Boeing

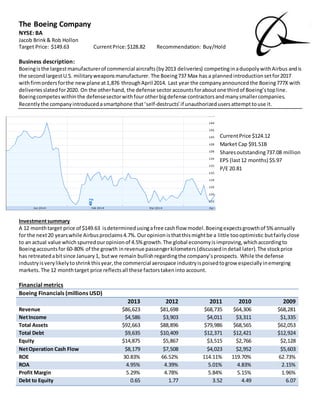

- 1. The Boeing Company NYSE: BA Jacob Brink& Rob Hollon Target Price: $149.63 CurrentPrice:$128.82 Recommendation: Buy/Hold Business description: Boeingisthe largestmanufacturerof commercial aircrafts(by2013 deliveries) competinginaduopolywithAirbus andis the secondlargestU.S. militaryweaponsmanufacturer. The Boeing737 Max has a plannedintroductionsetfor2017 withfirmordersforthe newplane at1,876 throughApril 2014. Last year the companyannouncedthe Boeing777X with deliveriesslatedfor2020. On the otherhand, the defense sectoraccountsforaboutone thirdof Boeing’stopline. Boeingcompeteswithinthe defensesectorwithfourotherbigdefense contractorsandmanysmallercompanies. Recentlythe companyintroducedasmartphone that‘self-destructs’if unauthorized usersattempttouse it. CurrentPrice $124.12 Market Cap $91.51B Sharesoutstanding737.08 million EPS (last12 months) $5.97 P/E 20.81 Investmentsummary A 12 monthtarget price of $149.63 isdeterminedusingafree cashflow model.Boeingexpectsgrowthof 5%annually for the next20 yearswhile Airbusproclaims4.7%.Ouropinionisthatthismightbe a little toooptimistic butfairlyclose to an actual value which spurredouropinionof 4.5% growth.The global economyisimproving,whichaccordingto Boeingaccountsfor 60-80% of the growth inrevenue passengerkilometers(discussedindetail later).The stockprice has retreatedabitsince January1, butwe remain bullishregardingthe company’sprospects. While the defense industryisverylikelytoshrinkthisyear,the commercial aerospace industryispoisedtogrow especiallyinemerging markets. The 12 monthtarget price reflectsall these factorstakeninto account. Financial metrics Boeing Financials (millions USD) 2013 2012 2011 2010 2009 Revenue $86,623 $81,698 $68,735 $64,306 $68,281 NetIncome $4,586 $3,903 $4,011 $3,311 $1,335 Total Assets $92,663 $88,896 $79,986 $68,565 $62,053 Total Debt $9,635 $10,409 $12,371 $12,421 $12,924 Equity $14,875 $5,867 $3,515 $2,766 $2,128 NetOperation Cash Flow $8,179 $7,508 $4,023 $2,952 $5,603 ROE 30.83% 66.52% 114.11% 119.70% 62.73% ROA 4.95% 4.39% 5.01% 4.83% 2.15% Profit Margin 5.29% 4.78% 5.84% 5.15% 1.96% Debt to Equity 0.65 1.77 3.52 4.49 6.07

