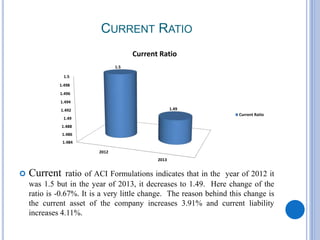

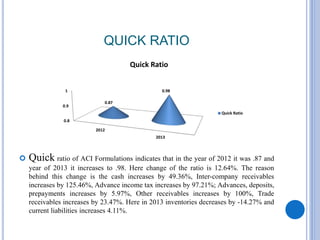

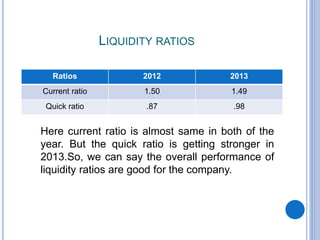

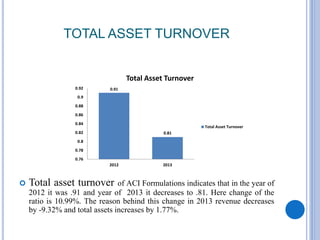

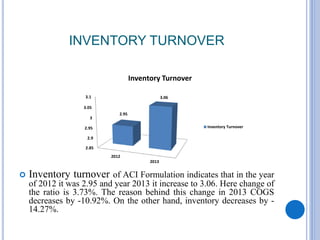

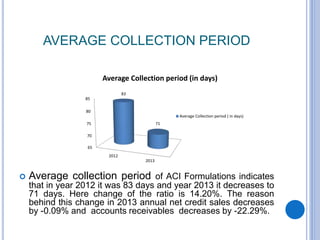

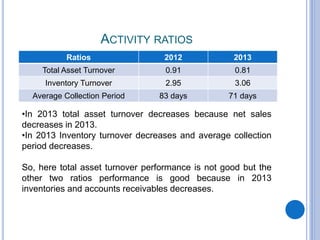

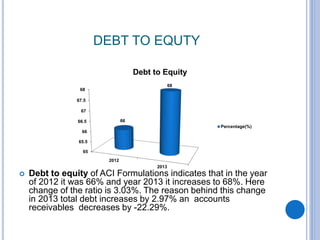

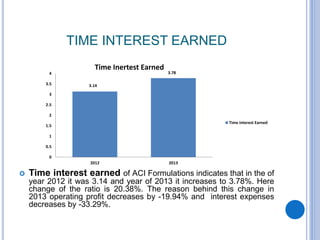

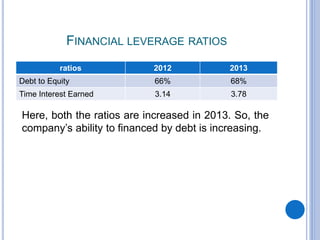

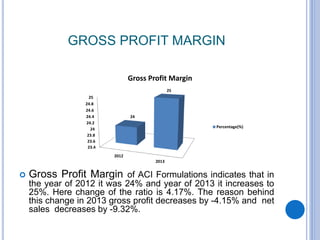

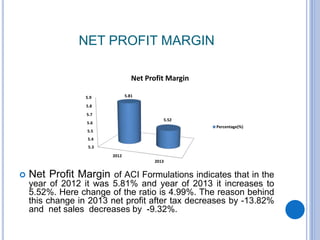

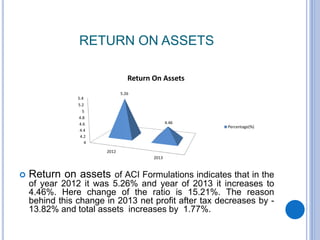

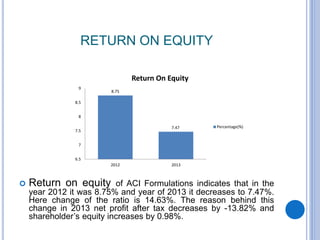

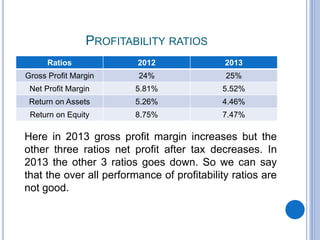

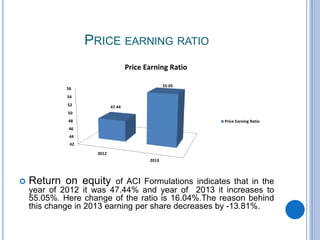

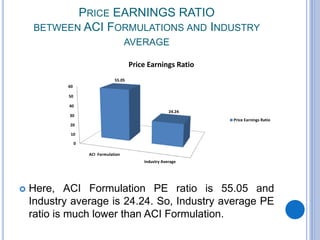

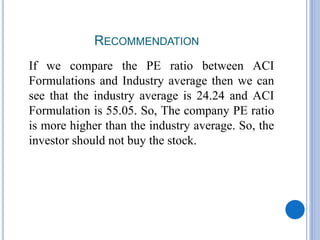

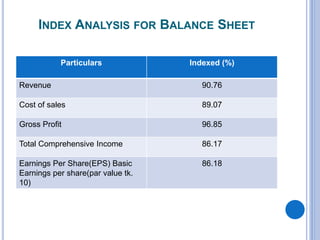

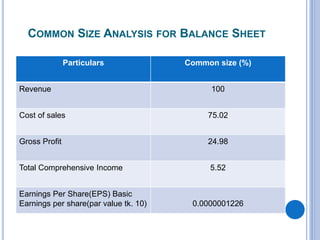

The document provides a financial analysis of ACI Formulations Limited, highlighting its liquidity, activity, financial leverage, and profitability ratios for the years 2012 and 2013. Key findings include a slight decrease in the current ratio but improvements in the quick ratio, while activity ratios showed a decline in total asset turnover despite better performance in inventory turnover and average collection period. Profitability ratios revealed mixed results, with an increase in gross profit margin but decreases in net profit margin, return on assets, and return on equity for 2013.