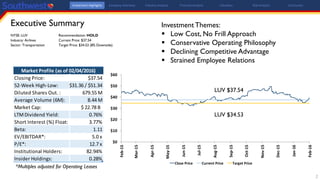

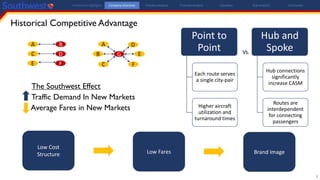

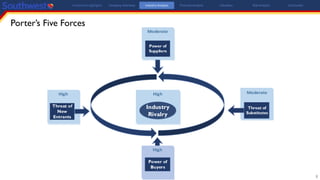

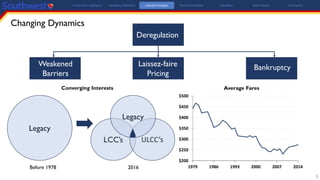

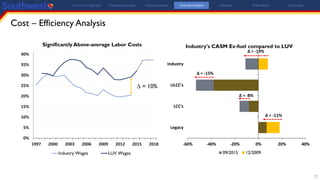

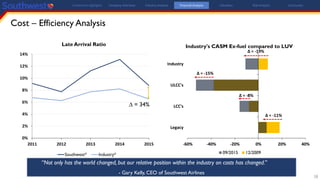

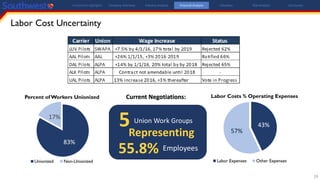

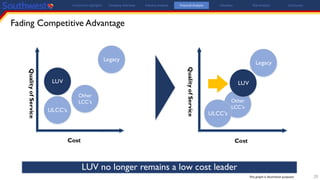

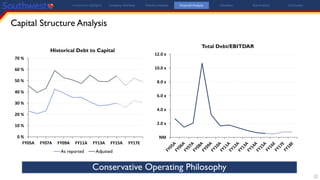

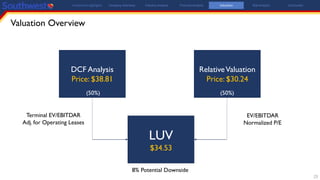

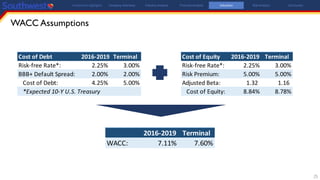

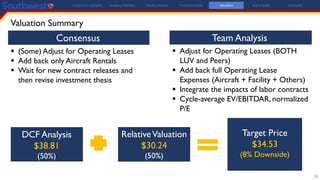

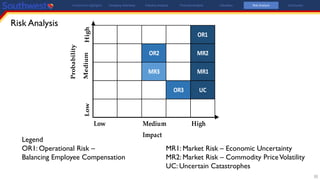

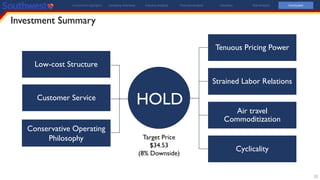

This document provides an analysis of Southwest Airlines (LUV) and makes the recommendation to HOLD the stock. It summarizes LUV's business model, competitive advantages, financial performance, and valuation. While LUV previously had a cost advantage due to its low-cost point-to-point structure, the analysis finds this advantage has diminished as other carriers have adopted similar models. It also notes concerns around LUV's strained employee relations and upcoming union negotiations which could increase costs. Based on the valuation methods used, the analysis sees 8% downside for LUV's stock price.