- 2. In 2010 Boeingexperiencednegativerevenue growthof 5.82% while the industryhadnegativegrowthof about 2%.For the nextthree yearsBoeingincreasedrevenue growth atarate above the commercial aerospace industry average. Boeinghasdecreaseditstotal debtalongwithitsdebttoequitywhichsignalsthatthe companyisbecoming lessvulnerable toeconomicdownturns. Notstatedabove yetstillnoteworthyisBoeing’stotal currentliabilitieswhich standsat $51,486 million.Thisisnotuncommonforanaircraft manufacturerandtheircurrentratio is1.26 which suggeststhatBoeingwill be able topaythese liabilities.Inthe firstquarterof 2014 Boeingincreasedtheirquarterly dividendfrom$.485 to $.73 per share.Thissignalsthatthe companyis comfortable withtheircurrentfinancial standing. Profitmarginincreasing Debtto equitydecreasing CheckROE/ROA Industry Analysis 2013 Sales Market Cap Current Price P/E Current Ratio Debt to Equity Net Margin Boeing 86.62B 91.51B $126.88 20.81 1.26 65.5 5.29 Airbus 81.86B 55.60B $70.49 27.73 0.97 50.87 2.47 LockheedMartin 45.36B 50.01B $158.81 17.16 1.2 125.09 6.5 General Dynamics 31.22B 36.60B $105.76 15.95 1.47 26.95 7.96 Raytheon 23.71B 30.30B $99.42 15.64 1.69 42.9 8.15 Northrop Grumman 24.66B 25.66B $119.69 14.24 1.63 55.84 7.92 Airbus financials converted from Euros atconversion of 1.38:1 U.S.D. Aerospace Keyforcesthat drive thataerospace industryare oil prices,economicgrowthanddevelopment,environmental regulations,infrastructure,airplanecapabilities,othermodesof transport,andemergingmarkets.The forcescan significantlyhelporhinderthe profitabilityof manufacturers. Assuchaircraftmanufacturersmustadaptto changesin these forcestoremaincompetitive. Forinstance,fuel now comprisesthe largestportionof anairline industrycost structure whichpressuresmanufacturerstodevelop more fuel efficientplanes. The two aircraft manufacturerseffectivelycompetinginthe industryare BoeingandAirbus.Competitionbetweenthe duo is intense andfocusesonthe numberof ordersanddeliverieseach companycan attain.Airlinesselectacompanybasedonfactors such as financing,fuelefficiency, maintenance,andseat capacity. Introductionof the AirbusA320neoisscheduledfor late 2015 while the comparable Boeing737 Max 8 inscheduled for introductionin2017. The successof these companieshingesonhavingasteadyflow of ordersand makingdeliveries as scheduled.If aircraftsare notdeliveredonschedulethenthere are usually heftyfinesplacedonthe manufacturer.In thismanner,some of the riskis placedonthe manufacturerratherthan the airline company. A verycritical factorfor bothcompaniesismeetingthe planneddeadline forthe introductionof theirnew aircrafts. Forthe firstquarterof 2014, Boeingreceivedmore ordersandfulfilledmore deliveriesthanAirbus.Airbus’sbacklogisabithigherthan Boeing,which isthe total numberof ordersminusthe total numberof deliveries. Sourcesare positive regardingthe growthof the airline industryoverthe comingyears. Historicallygrowthin revenue passengerkilometers(RPK) hasoutpacedGDP.SourcesforecastgrowthinRPKas a functionof GDP growthand a time trendvariable thattypicallycentersat2%.The GDP growthvariable accountsfor60-80% of air trafficgrowth while the time trendaccountsforthe other20-40%. Thisrelationshipcanbe seenoverthe longterm, yetunexpected economiceventscandirectlyorindirectly cause declinesinairtraffic.InBoeing’s CurrentMarketOutlook2013-2032 the companyprojectsthat worldwide airtrafficandcargo trafficwill grow at a compoundannual rate of 5% overthe next20 years.Thisaccordingto S&P may be a little tooptimistic. Incolloquial termspositive RPKgrowth isdue tostrong demandinemergingmarketssuchasLatin America,Africa,Middle East,andAsiaPacificaswell ascontinueddemandin Europe and the Americas. Otherfactorsinclude the needformaintenance,repair,andoverhaul onexistingplanesand the businessjetmarket takingoff once again. Airbus Boeing Backlog 5,521 5,154 Q1 2014 Deliveries 141 161 Q1 2014 Orders 103 235

