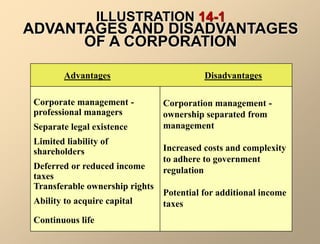

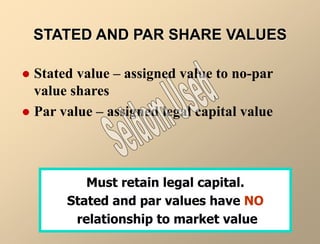

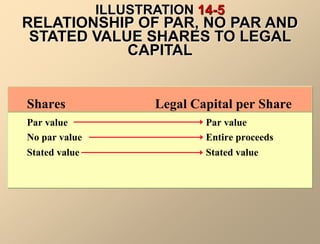

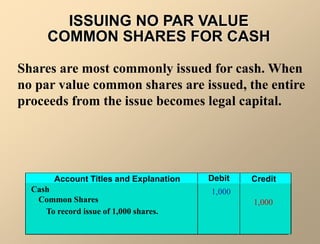

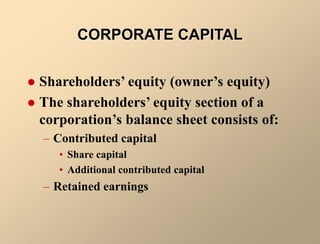

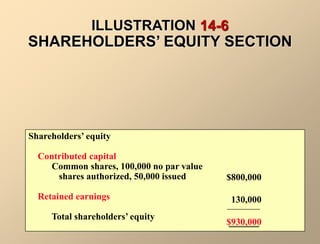

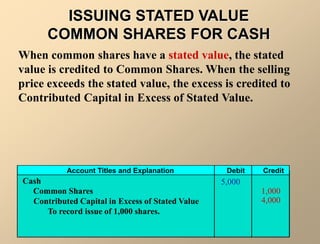

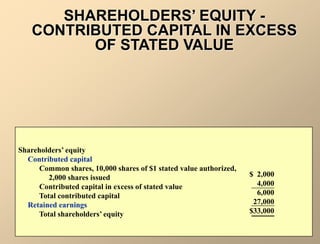

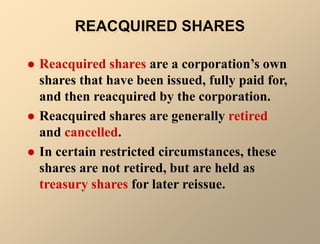

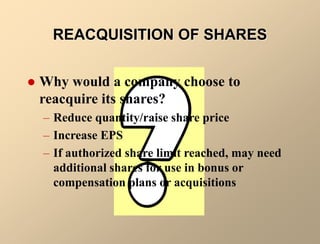

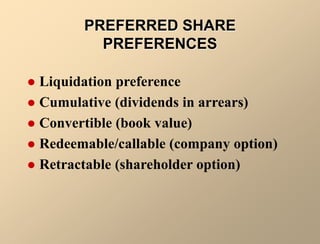

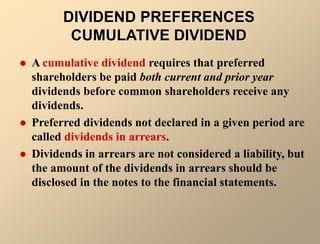

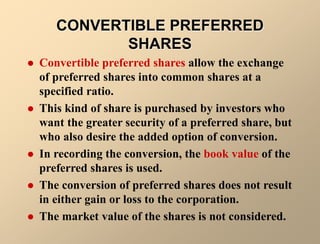

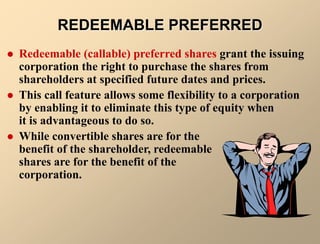

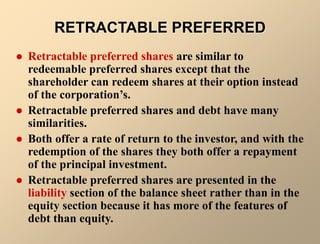

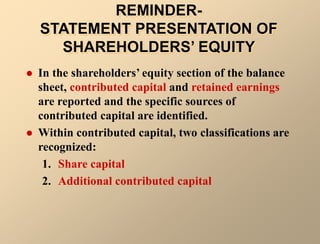

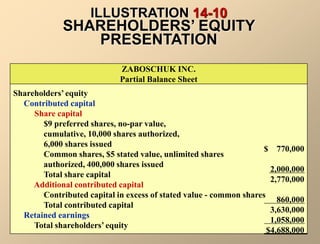

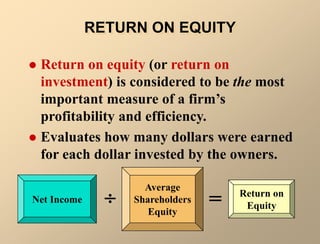

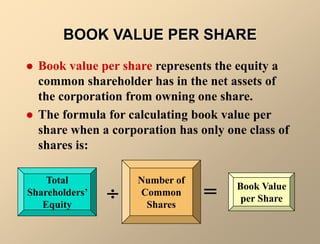

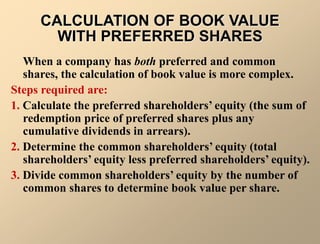

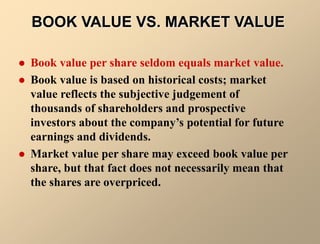

The document outlines the characteristics and organizational structure of corporations, including their advantages, disadvantages, and shareholder rights. It explains various types of shares, including common and preferred shares, and discusses issues related to capitalization and shareholder equity. Key financial metrics like return on equity and book value per share are also addressed, highlighting their significance in assessing a corporation's performance.