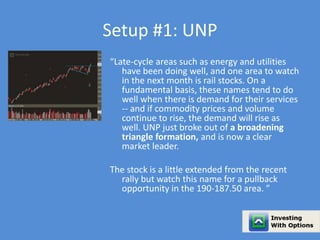

The document discusses 11 stock trading setups shared on TraderPlanet.com, detailing the reasoning and trading strategies behind each setup. Each trade includes discussion of current market conditions, technical patterns, and insights for traders. Key focus points include breakout levels, volatility, and utilizing options strategies in response to earnings and market movements.

![Setup #3: VVIX

“Is it really that quiet out there?

You would think that the market would be a

little more scared, that investors would be

buying protection as we head into the summer.

But that’s not what we’re seeing.

The traditional "fear" index is the VIX, which

measures the supply and demand for SPX

options. With a reading of 13.71, it puts it in

towards the lower end of its six month trading

range.

But let's go down the rabbit hole just a little

more.

The VVIX measures the supply and demand for

VIX. I feel that this chart is just as important as

the VIX because investors are not just using SPX

puts to get protection-- they're now using VIX

calls. [continued…]”](https://image.slidesharecdn.com/traderplanet-140930200933-phpapp02/85/A-Look-Back-at-11-Stock-Trading-Setups-15-320.jpg)