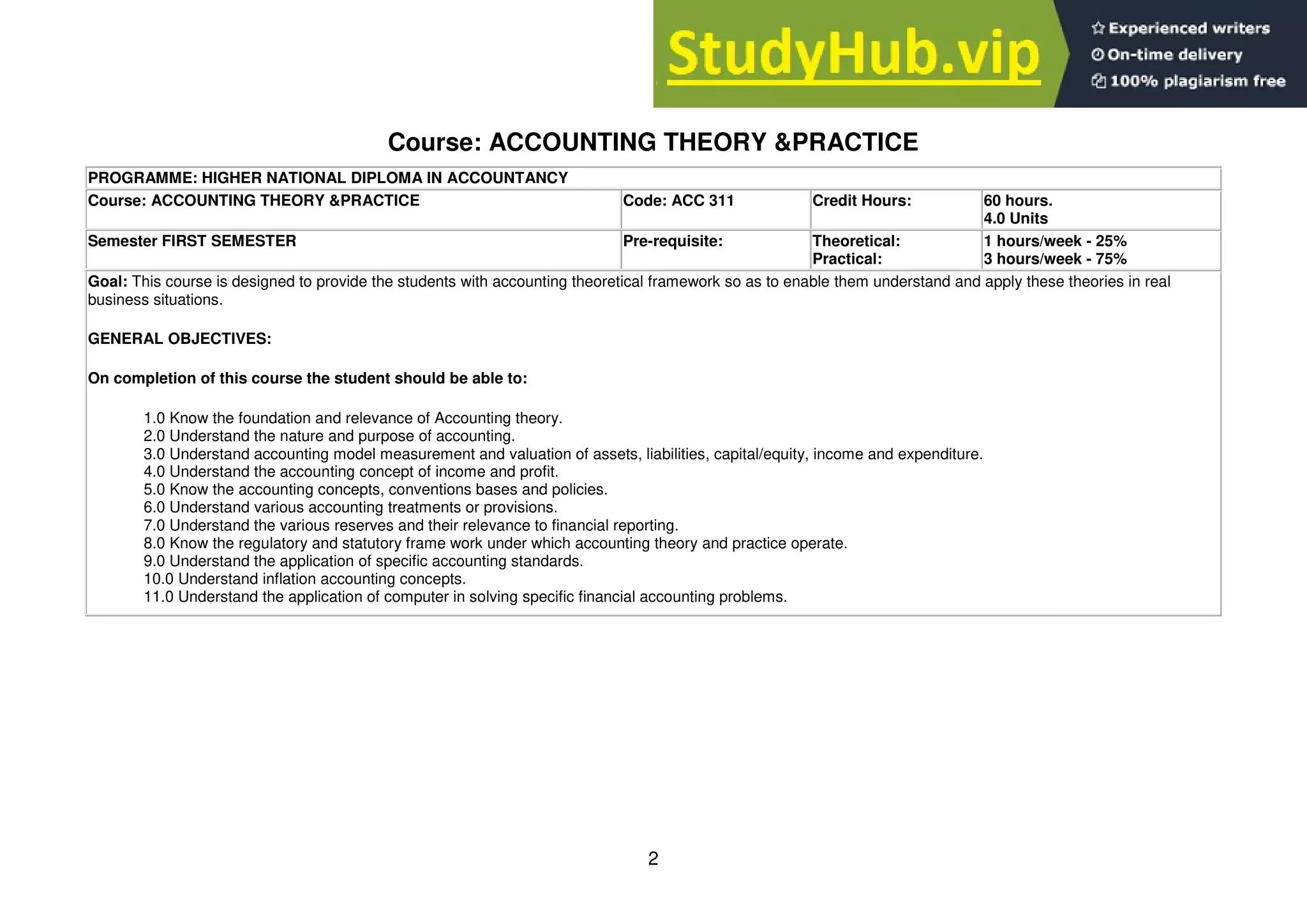

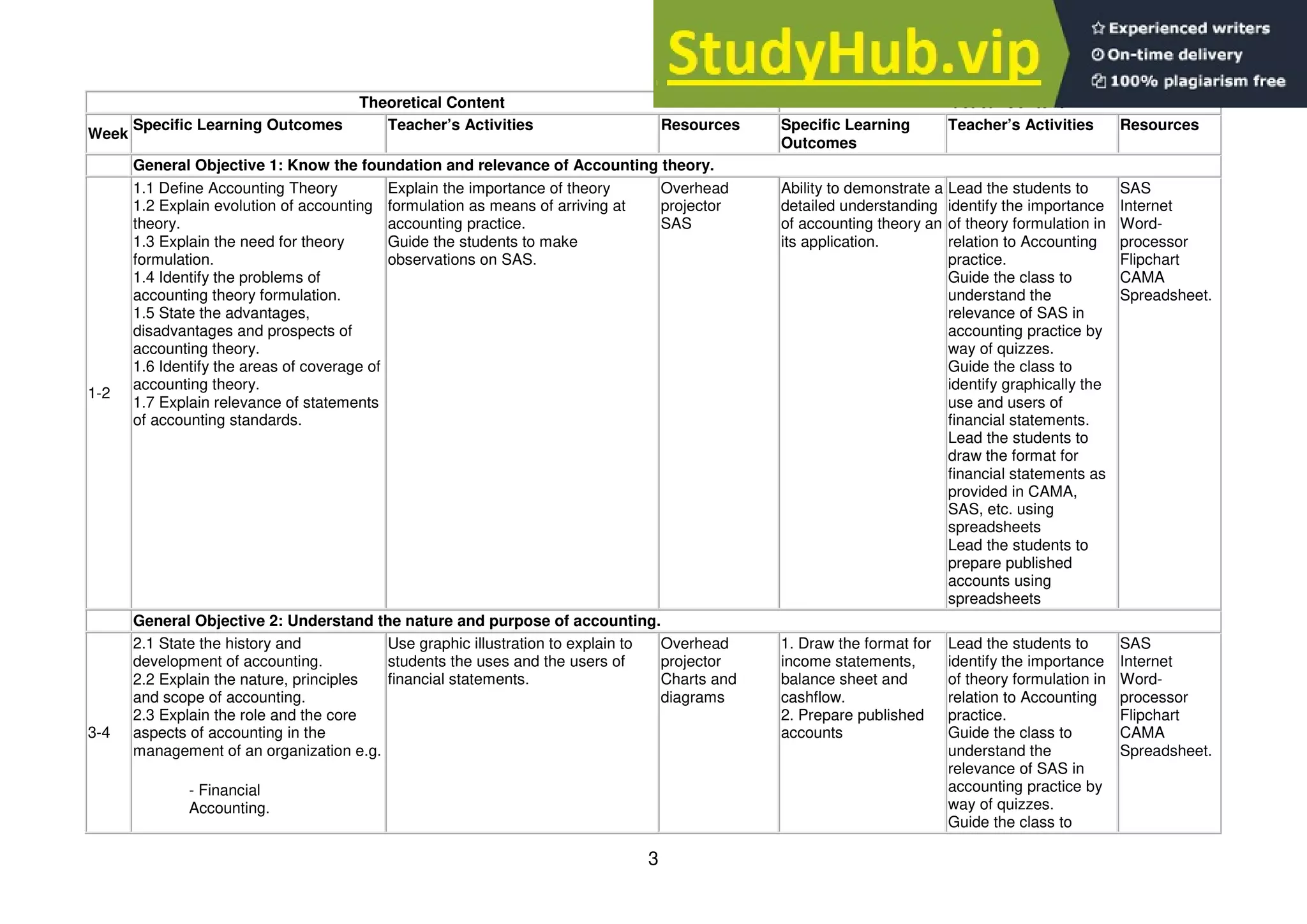

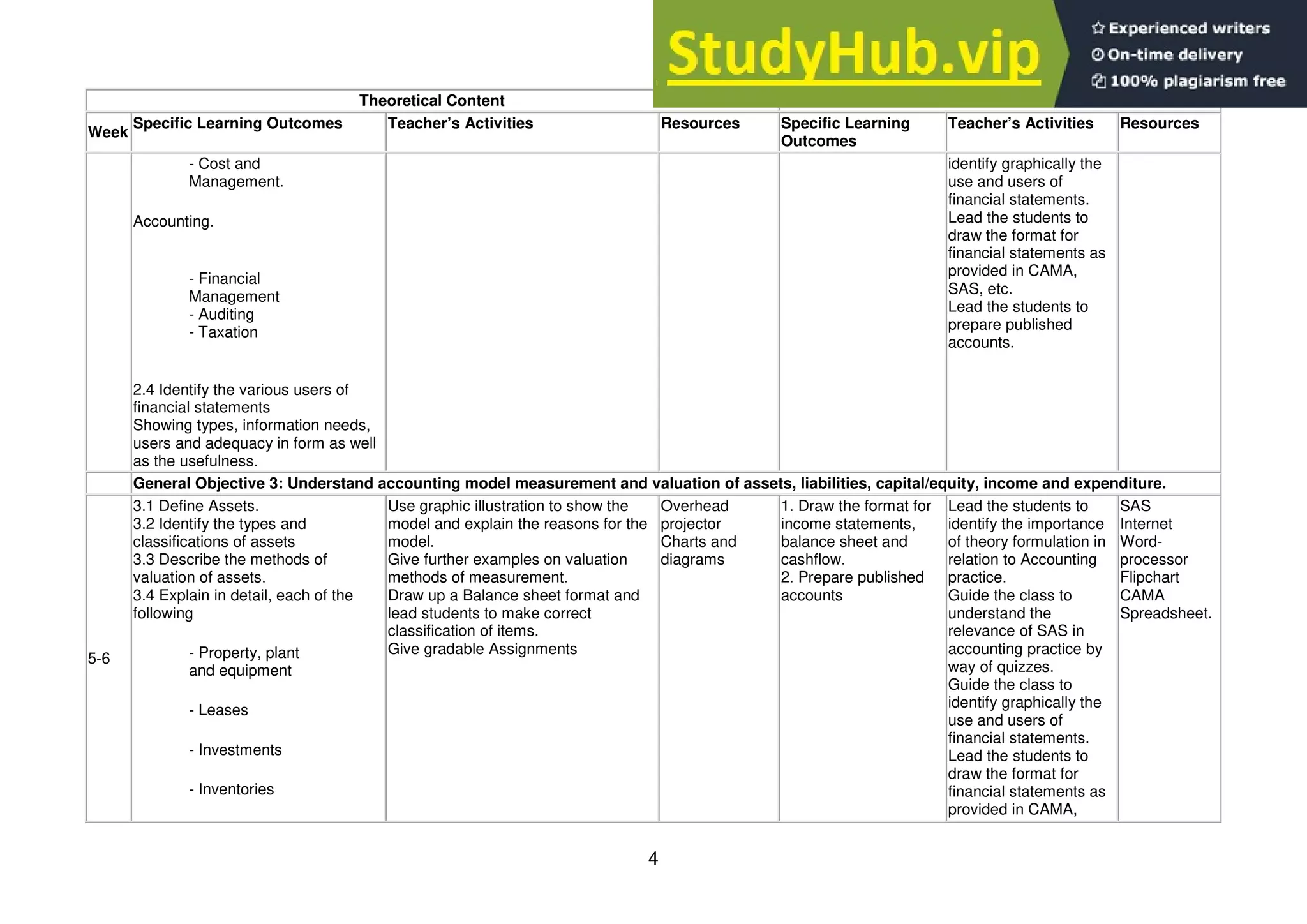

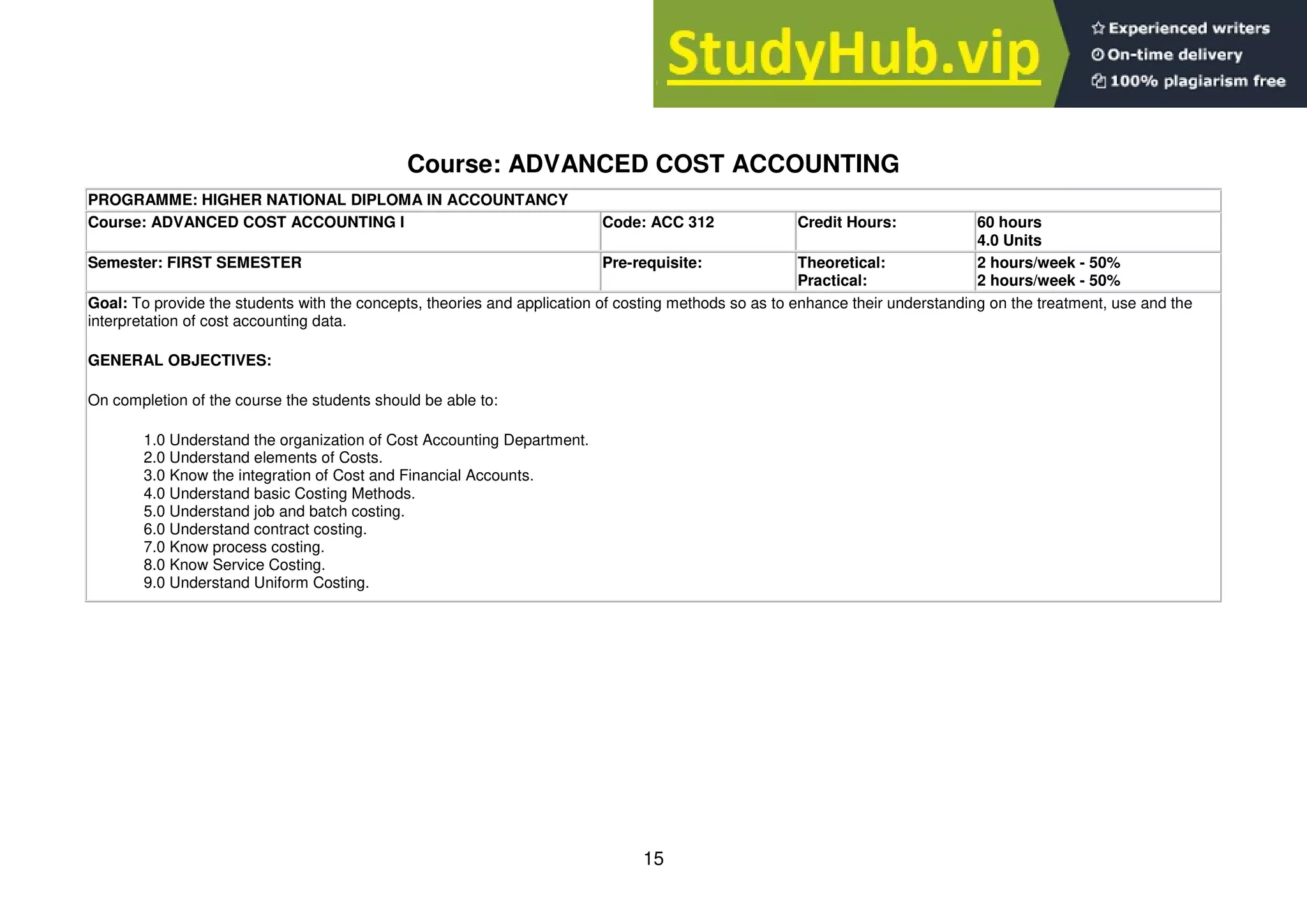