- 3. Defense The defense industryconsistsof the bigfive defense contractorsalongwithmany smallercompanies.The topsix in orderof 2012 revenue are LockheedMartin,Boeing,BAESystems(aBritishcompany),Raytheon,General Dynamics,and NorthropGrumman.Currentlythe U.S.governmentisreducingitsspendinginmilitaryequipment.Asaresult,those companiesthatderive alarge portionof theirtopline fromtheirdefenseproductswillbe influencedthe most. Lockheed Martin, BAE Systems,andRaytheonall deriveover90% of theirrevenuesfrommilitarysales. Thistrendof reducingthe budgetinthe defense sectorwilllikelycontinueforthe 3-5 years.Overthe longtermthe industryisprojectedtogrow at 3%. Since militaryproductsaccountsforaboutone thirdof theirrevenue,Boeingwill face headwindinthe nextfew yearsdue to the fact that the U.S. governmentiscuttingspendingondefense.However,thiswill be offsetbythe large growththat is expectedinthe commercialairline industry.Asthe global economyimproves,the commercial aerospace industrywill improve aswell.Aftermarketservicesare likelytogainmore businessaswell asfleetsare startingtoage for manyairlines. Valuation For The BoeingCompanyvaluationwe usedadiscountfree cashflow model todetermine the futureprice.First we forecastedaflat4.5% growthacross the company,and usedtocome upwiththe free cash flow forthe next3 years and beyondthat,thenwe discountedthose valuesbythe weightedaveragecostof capital,withwe determinedtobe 9.87%. Date 4/22/2014 G=4.5% in$ millions 2013 2014 2015 2016 2017 OperatingCashflow 8,179.00 8,547.06 8,931.67 9,333.60 9,753.61 less:Capex 2,098.00 2,192.41 2,291.07 2,394.17 2,501.90 FCF 6,081.00 6,354.65 6,640.60 6,939.43 7,251.71 Discountrate (WACC) PV(14-16) 5783.84 5501.20 5232.37 PV( 2017 and beyond) 101840.67 FirmValue 118,358.07 Less:Long termDebt 8,072.00 EquityValue 110,286.07 # sharesoutstanding( millionshares) 737 Target price $149.64 The assumptionswiththe model are thatBoeingcontinueswithaconstant4.5% growthrate.As well asthat theirdebt staysconstant. Some risksto the recommendationwouldbe thatinorderforBoeingto keepaconstant 4.5% growthrate, Chinas economyneedstostaystable andcontinue growing.A lotof theirnew businessiscomingfromthe amountof airports beingbuiltoverthere.Anotherfactoristhat Boeinghasbeenreducingthere longtermdebtoverthe pastfive yearsand lookas if theyplanon continuingtodoso. Thiswill change theirWACC,ultimatelyalteringthe model slightly.There are otherfactors that couldhave an effectsuchasmissinga deliverydate,ora large rise inoil prices. Catalysts

- 4. CatalystsforThe BoeingCompanyandtheyare oil prices, the threatof new entrants,andothermodesof transportation.Oil priceshave alarge effectonthe companyas a whole.Oil price effectsthe overalldesignprocessof the BoeingCompany.If theyexpectoil pricestorise thentheywill be lookingtomanufacture more fuel efficientplanes like the 787 Dreamliner,becausetheywill be more indemand.Boeinghastobe able toadjustits productionbasedon oil prices. The nextmajor catalystisthe threat of new entrantsinto the market.Companieslike ComacandBombardier whichare startingto become real competitorsandmayevenbe acause of worryin the longterm. Comac is the Commercial AircraftCorporationof China,andBombardierisaUS base companythat specializesinmidsizedaircrafts. These companies are playersinthe businessjetmarketand inthe longrun couldthreatenBoeingssales.Comacis startingto gainsome traction,and couldbreakup the duopolythatBoeingandAirbushave onthe market. Modesof transportationsuchas highspeedrail (HSR) canpotentiallypose athreatforthe airline industry.HSR islikelymore efficientforshorterjourneysandcarryingcargo. Howeveraviationisefficientforlongerjourneysandasa meansof transportationwithoutheavycostsoninfrastructure. Management The BoeingCompanyhasa veryexperiencedmanagementteam.W.JamesMcNerneyhasbeenthe CEOfor aroundnine yearand before thatwasthe CEO of 3M and has heldtopexecutivepositionsatGE and Proctor&Gamble. He alsoisthe Chairmanof the Export Council andwasappointedbyPresidentObamahimself.Theyoperate asan advisorycommittee oninternational trade.Boeing’sCFOGregSmithhasbeenonboard withBoeingsince asthe CFO since 2010, but has workedforBoeingsince 2008. Priorto beingthe CFOat Boeinghaswas the VPfor Raytheon,aswell as a controllerforBoeingsfinancial operations.Boeing’sleadengineerJohnJ.Tracy has servedasthe general mangerof EngineeringforBoeingsMilitaryAircraftandMissiles,he wasalsothe directorof the Space and Communications AdvancedEngineer.Tracyhasauthoredmore thanthirtypublicationsandcurrentlyservesonthe boardof trusteesfor the IllinoisInstitute of Technologyandonthe engineeringadvisoryboardforseveral leadinguniversities. Wall Street consensus No. of Recommendations % of Total Buy 13 48% Buy/Hold 7 26% Hold 7 26% WeakHold 0 0% Sell 0 0% No opinion 0 0% Total 27 100% Recent News Earningsannouncedonthe 23rd of April withbuy-sideanalystexpectingBoeingtobeatthe estimates. Deliveriesof the 787-9 are to start mid-year Boeingnamed2014 EnergyStar partner of the year.