The document provides an overview of key concepts in financial accounting including:

- The meaning and objectives of financial accounting

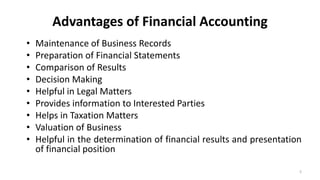

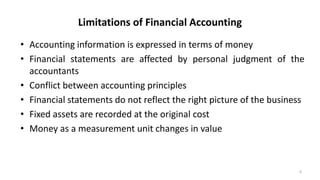

- The advantages and limitations of financial accounting

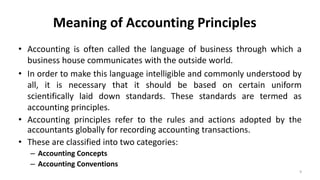

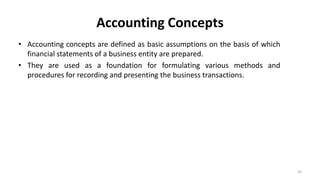

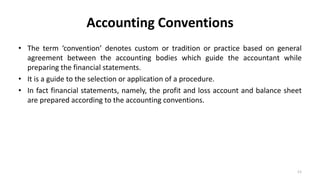

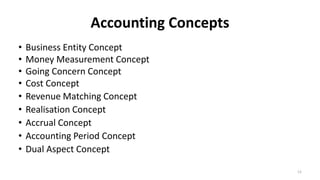

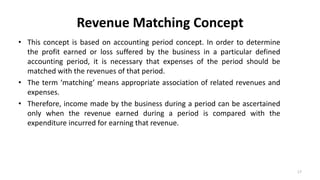

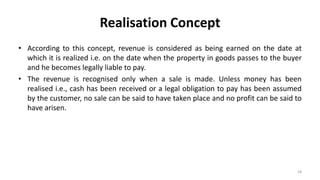

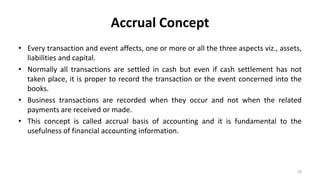

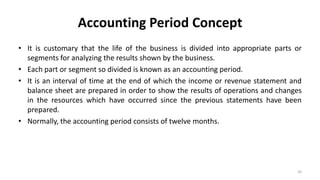

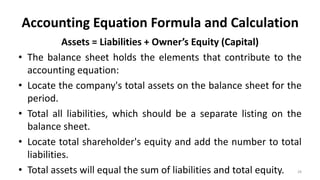

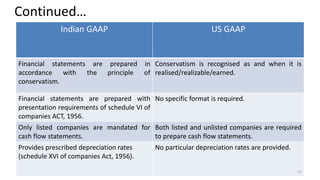

- Accounting principles like the accounting equation, concepts, and conventions

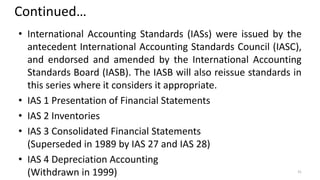

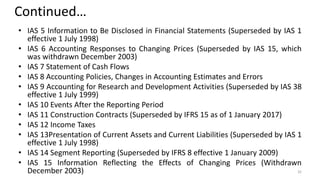

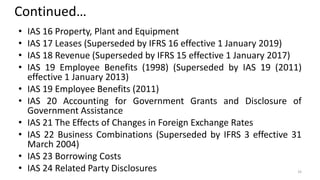

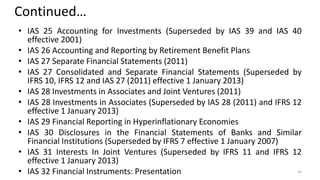

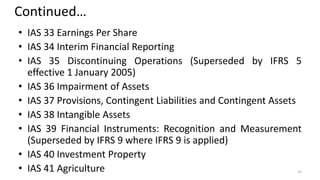

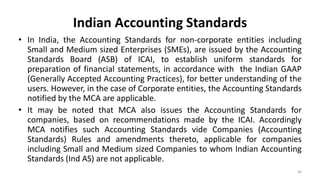

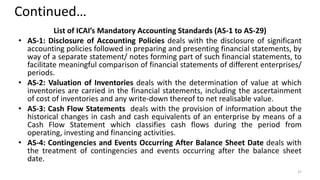

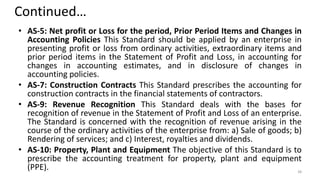

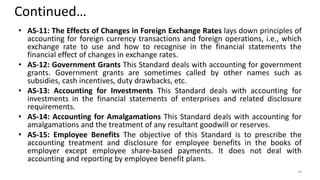

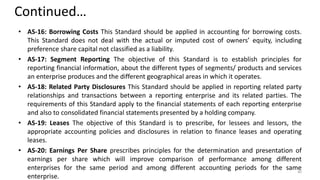

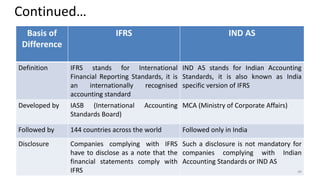

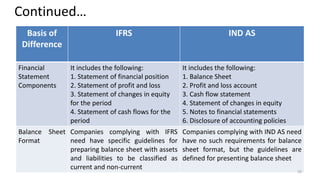

- International accounting standards set by the IASB

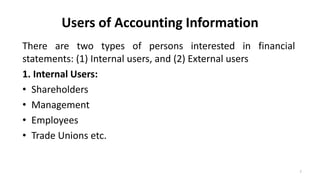

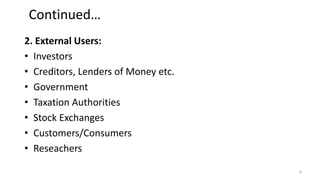

- Users of accounting information both internal and external to a business