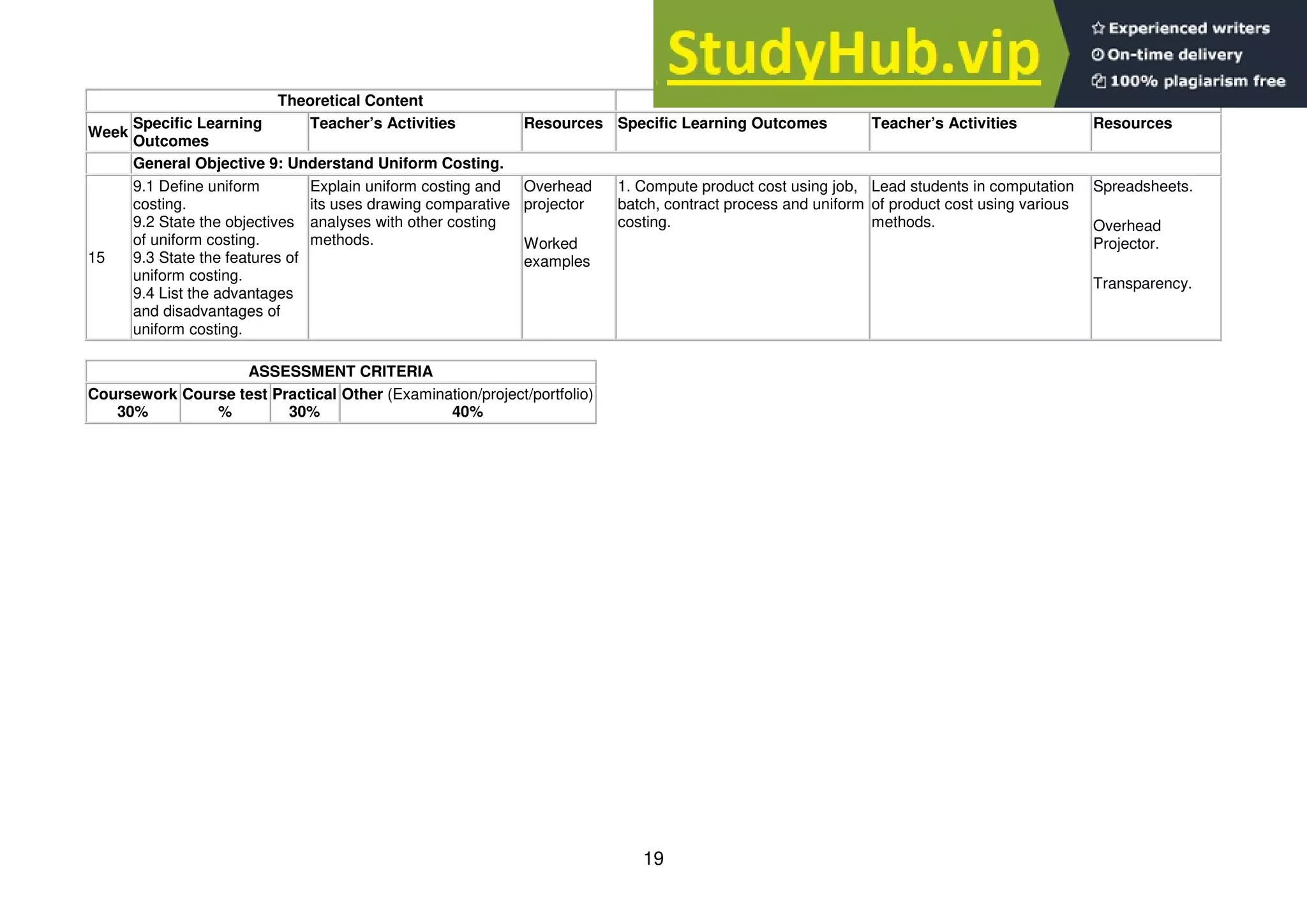

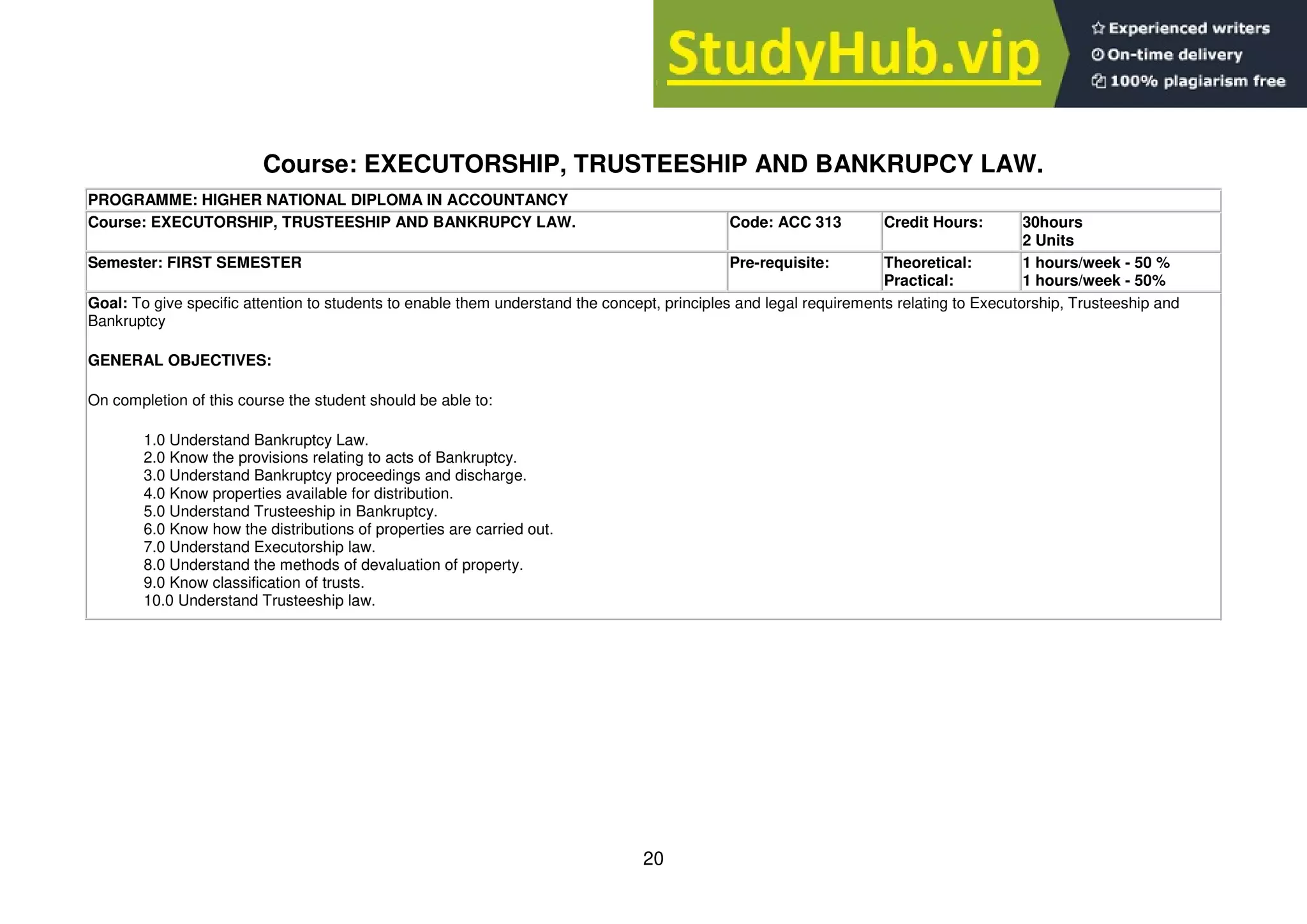

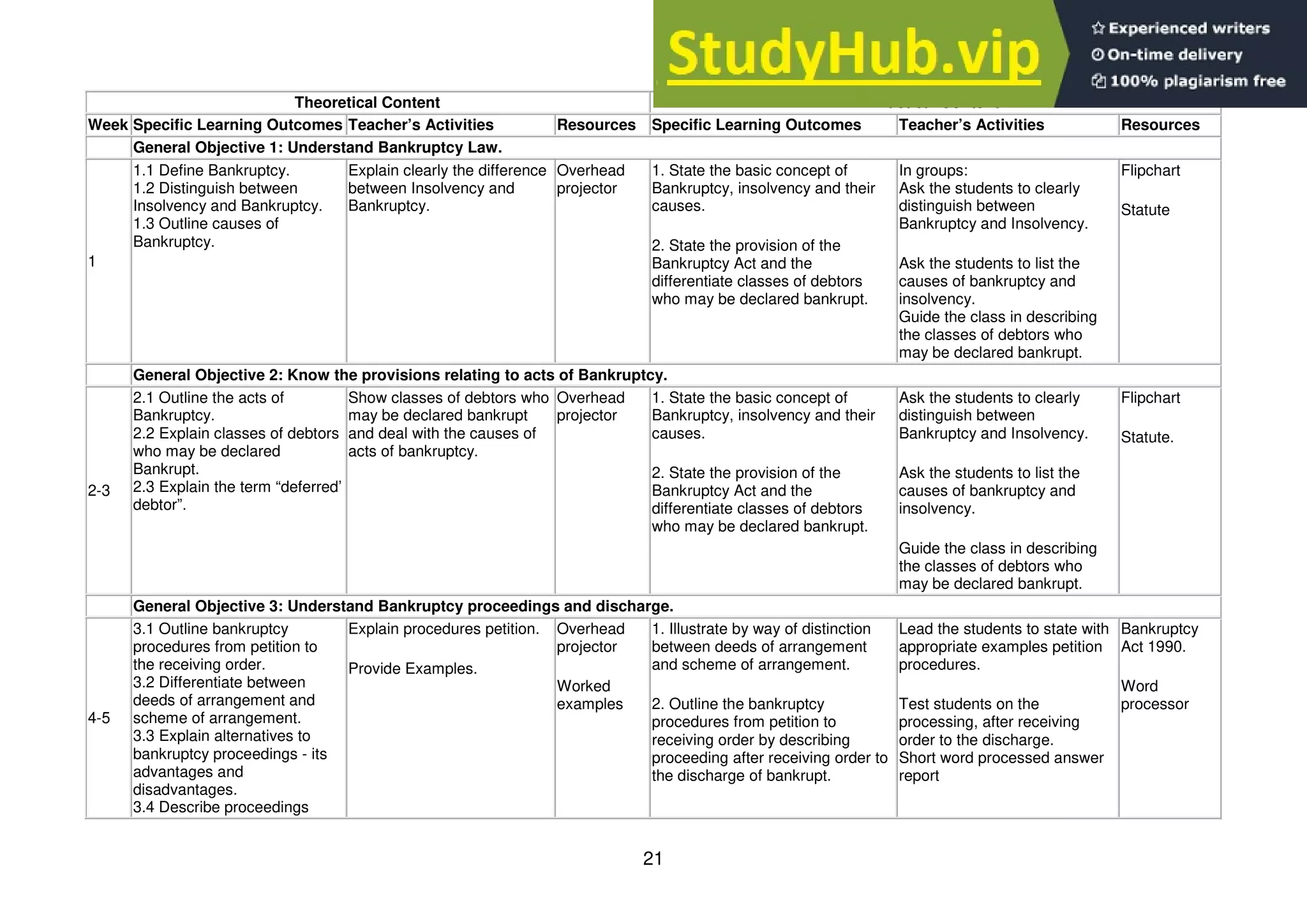

