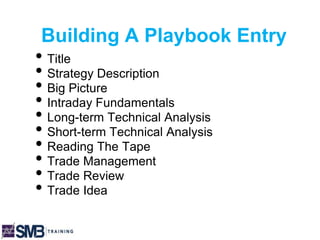

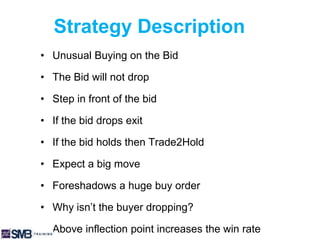

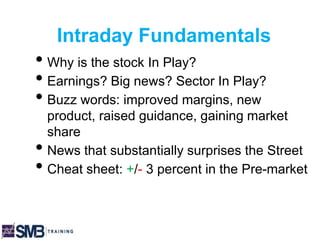

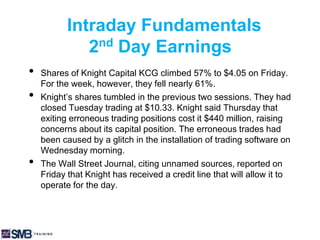

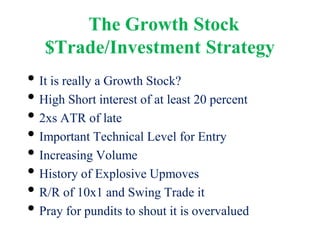

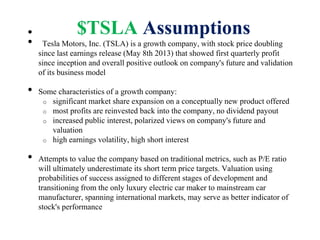

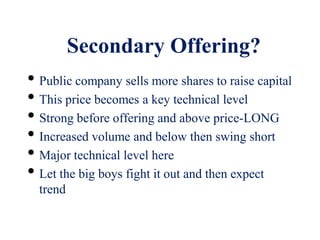

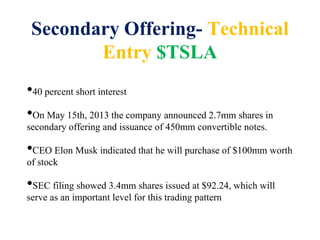

The document summarizes SMB Training's services, which include online and in-person trading courses and seminars for educational purposes. SMB Training is not a broker-dealer. The seminars teach trading strategies but are not recommendations to buy or sell securities. Investment decisions are the full responsibility of the individual and should be based on their financial situation and risk tolerance.