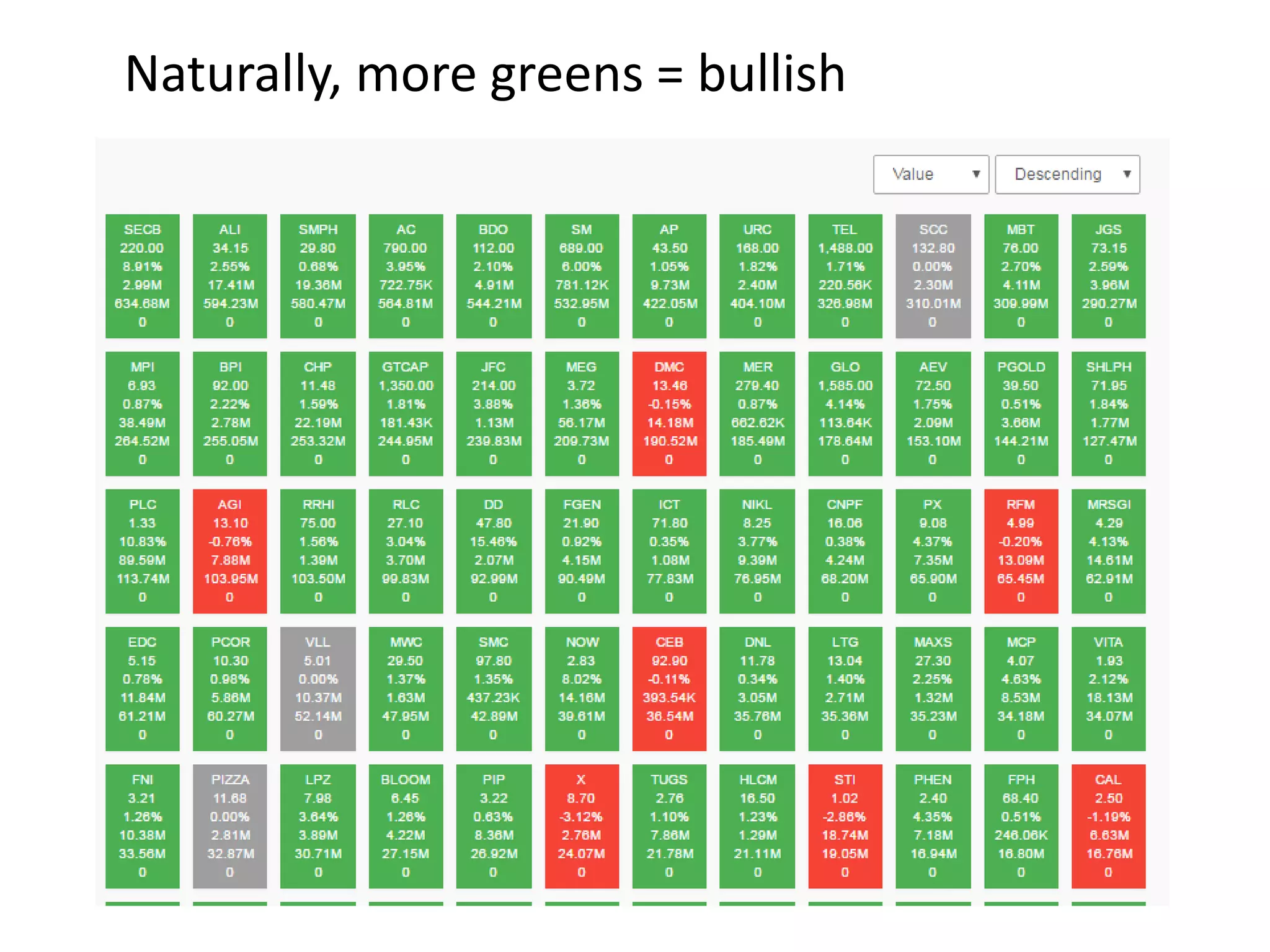

The document discusses strategies for day trading, emphasizing the importance of technical analysis and market sentiment over traditional stock research. It highlights the dangers of speculation and the volatility of speculative stocks, advocating for disciplined trading strategies and the use of stop-loss points. Additionally, it advises traders to stay nimble, seize breakouts, and be cautious during market corrections.