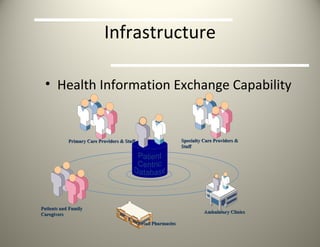

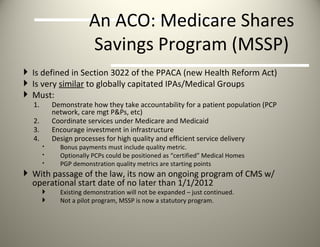

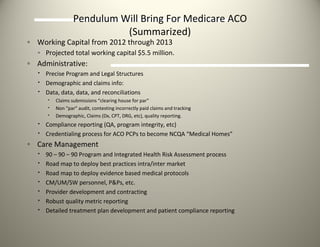

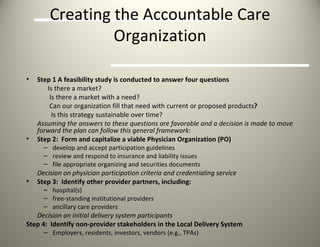

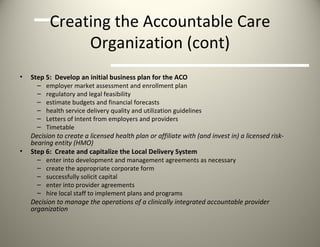

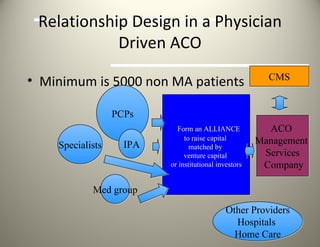

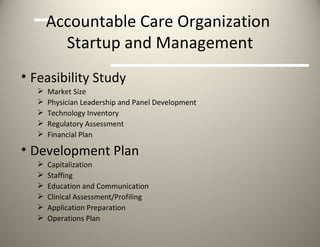

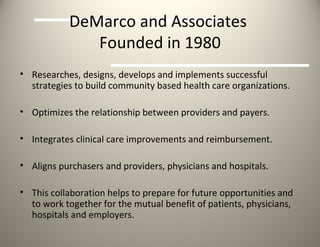

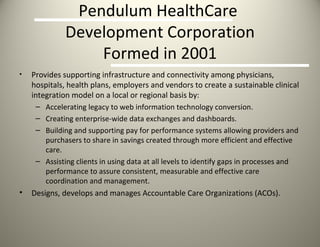

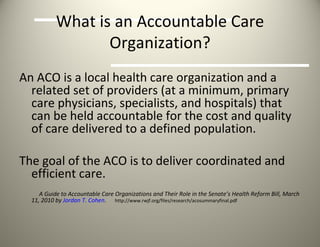

DeMarco and Associates and Pendulum HealthCare Corporation provide services to help organizations develop accountable care organizations (ACOs). They assist with infrastructure development, care coordination, and data analytics. Pendulum also designs, develops, and manages ACOs. An ACO aims to deliver coordinated, efficient care to a defined patient population through provider collaboration and accountability for costs and quality outcomes. Requirements include agreements between primary care physicians, specialists, and hospitals to be responsible for a minimum number of Medicare beneficiaries.

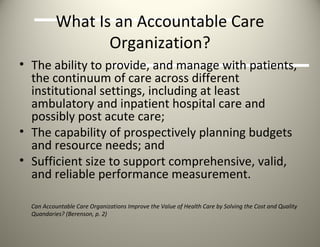

![To earn the incentive payment the organization would have to meet certain quality thresholds ACOs must agree to report annually to the Secretary of Health and Human Services on a specified set of quality indicators. ACOs would be allowed to report at the group or individual level on measures specified by the Secretary, including measures of: (1) clinical processes and outcomes (e.g. mortality, improvements in functionality), (2) patient perspectives on care, and (3) utilization and costs (e.g. ambulatory-sensitive admissions). For the purposes of calculating quality and cost performance, CMS would assign beneficiaries to ACOs based on the physician from whom the beneficiary received the most primary care services in the preceding year. [Note: This is for the purpose of gauging performance only, and does not impact the ability of beneficiaries to choose their own site of care.] ACOs would [in addition to the bonus] continue to be paid on a fee-for-service basis.](https://image.slidesharecdn.com/pendulumphysicianaco-13306386872943-phpapp02-120301155234-phpapp02/85/Pendulum-Physician-ACO-10-320.jpg)