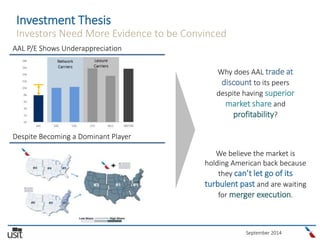

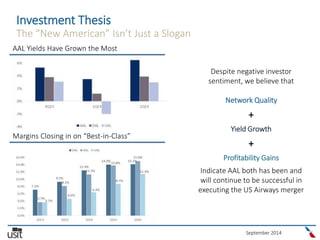

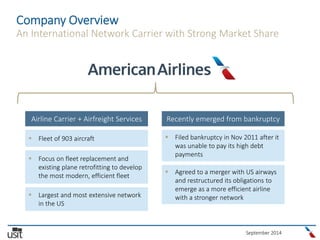

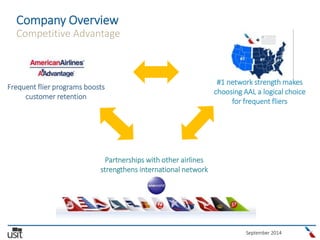

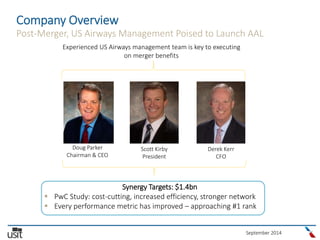

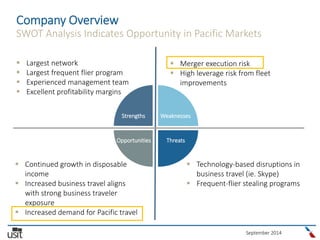

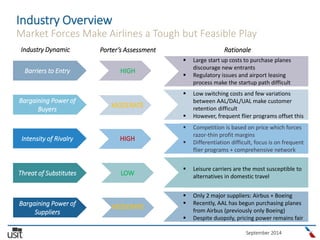

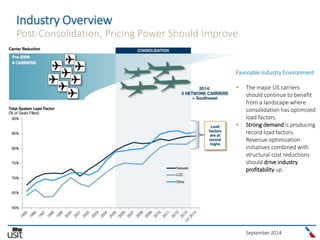

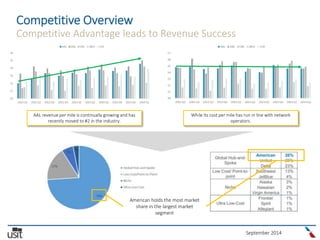

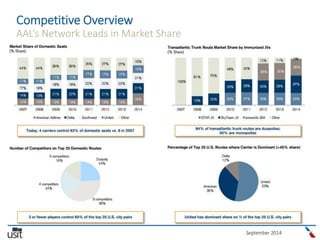

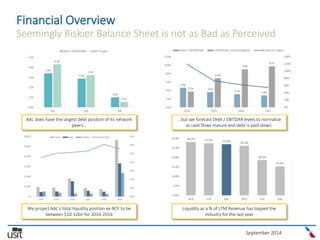

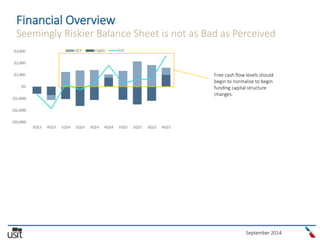

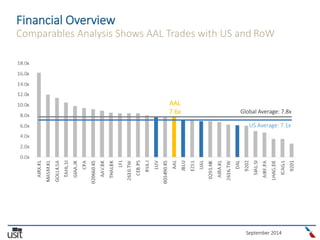

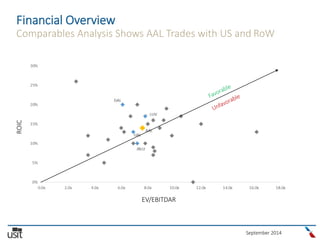

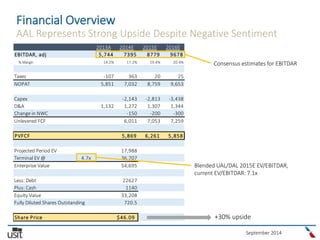

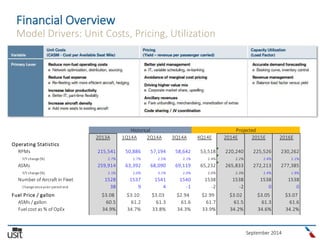

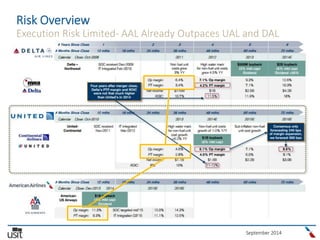

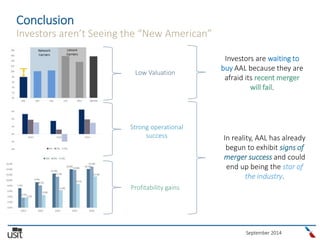

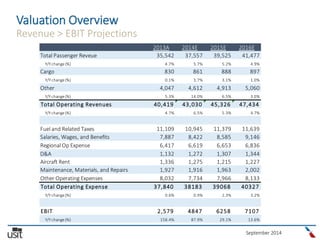

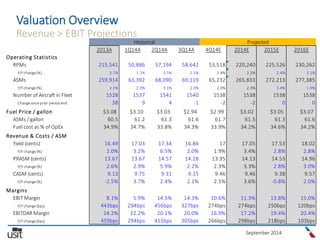

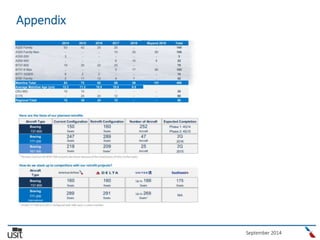

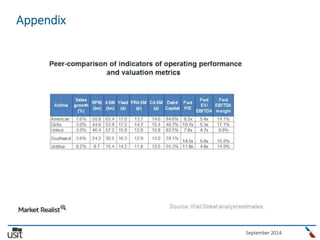

This document analyzes American Airlines Group (AAL) and recommends it as a long investment. It provides an overview of AAL, the airline industry, AAL's competitive position and financials. Key points are that AAL has the largest US network, experienced management from the US Airways merger, and improving profitability margins. While the market remains skeptical due to AAL's bankruptcy, the analysts believe AAL is executing its turnaround successfully and that its profitability and valuation make it underappreciated relative to peers.