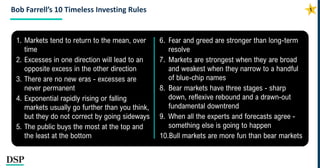

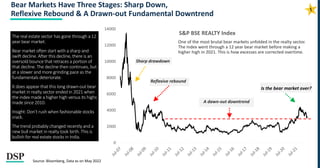

This document summarizes Bob Farrell's 10 timeless investing rules using charts and live data to illustrate each rule. The rules include that markets tend to return to the mean over time, excesses in one direction will lead to an opposite excess, there are no new permanent eras, rapidly rising or falling markets usually go further than expected but don't correct sideways, the public buys at tops and sells at bottoms, and bull markets are more fun than bear markets. The document uses charts and examples to demonstrate each rule.