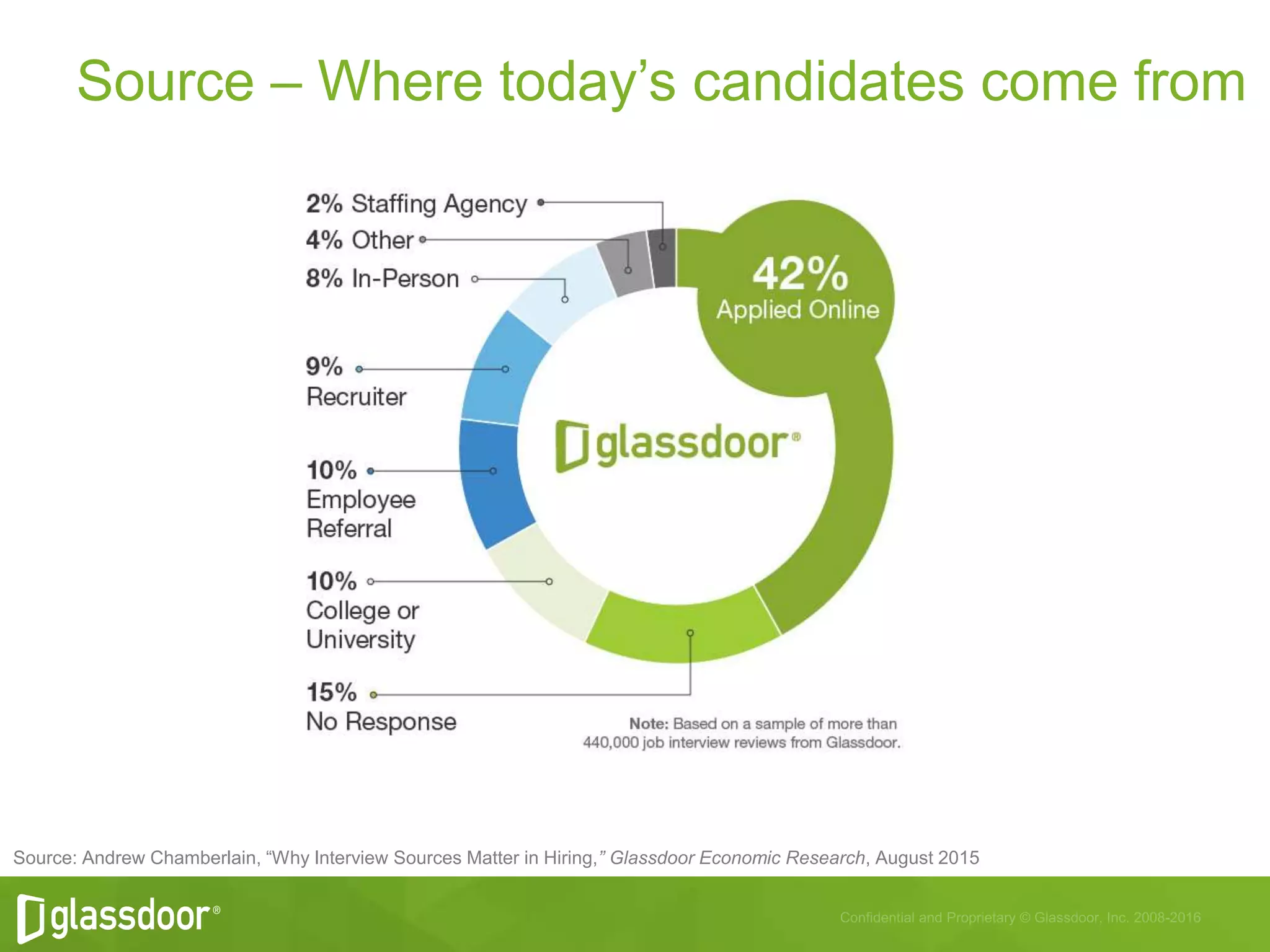

