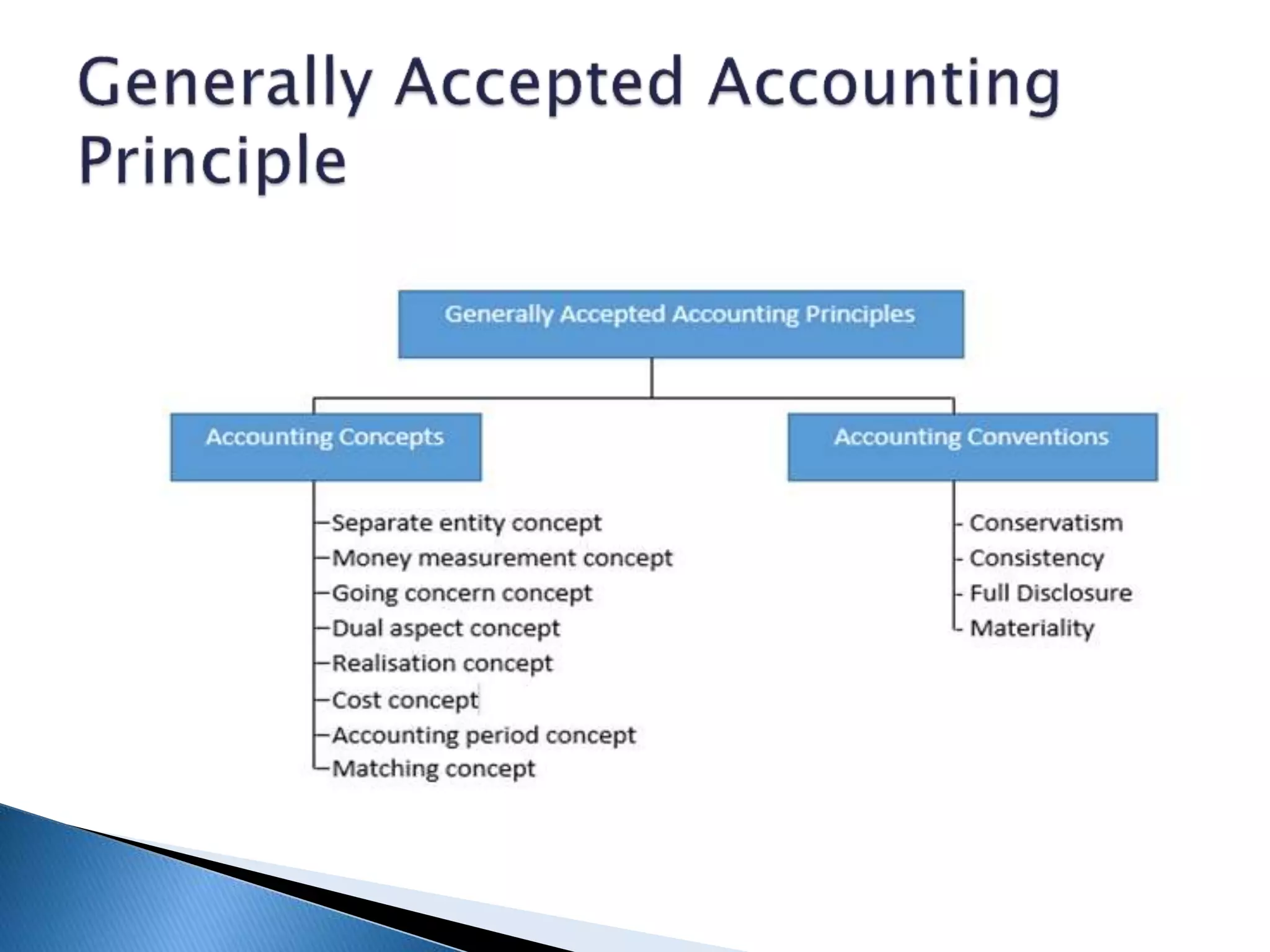

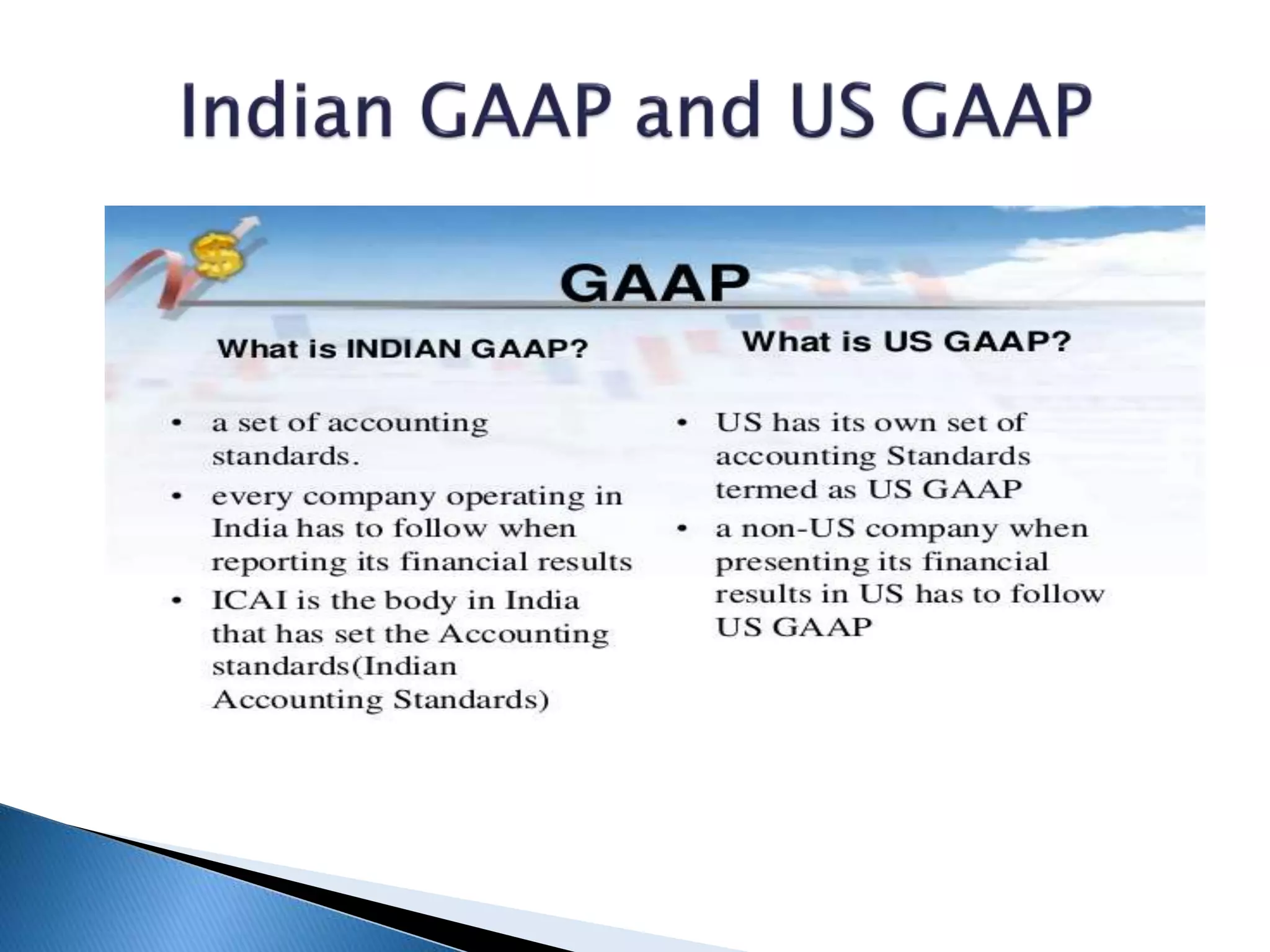

GAAP, or Generally Accepted Accounting Principles, is a set of rules governing business accounting in the United States, aimed at organizing and reporting financial statements. Its key objectives are to provide relevant, reliable, and comparable information for making financial decisions and maintaining accurate records. The importance of GAAP lies in enhancing comparability, promoting consistency, and ensuring the reliability of financial reporting for organizations and their stakeholders.