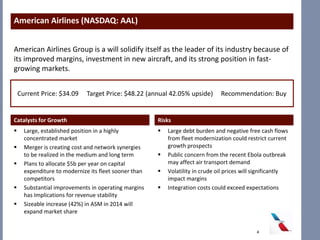

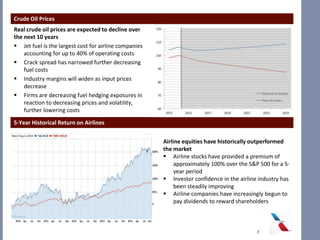

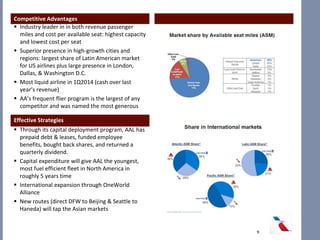

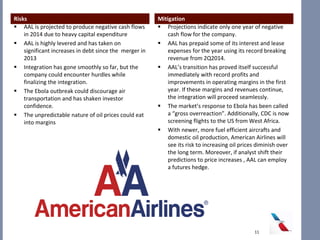

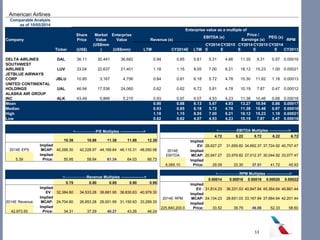

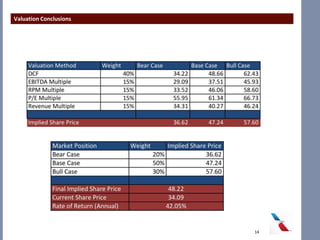

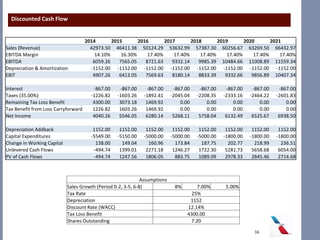

American Airlines (NASDAQ: AAL) is poised for growth due to its large, established market position and planned $5 billion annual capital expenditures to modernize its fleet. This will give it younger, more fuel efficient aircraft sooner than competitors and expand capacity. The merger is creating synergies that will improve margins. However, AAL faces risks from its debt load and negative cash flows from fleet investment. Volatility in oil prices also impacts margins. The analysis provides a target price of $48.22 based on comparable company and discounted cash flow valuations.