Debt $(30,000)

Extension of Service Lines (75,000)

Net Cash Used for Capital and

Related Financing Activities (105,000)

Cash Flows from Investing Activities -0-

Net Increase in Cash $ 19,600

Cash at Beginning of Year 92,000

Cash at End of Year $111,600

Reconciliation of Operating Income to Net Cash

Provided by Operating Activities:

Operating Income $ 38,500

Adjustments to Reconcile Operating Income to Net Cash

Provided by Operating Activities:

Depreciation $ 32,000

Change in Assets and Liabilities:

Decrease in Inventory and Supplies 2,800

Decrease in net Accounts Receivable 18,300

Increase in Vouchers Payable 3,000

Total Adjustments 56,100

Net Cash Provided by Operating Activities $ 94,600

[Note that interest paid on capital-related debt is reported in cash flows from capital

and related financing activities and not in the operating activities.]](https://image.slidesharecdn.com/smadvaccbaker9echap18-150204183312-conversion-gate01/85/Solution-Manual-Advanced-Financial-Accounting-by-Baker-9th-Edition-Chapter-18-21-320.jpg)

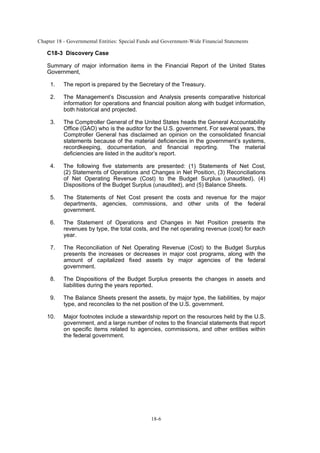

![Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements

18-27

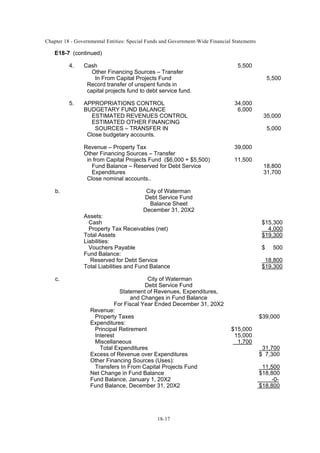

E18-11 Multiple-Choice Questions on Government-wide Financial Statements

1. c ($1,450,000 - $120,000)

2. a [($1,450,000 - $120,000) - $780,000]

3. b

4. c For the amount of the bond issue proceeds. Note that no repayments

of debt were made during the year.

5. c The interest adjustment is from the modified accrual basis ($30,000)

to the accrual basis of measurement ($25,000).

6. d

7. c

8. b

9. c

10. b](https://image.slidesharecdn.com/smadvaccbaker9echap18-150204183312-conversion-gate01/85/Solution-Manual-Advanced-Financial-Accounting-by-Baker-9th-Edition-Chapter-18-27-320.jpg)

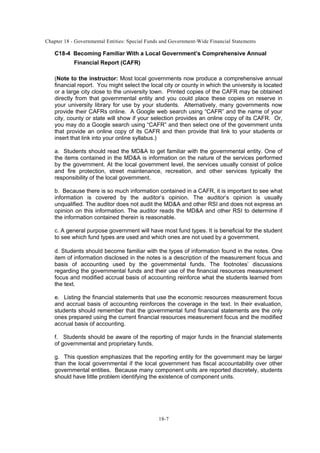

![Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements

18-28

SOLUTIONS TO PROBLEMS

P18-12 Adjusting Entries for General Fund [AICPA Adapted]

Adjusting entries to correct the general fund:

1. No entry required.

2. Expenditures 300,000

Buildings 300,000

Correct for state grant

expended for buildings.

Expenditures 22,000

Capital Outlays (equipment) 22,000

Correct for expenditures

for playground equipment.

3. Bonds Payable 1,000,000

Buildings 1,000,000

Correct for bonds used

to construct buildings.

Other Financing Uses – Transfer

Out to Debt Service Fund 130,000

Debt Service from Current Funds 130,000

Correct for transfer to debt service fund.

