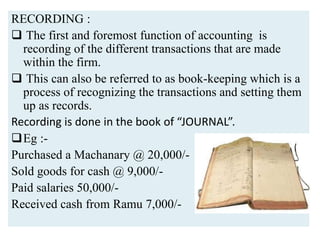

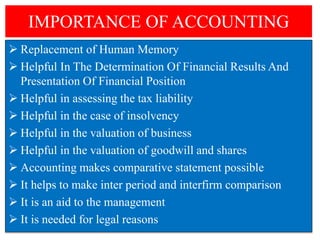

Accounting is the language of business that records, classifies, summarizes, and reports financial transactions to provide insights into a firm's financial position. The American Institute of Certified Public Accountants defines it as a systematic process for recording monetary transactions and interpreting the results. Key accounting principles include the business entity concept, going concern, and the matching concept, all aimed at ensuring accuracy and consistency in financial reporting.

![KEY WORDS

ACCOUNT:

A summarized statement of transactions

relating to a particular person, thing, expense or income.

TRANSACTION:

It refers to any happening event which is

measurable in terms of money and which changes the

financial position of the business concern.

Any sale or purchase of goods or services is called the

transaction

a. Cash Transaction : [ purchased furniture for cash ]

b. Credit Transaction :[ purchased furniture on credit]](https://image.slidesharecdn.com/fafmunit-1-240723151038-d1899562/85/FAFM-UNIT-1-pptx-financial-accounts-for-managers-52-320.jpg)