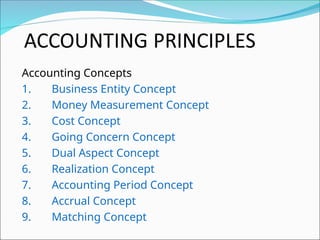

The document outlines accounting principles divided into concepts and conventions. Key accounting concepts include the business entity concept, money measurement, and the matching concept, while accounting conventions focus on consistency, full disclosure, and conservatism. These principles guide the preparation of financial statements and ensure accurate representation of a business's financial position.