4. ENCUMBRANCES 2,800

BUDGETARY FUND BALANCE – RESERVED

FOR ENCUMBRANCES 2,800

Correct for unrecorded encumbrances.

5. Expenditures 4,950

Inventory of Supplies 4,950

Correct for supplies used in period.

Fund Balance – Unreserved 6,500

Fund Balance – Reserved for Inventory 6,500

Correct for reserve for ending inventory.](https://image.slidesharecdn.com/smadvaccbaker9echap18-150204183312-conversion-gate01/85/Solution-Manual-Advanced-Financial-Accounting-by-Baker-9th-Edition-Chapter-18-28-320.jpg)

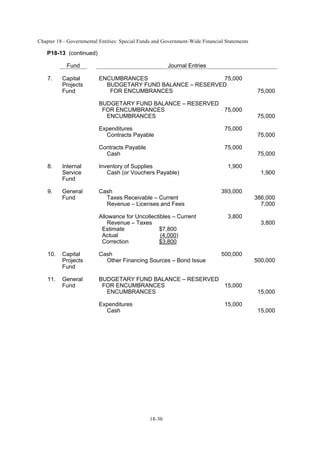

![Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements

18-29

P18-13 Entries for Funds [AICPA Adapted]

Fund Journal Entries

1. General ESTIMATED REVENUES CONTROL 400,000

Fund APPROPRIATIONS CONTROL 394,000

BUDGETARY FUND BALANCE – UNRESERVED 6,000

2. General Taxes Receivable – Current 390,000

Fund Revenue – Taxes 382,200

Allowance for Uncollectibles – Current 7,800

3. Private- Investments 50,000

Purpose Contributions 50,000

Trust Fund

Cash 5,500

Additions – Interest 5,500

4. General Other Financing Uses – Transfer

Out to Internal Service Fund 5,000

Cash 5,000

Internal Cash 5,000

Service Transfer In from General Fund 5,000

Fund

5. Capital Cash 72,000

Projects Other Financing Sources – Bond Issue 72,000

Due from General Fund 3,000

Other Financing Sources –

Transfer In from General Fund 3,000

Debt Special Assessments Receivable 24,000

Service Revenue – Special Assessments 24,000

Fund

General Other Financing Uses – Transfer

Out to Capital Projects Fund 3,000

Due to Capital Projects Fund 3,000

6. General Due to Capital Projects Fund 3,000

Fund Cash 3,000

Capital Cash 3,000

Projects Due from General Fund 3,000

Fund

Debt Cash 24,000

Service Special Assessments Receivable 24,000

Fund](https://image.slidesharecdn.com/smadvaccbaker9echap18-150204183312-conversion-gate01/85/Solution-Manual-Advanced-Financial-Accounting-by-Baker-9th-Edition-Chapter-18-29-320.jpg)

![Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements

18-31

P18-14 Entries to Adjust Account Balances [AICPA Adapted]

a. General Fund

Adjusting entries:

1. Allowance for Uncollectibles – Delinquent 2,200

Fund Balance – Unreserved 2,200

Reduce estimated losses on prior year's

taxes to amount of receivables of $8,000.

2. Revenue 27,000

Donated Land 27,000

Remove accounts belonging only in the

government-wide financial statements.

3. Fund Balance – Unreserved 8,800

Fund Balance – Reserved

for Encumbrances – 20X0 8,800

Record purchase orders outstanding

on June 30, 20X0.

Expenditures – 20X0 8,800

Other Expenditures 8,800

Reclassify purchases of supplies

chargeable to prior year's appropriations.

Excess of $600 actual cost over estimate

is approved and charged to current year

expenditures.

4. ENCUMBRANCES 2,100

BUDGETARY FUND BALANCE – RESERVED

FOR ENCUMBRANCES 2,100

Record encumbering of appropriations for

purchase orders outstanding on June 30, 20X1.

5. Special Assessment Bonds Payable 100,000

Due to Capital Projects Fund 100,000

Record liability to capital projects

fund for cash obtained from sale of

special assessment bonds.