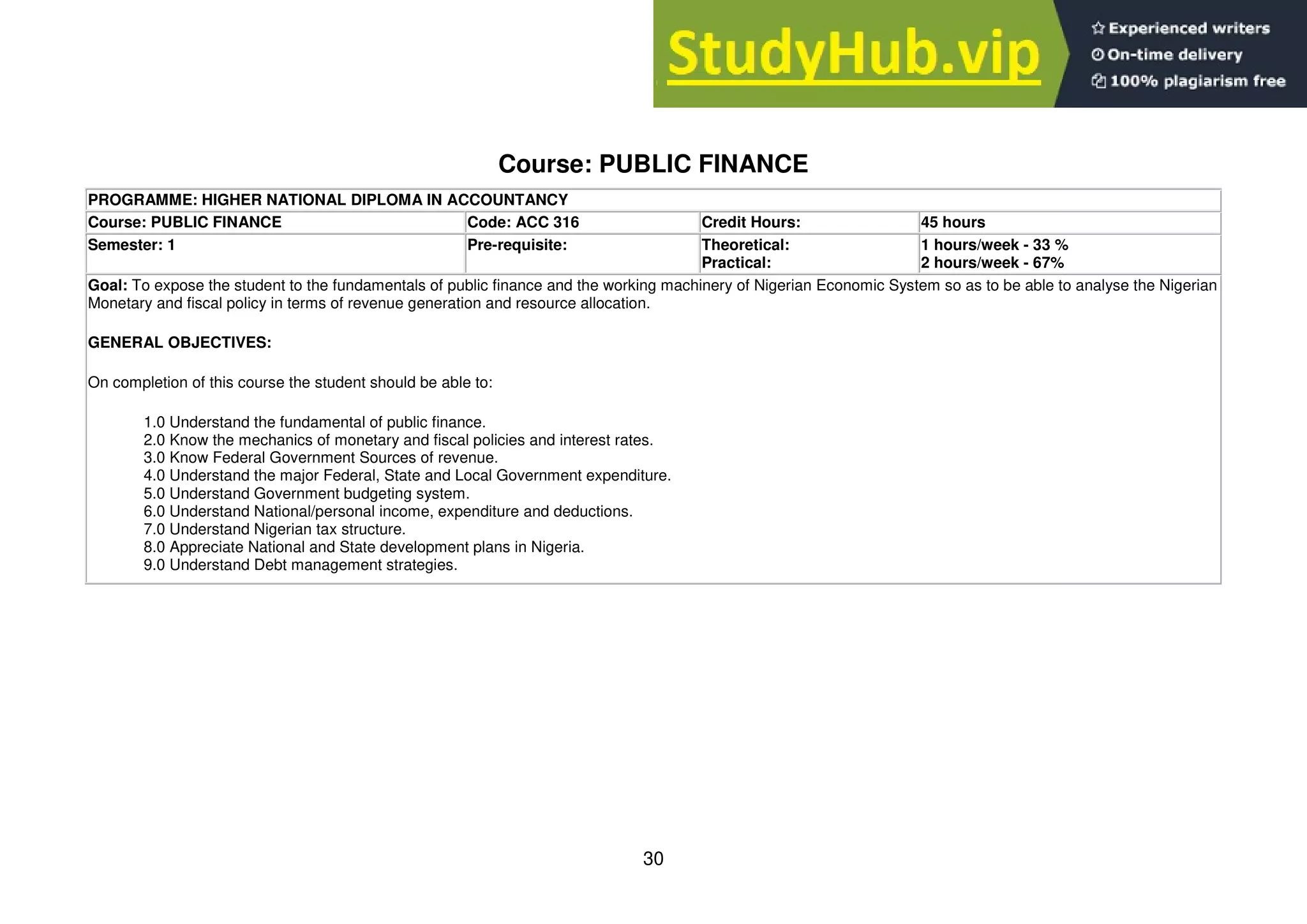

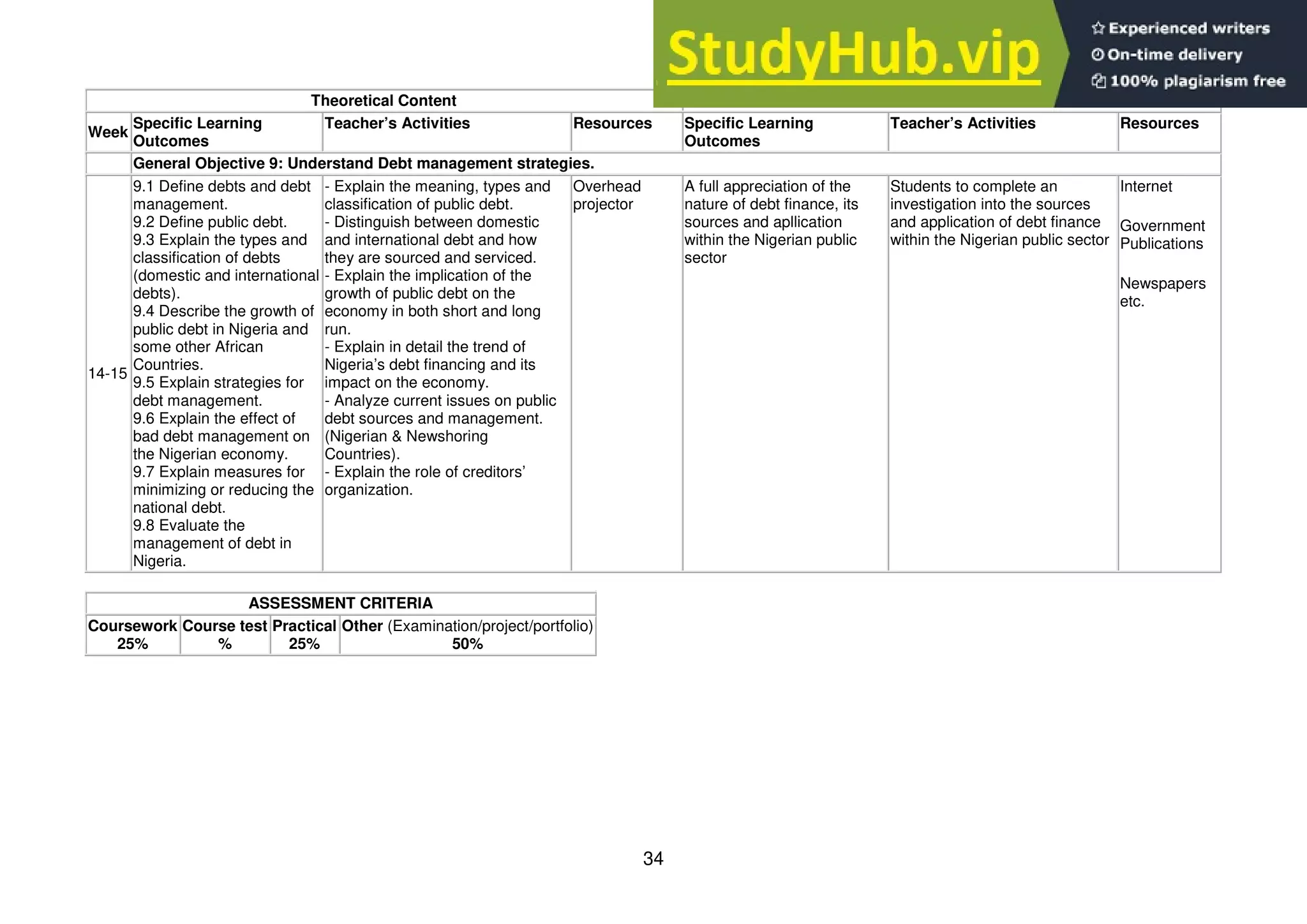

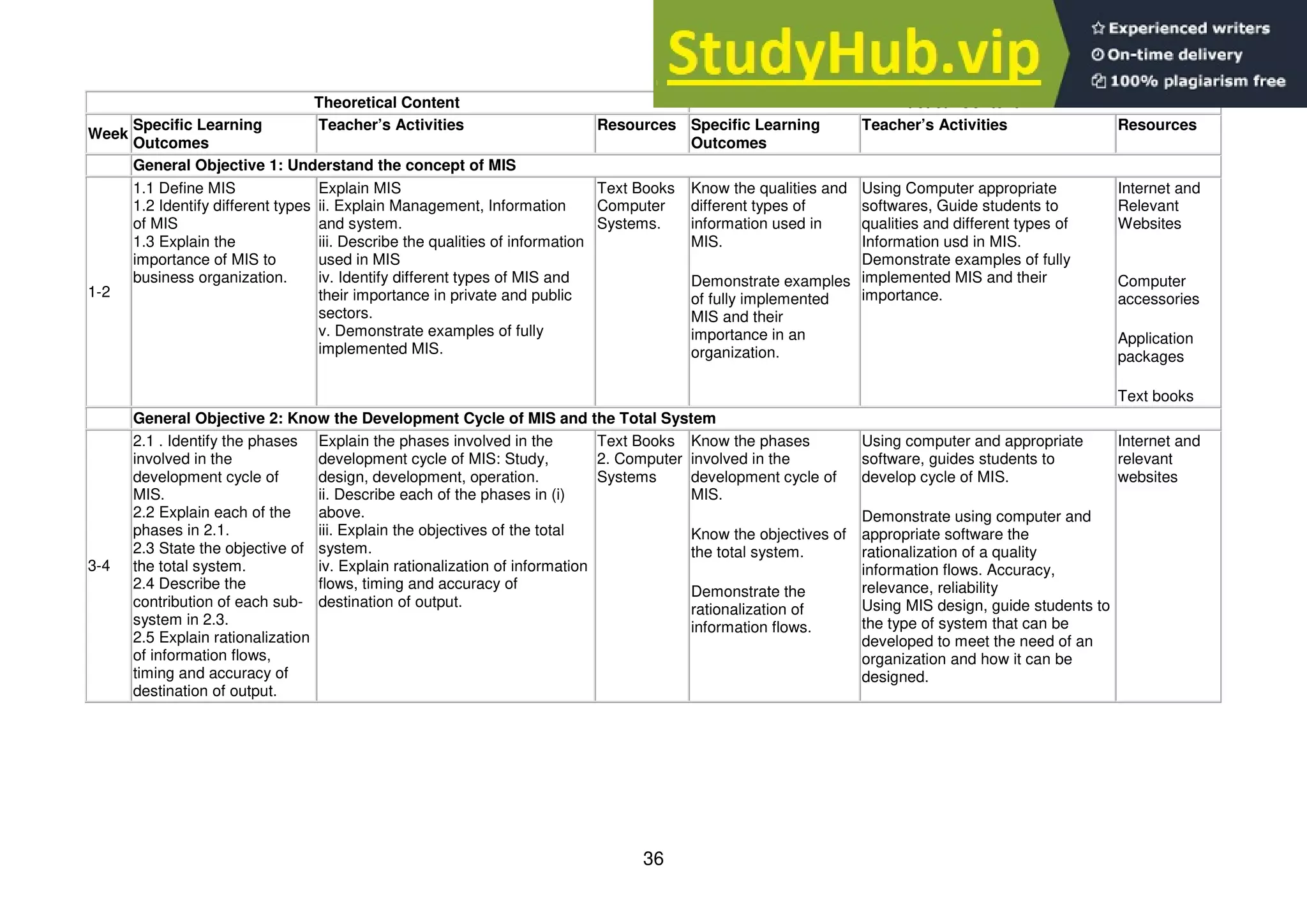

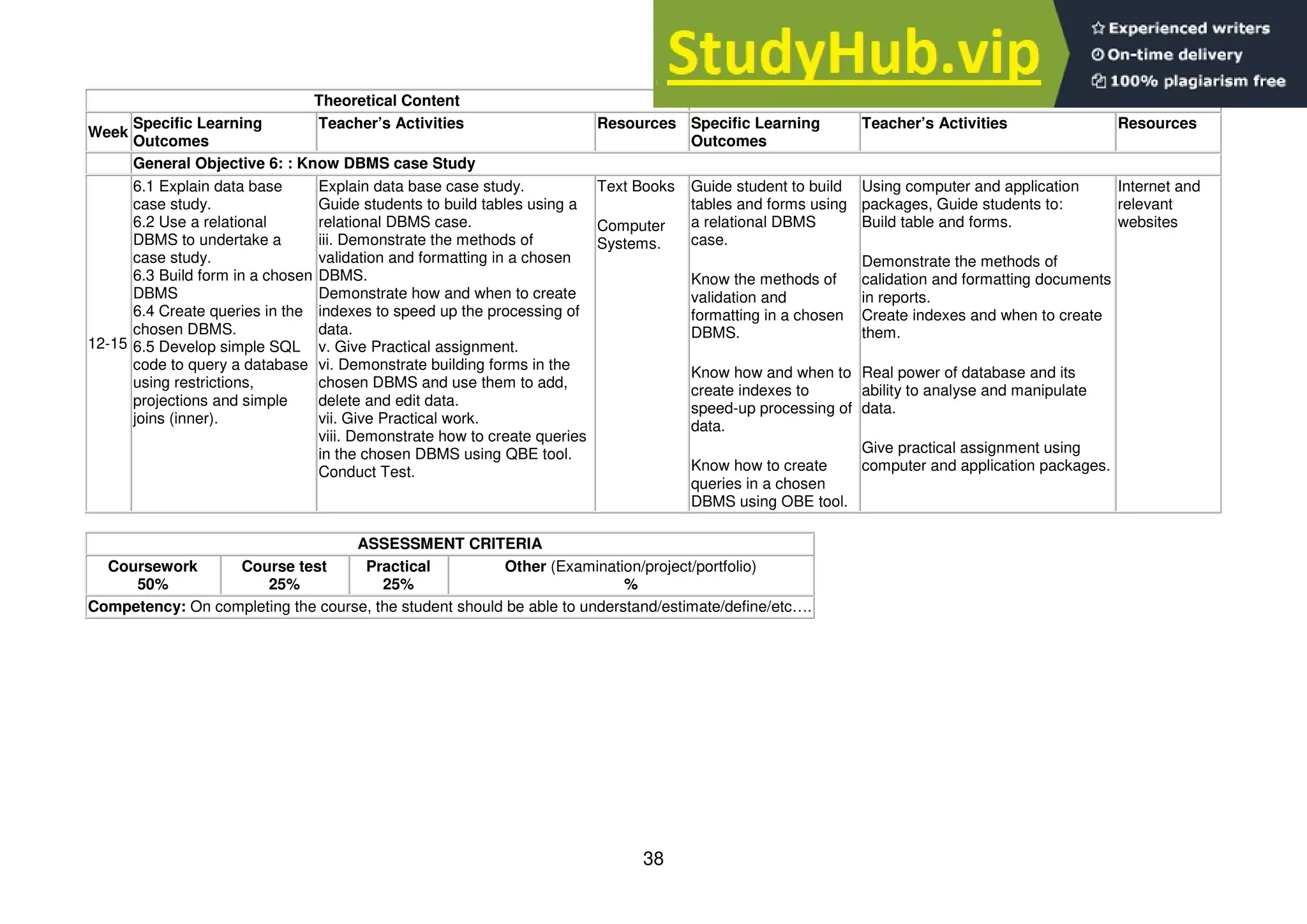

1) The document outlines the course content and objectives for Accounting Theory & Practice, which is part of the Higher National Diploma in Accountancy program.

2) It details 13 general objectives that cover understanding accounting theory, concepts, standards and their application.

