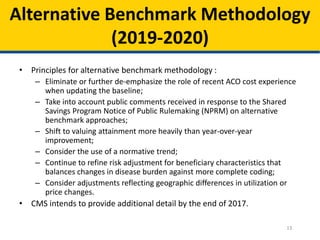

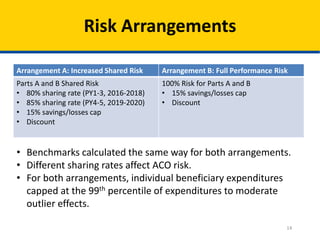

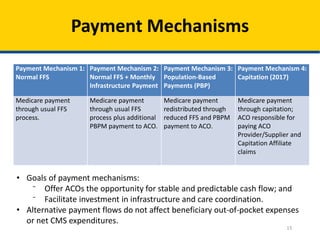

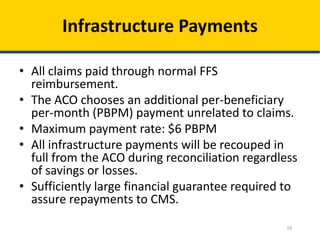

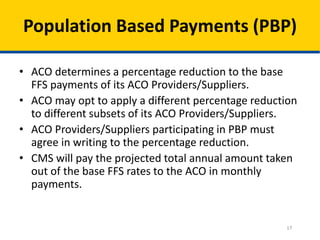

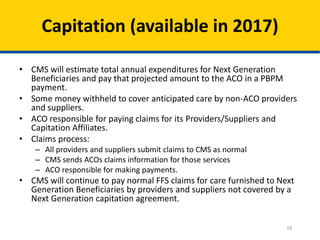

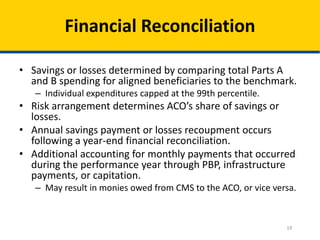

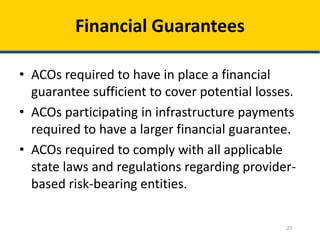

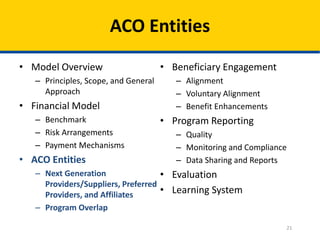

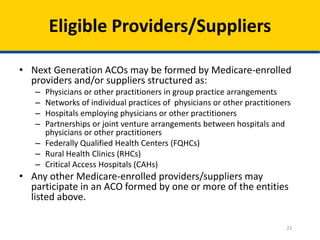

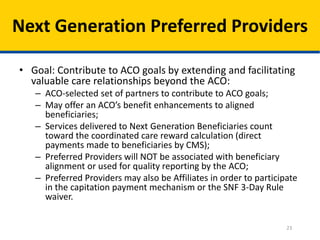

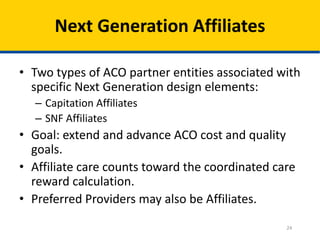

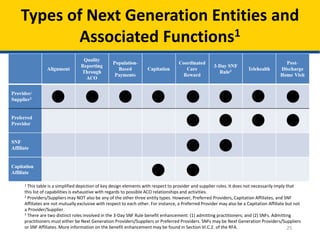

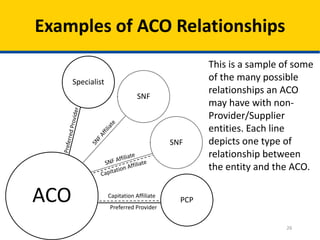

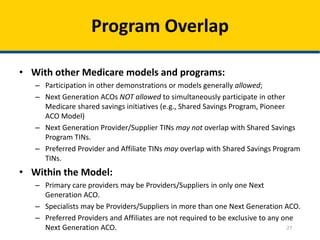

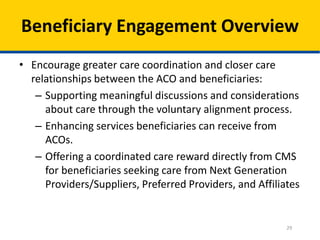

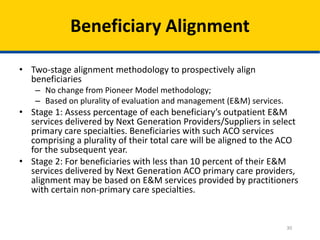

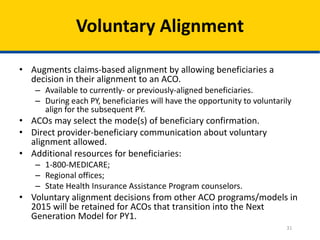

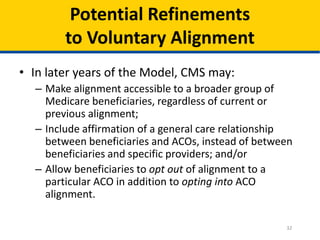

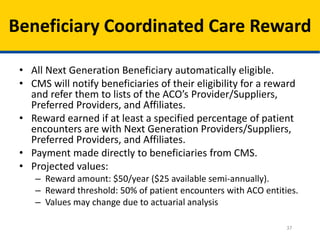

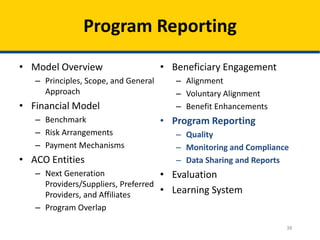

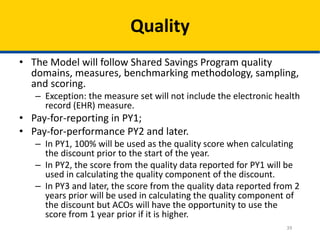

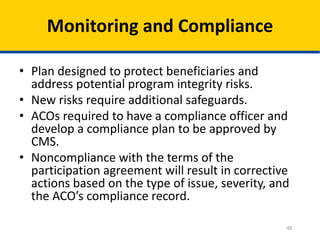

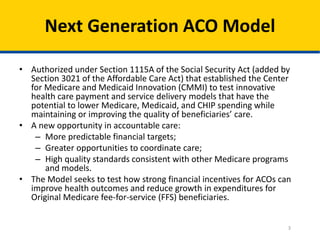

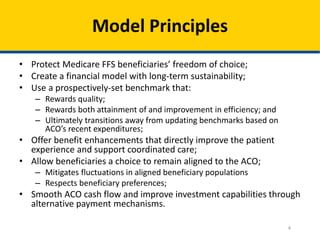

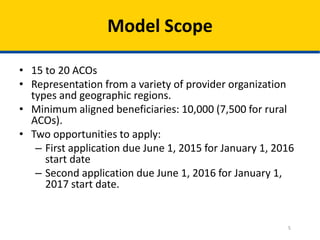

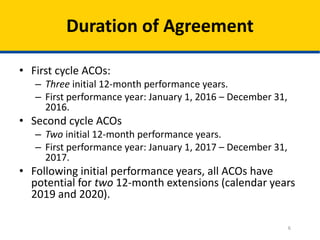

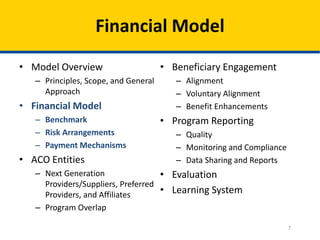

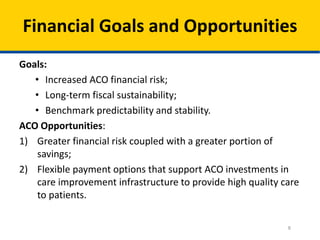