6. Revenue 21,000

Tax Anticipation Notes Payable 20,000

Due to Water Utility Fund 1,000

Record tax anticipation notes payable

and liability to water utility fund for

funds obtained from sale of scrap.](https://image.slidesharecdn.com/smadvaccbaker9echap18-150204183312-conversion-gate01/85/Solution-Manual-Advanced-Financial-Accounting-by-Baker-9th-Edition-Chapter-18-31-320.jpg)

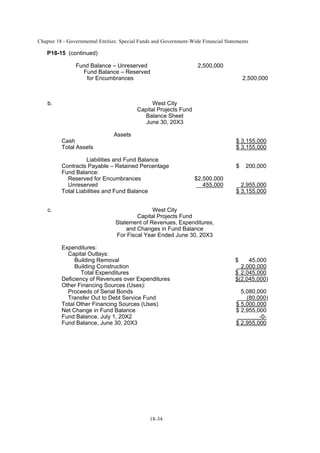

![Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements

18-35

P18-16 Recording Entries in Various Funds [AICPA Adapted]

1. Entries made in the capital projects fund for 20X8:

Cash 800,000

Other Financing Sources – Bond Issue 800,000

Issued $800,000 of bonds at their face value.

ENCUMBRANCES 750,000

BUDGETARY FUND BALANCE – RESERVED

FOR ENCUMBRANCES 750,000

Contractor’s bid is accepted.

BUDGETARY FUND BALANCE – RESERVED FOR

ENCUMBRANCES 250,000

ENCUMBRANCES 250,000

One-third of the project was completed during 20X8.

Expenditures 246,000

Contracts Payable 246,000

Actual construction cost incurred in 20X8.

2. Entries made in the special revenue fund for 20X8:

ESTIMATED REVENUES CONTROL 112,000

APPROPRIATIONS CONTROL 108,000

BUDGETARY FUND BALANCE – UNRESERVED 4,000

Record the budget for 20X8.

Cash 109,000

Revenues 109,000

Collected hotel room taxes.

Expenditures 103,000

Vouchers Payable 103,000

Incurred expenditures for general promotion

and motor vehicle.

Vouchers Payable 103,000

Cash 103,000

Paid expenditures.](https://image.slidesharecdn.com/smadvaccbaker9echap18-150204183312-conversion-gate01/85/Solution-Manual-Advanced-Financial-Accounting-by-Baker-9th-Edition-Chapter-18-35-320.jpg)

![Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements

18-38

P18-18 Questions on Fund Transactions [AICPA Adapted]

1. $104,500 (Stated in item #3.)

2. $17,000 (Stated in item #4.)

3. $125,000 (Item #5 states that $83,000 is reserved for encumbrances. To this

is added the $42,000 reserve for the ending inventory.)

4. $236,000 (Item #1 states that $600,000 of bond proceeds were received in

the capital project fund, less $364,000 of construction expenditures

in the period.)

5. $6,000 (Item #2 states that $109,000 tax revenues were received from

which $81,000 and $22,000 was expended.)

6. $104,500 (Stated in item #3.)

7. $386,000 (Item #1 states construction expenditures of $364,000 plus item #2

states a motor vehicle purchase of $22,000.)

8. $100,000 (Item #3 states a reduction in long-term debt principal of

$100,000.)

9. $181,000 (Item #6 states that $181,000 was used to purchase supplies

during the period.)

10. $190,000 (Item #6 states encumbrances of $190,000.)](https://image.slidesharecdn.com/smadvaccbaker9echap18-150204183312-conversion-gate01/85/Solution-Manual-Advanced-Financial-Accounting-by-Baker-9th-Edition-Chapter-18-38-320.jpg)

![Chapter 18 - Governmental Entities: Special Funds and Government-Wide Financial Statements

18-41

P18-21 Question on Fund Transactions [AICPA Adapted]

a.

1. G

2. K

3. L

4. L

5. E

6. J

7. D

8. A

9. F

10. B

b.

11. B and J

12. F and J

13. C and J

14. J

15. B and J

16. G and J

17. A

18. D

19. I and J

20. H and J](https://image.slidesharecdn.com/smadvaccbaker9echap18-150204183312-conversion-gate01/85/Solution-Manual-Advanced-Financial-Accounting-by-Baker-9th-Edition-Chapter-18-41-320.jpg)