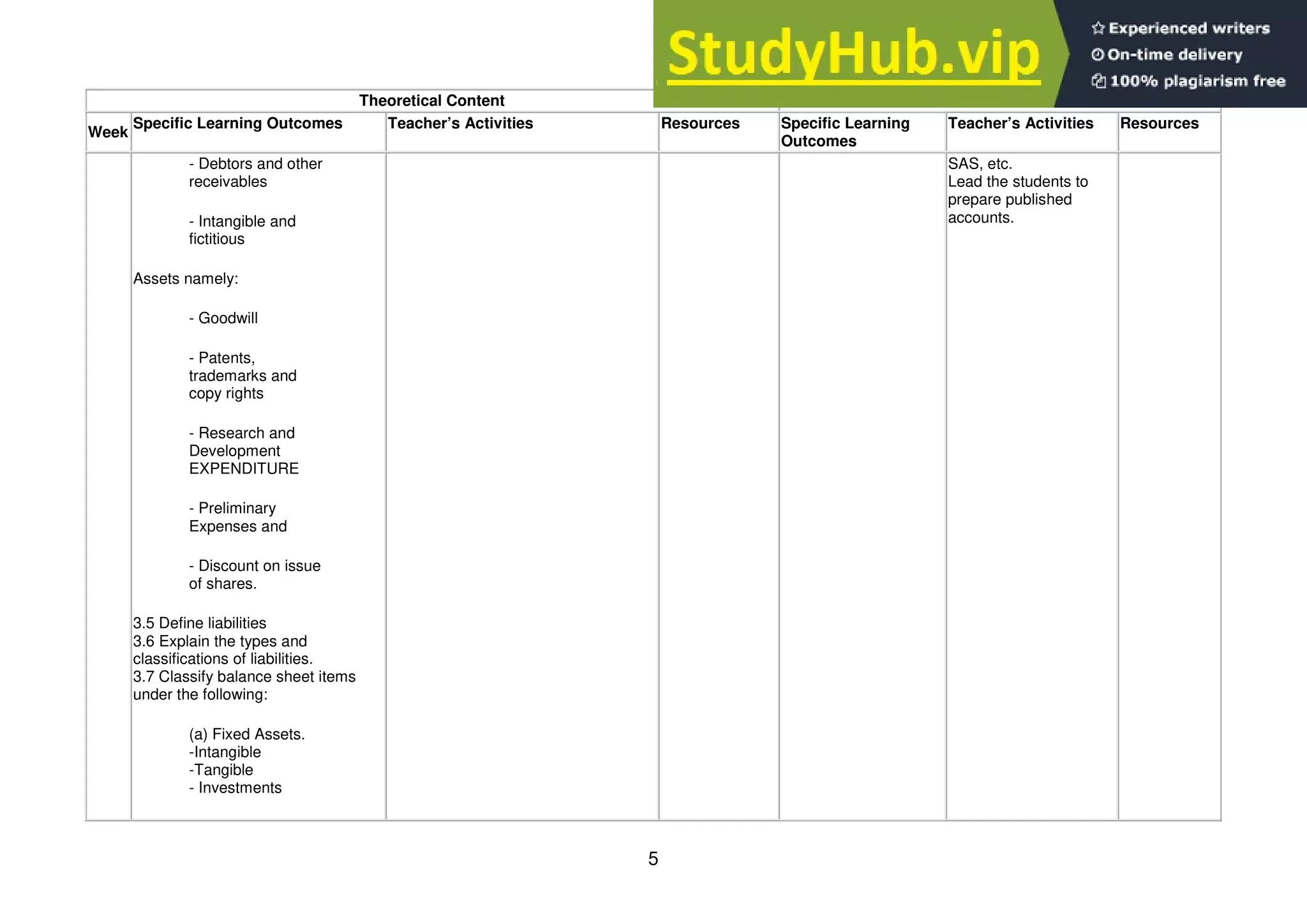

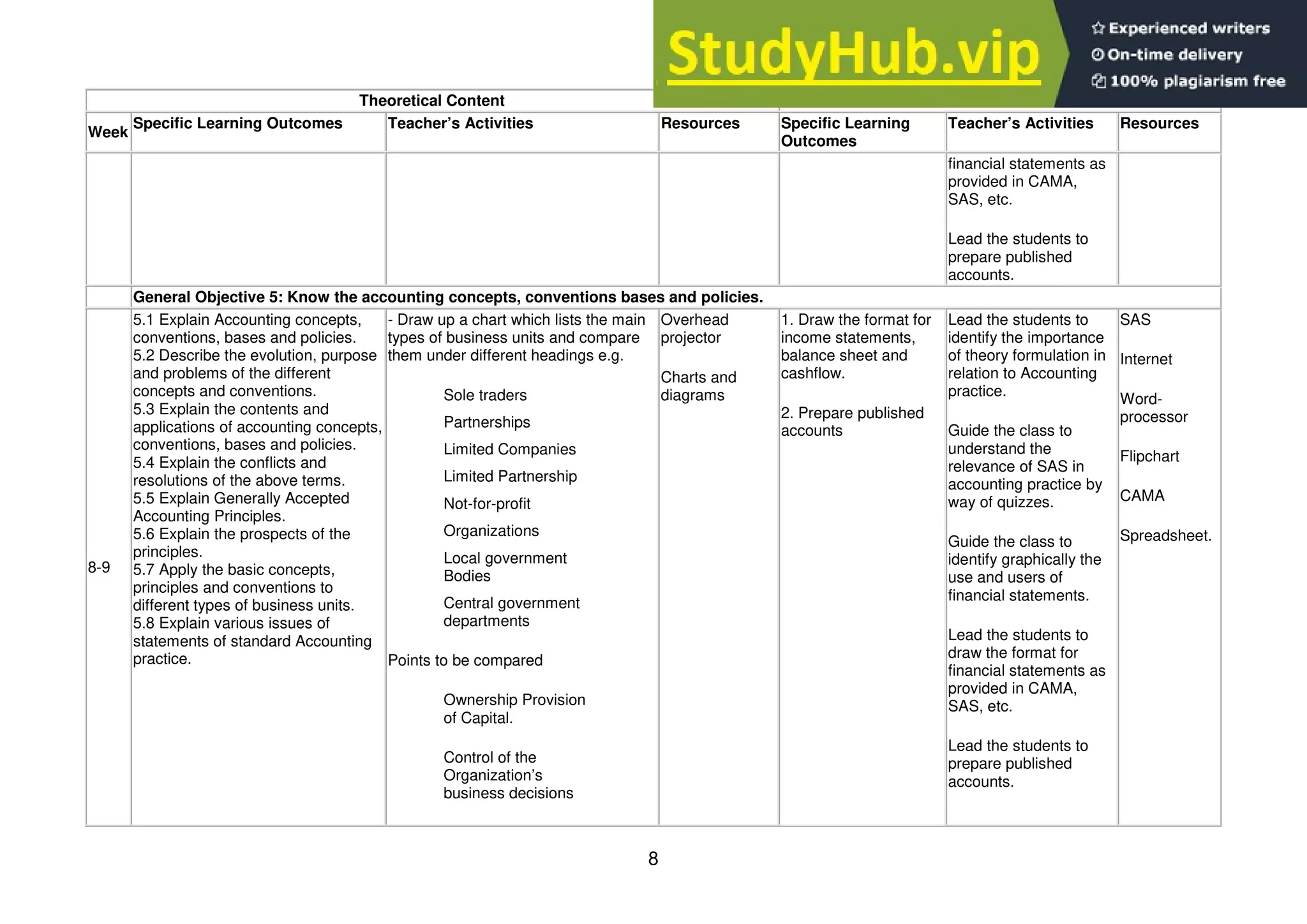

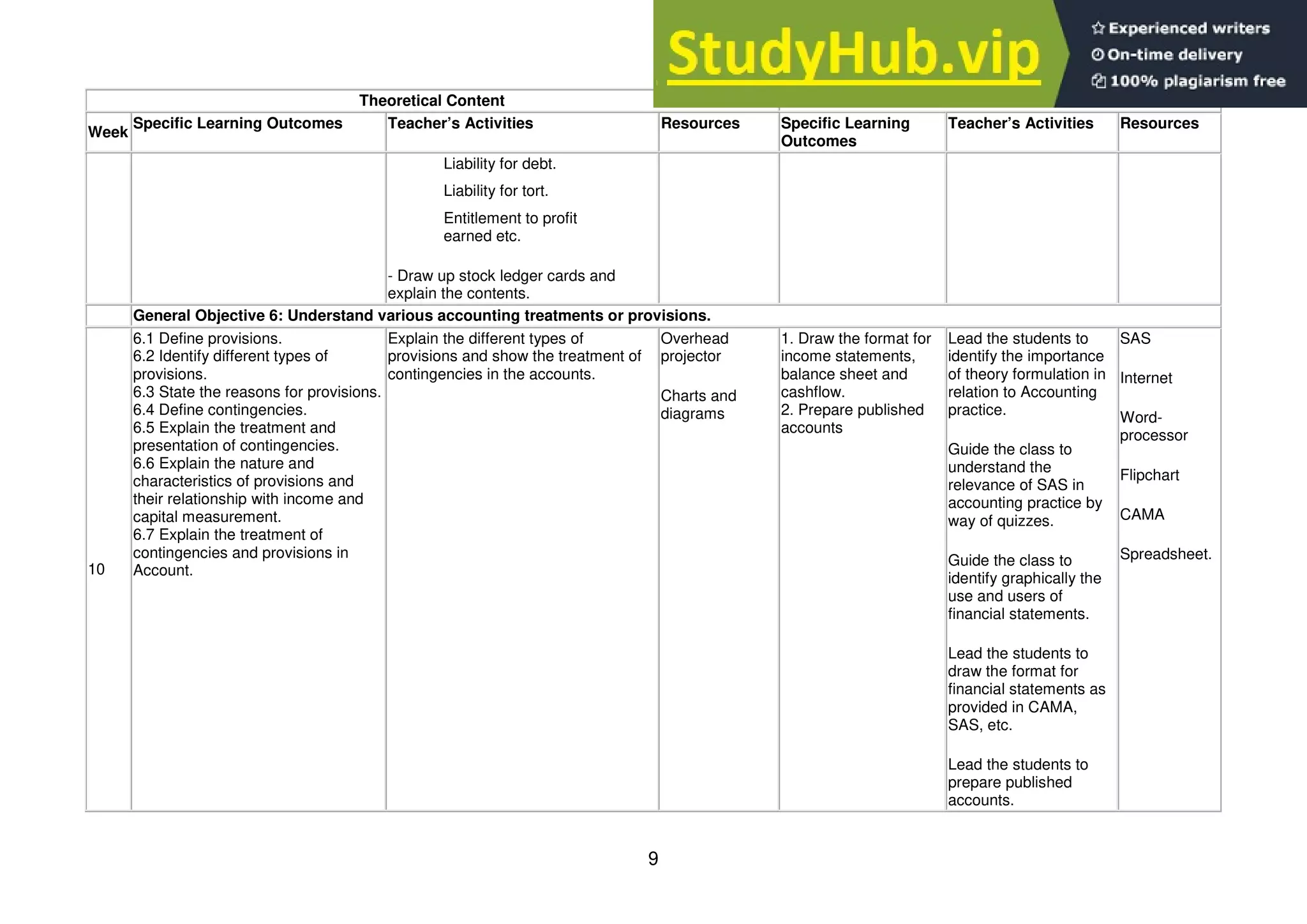

