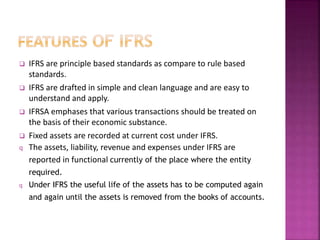

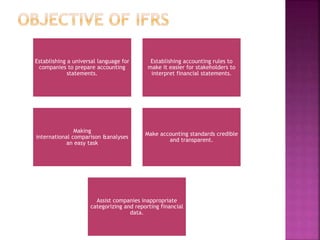

International Financial Reporting Standards (IFRS) are a set of accounting standards developed by the International Accounting Standards Board (IASB) to provide a common global language for business affairs worldwide. IFRS include standards for how particular types of transactions and events should be reported in financial statements to make them understandable and comparable across international borders. IFRS are designed to establish a universal set of accounting rules to facilitate easier international comparison and analysis of companies' financial statements.