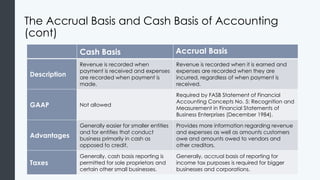

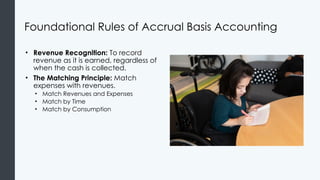

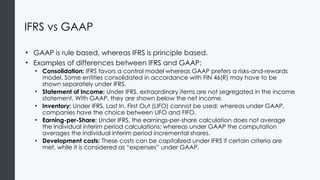

The document outlines fundamental accounting principles, including the roles of the FASB in establishing GAAP, the significance of accrual versus cash basis accounting, and the differences between U.S. GAAP and international standards like IFRS. It highlights key concepts such as the monetary unit assumption, the going concern assumption, and various guiding principles of GAAP, providing a structured process for creating accounting standards. Additionally, it addresses the convergence movement aimed at harmonizing accounting standards globally.