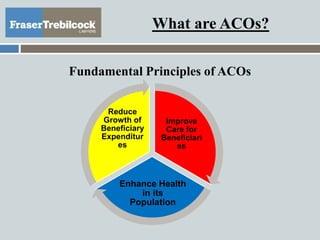

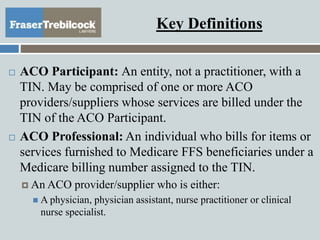

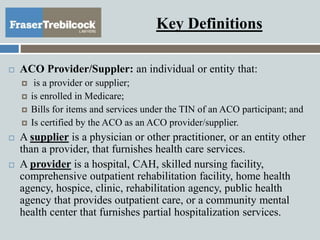

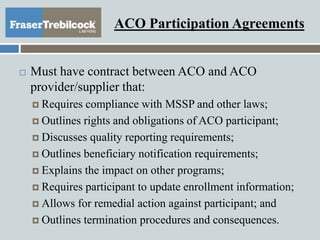

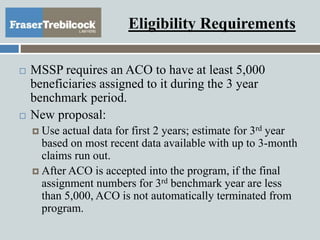

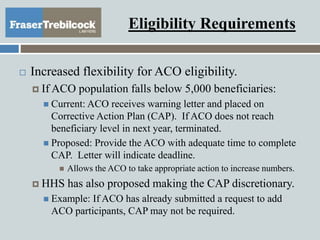

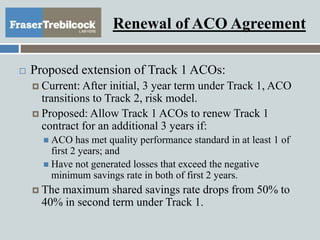

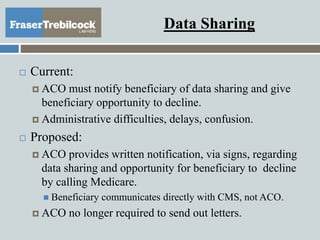

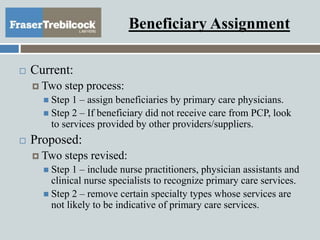

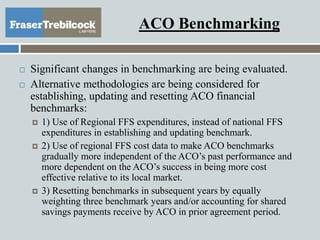

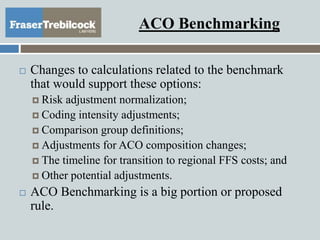

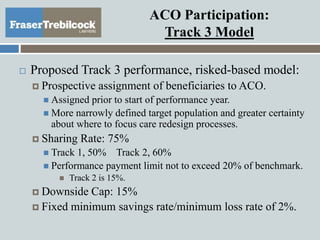

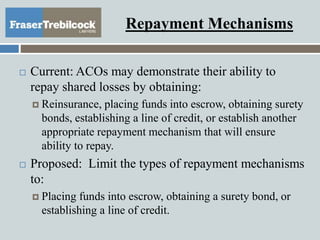

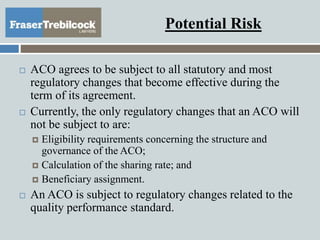

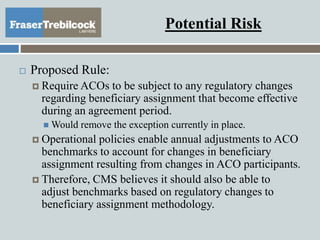

The document discusses the Medicare Shared Savings Program (MSSP) and the role of Accountable Care Organizations (ACOs) in improving patient care and reducing healthcare costs. It outlines new regulations proposed by the Department of Health and Human Services in December 2014, including eligibility requirements, reporting obligations, and changes to ACO participation models. Key changes involve adjustments to beneficiary assignment processes, benchmarks for financial performances, and the legal structure of ACOs.