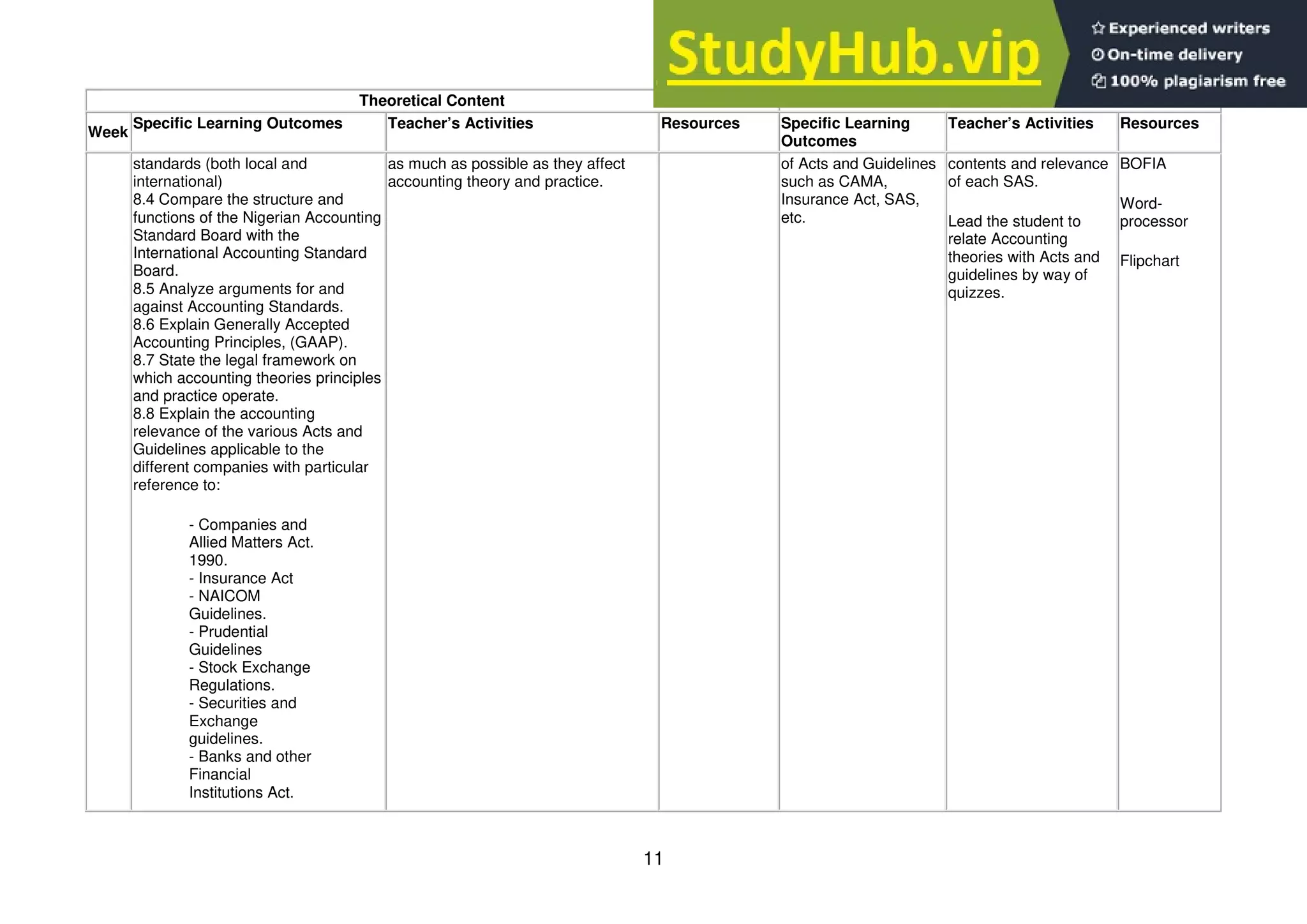

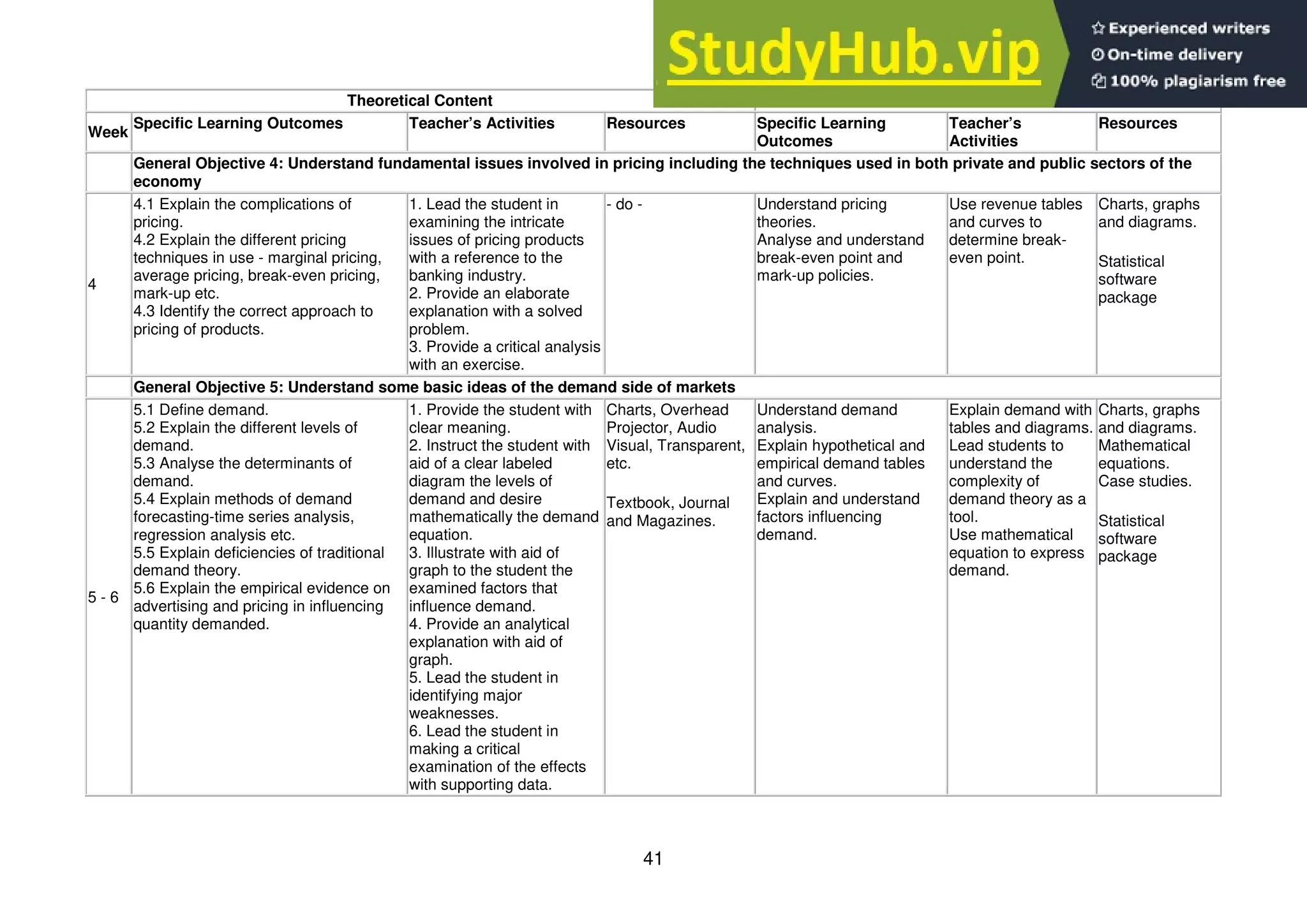

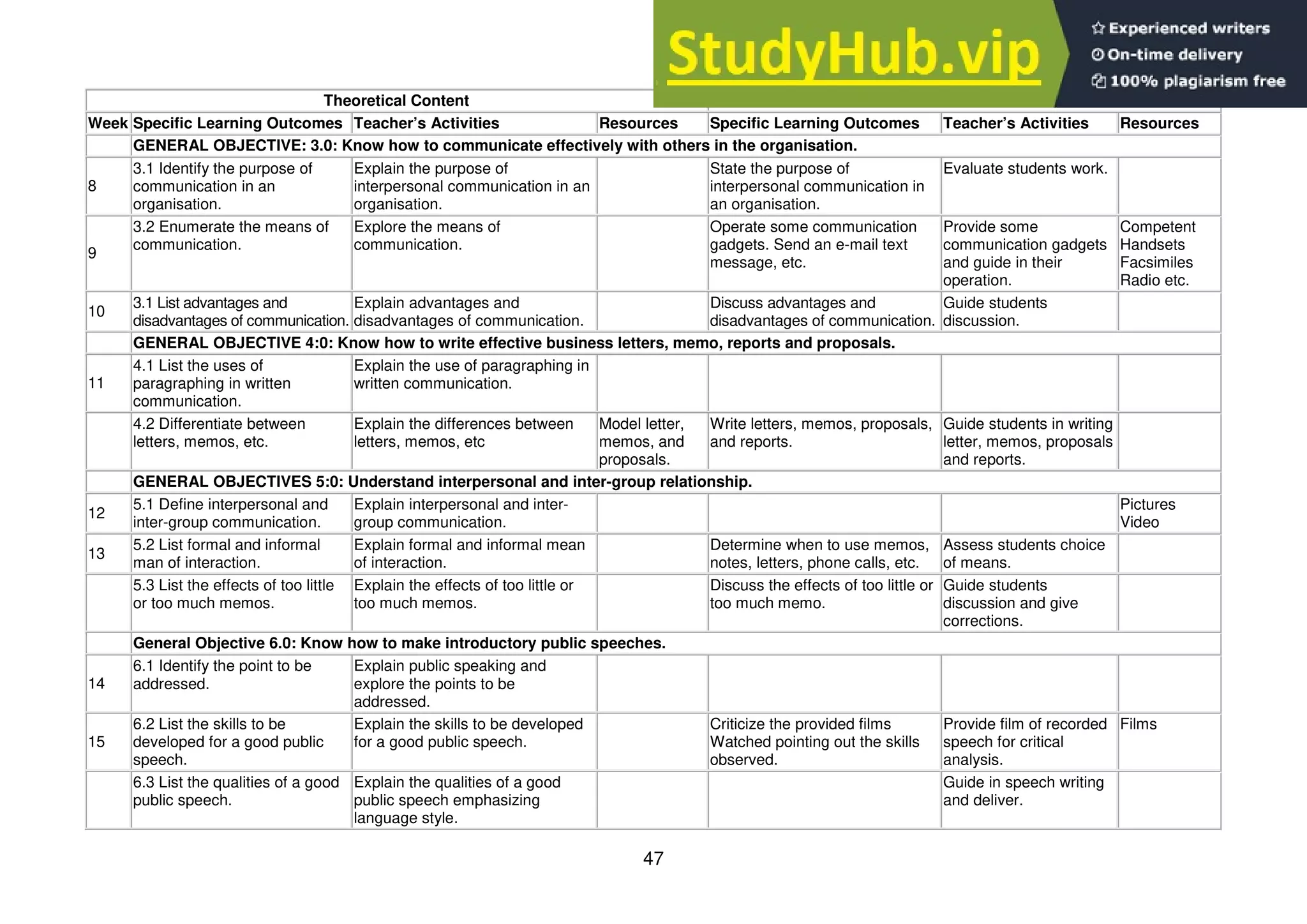

3) For each objective, it lists specific learning outcomes, theoretical content to be covered by the instructor, and practical exercises for students.