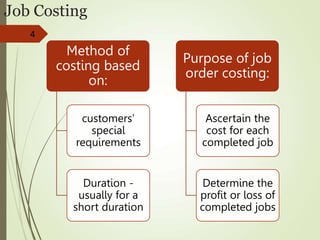

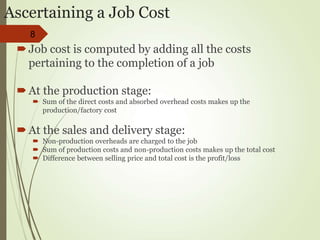

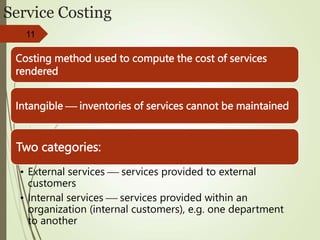

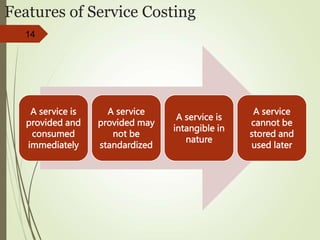

This document discusses different costing methods used to determine the costs of jobs, batches, and services. It explains that job costing is used for customer-specific orders, batch costing for identical units produced in batches, and service costing for intangible services. The key steps in job costing include obtaining a customer order, estimating costs, setting a selling price, producing the job, and determining profit or loss. The document also provides examples and outlines the process for calculating costs and profits under different costing methods.

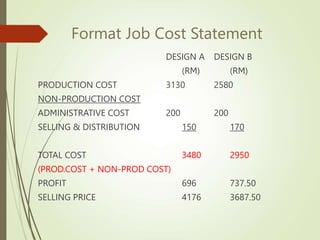

![WORKING TO CALCULATE PROFIT FOR DESIGN

A and B

DESIGN A: PROFIT IS BASED ON TOTAL COST @ PROFIT MARK-UP.

FORMULA:

PROFIT = TOTAL COST X % PROFIT

= RM3480 X 20%

= RM696

DESIGN B: PROFIT IS BASED ON SELLING PRICE @ PROFIT MARGIN

FORMULA:

PROFIT = [% PROFIT /(100 - PROFIT %)] X TC

= 20/(100 - 20) X RM2950

=( 20 / 80 )X RM2950

= RM737.50](https://image.slidesharecdn.com/topic5-costingmethodct-230202083908-0dd356a5/85/Topic-5-Costing-Method_CT-ppt-25-320.jpg)