This document provides an overview of the Next Generation Accountable Care Organization (ACO) model, which aims to improve healthcare quality for Medicare beneficiaries while managing costs. It outlines the model's principles, financial arrangements, risk-sharing options, beneficiary engagement strategies, and program reporting mechanisms, highlighting the importance of coordinated care and involvement of diverse healthcare providers. The implementation includes various payment mechanisms, benefit enhancements, and a two-stage beneficiary alignment process to promote better care delivery.

![Discount (2016-2018)

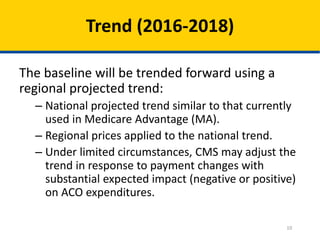

• Once the baseline has been calculated, trended, and risk-adjusted,

CMS will apply a discount.

• Summing the following components creates each ACO’s discount:

– Quality:

• Range: 2.0% to 3.0%

• Formula: [2.0 + (1- quality score)]%

– Regional Efficiency:

• Range: -1% to 1%

• Compares the ACO’s risk-adjusted historical per capita baseline to a risk-

adjusted regional FFS per capita baseline.

– National Efficiency:

• Range: -0.5% to 0.5%

• Compares the risk-adjusted regional FFS baseline to risk-adjusted national FFS

per capita spending.

• Total discount range: 0.5% to 4.5%](https://image.slidesharecdn.com/nextgenerationaco-odf2slides32715-150327121514-conversion-gate01/85/Open-Door-Forum-Next-Generation-ACO-Model-Second-Open-Door-Forum-12-320.jpg)