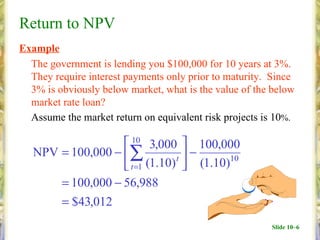

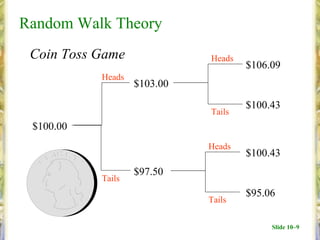

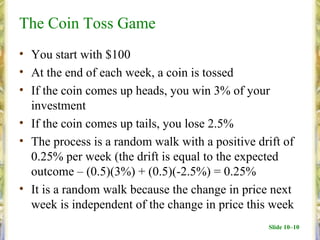

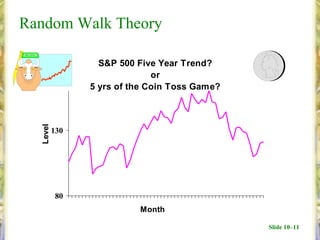

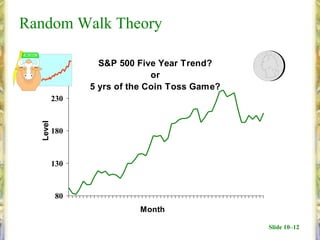

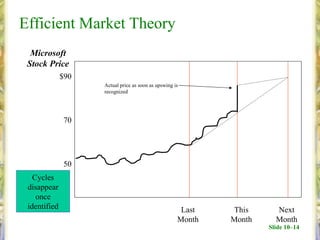

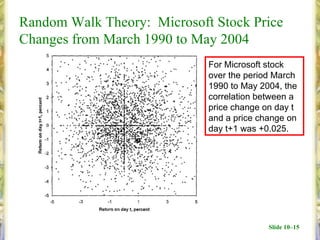

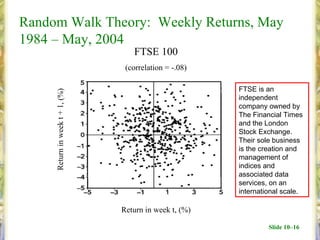

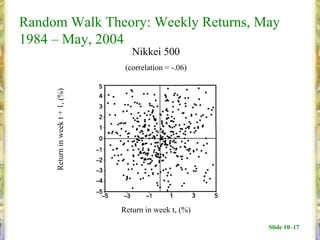

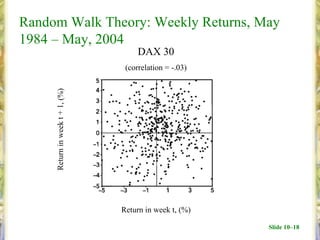

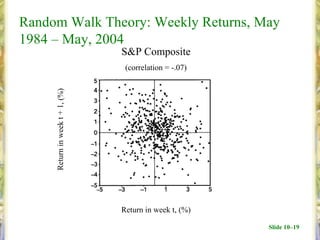

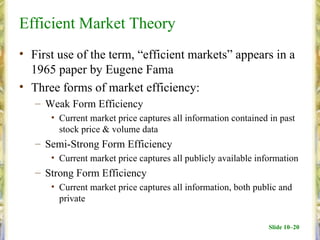

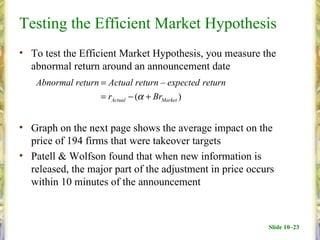

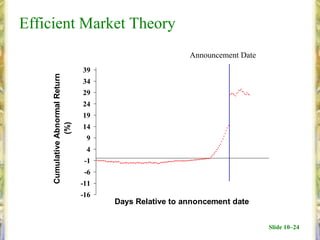

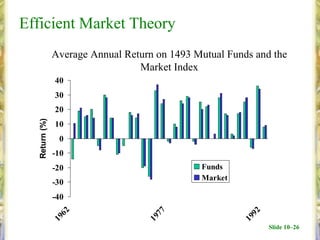

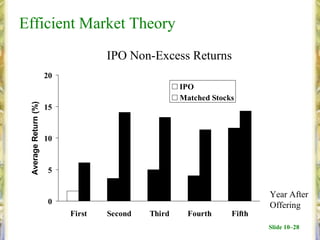

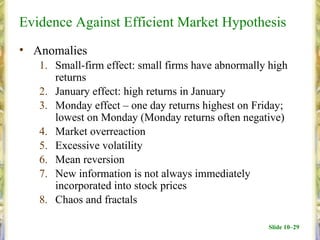

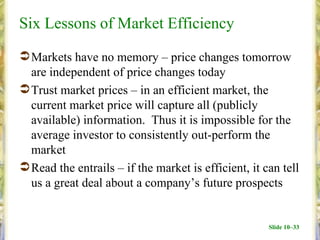

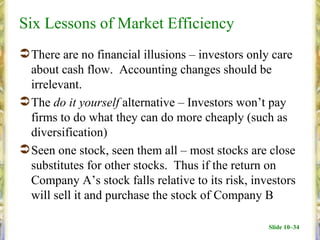

The chapter discusses the efficient market hypothesis, which states that stock prices fully reflect all available information. It begins by reviewing the concept of net present value. It then covers random walk theory, where stock prices are said to follow a random walk without predictable patterns. Evidence for market efficiency comes from studies finding stock prices adjust rapidly to new information. While markets are mostly efficient, some puzzles and anomalies exist that are not fully explained.