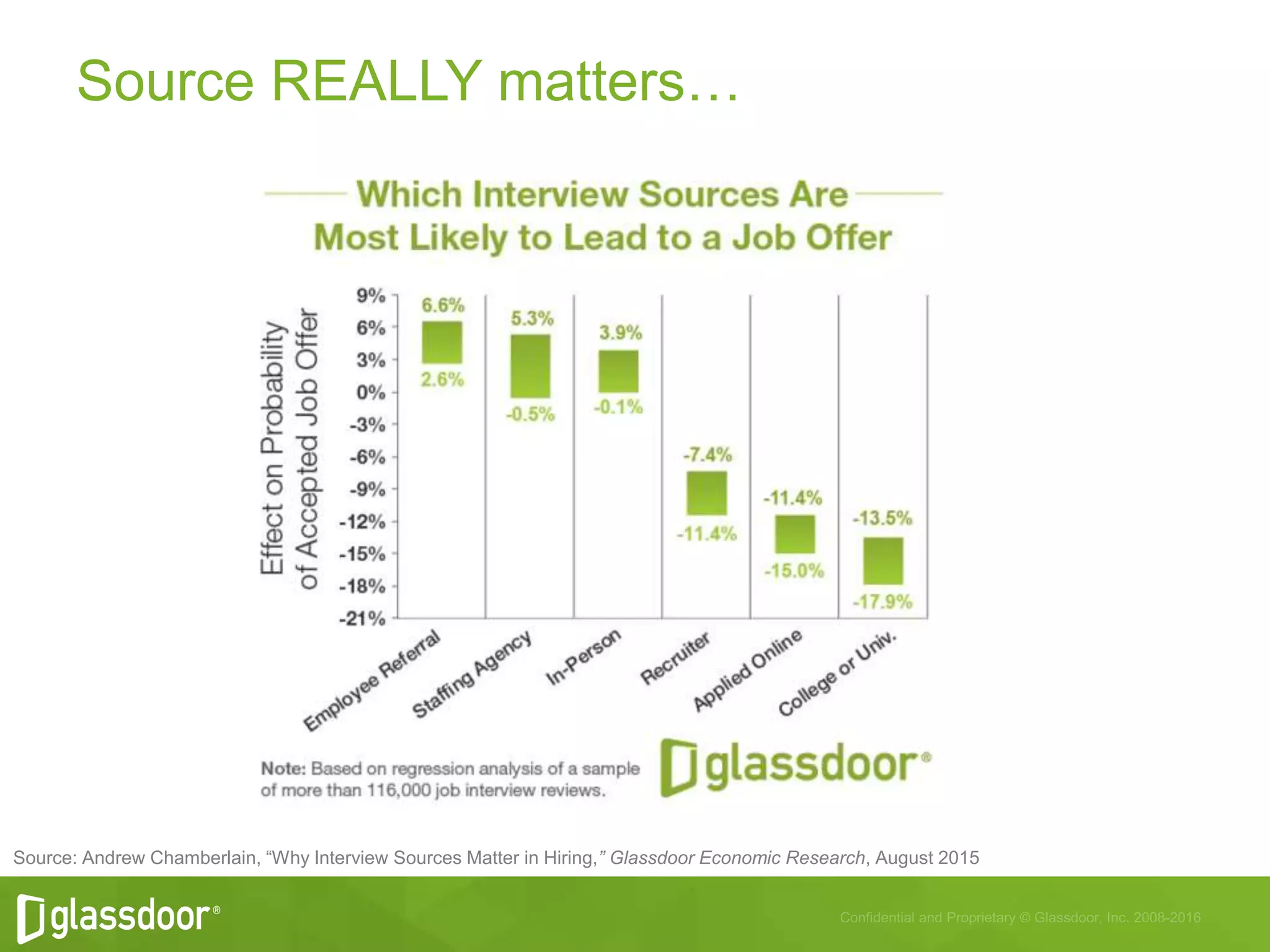

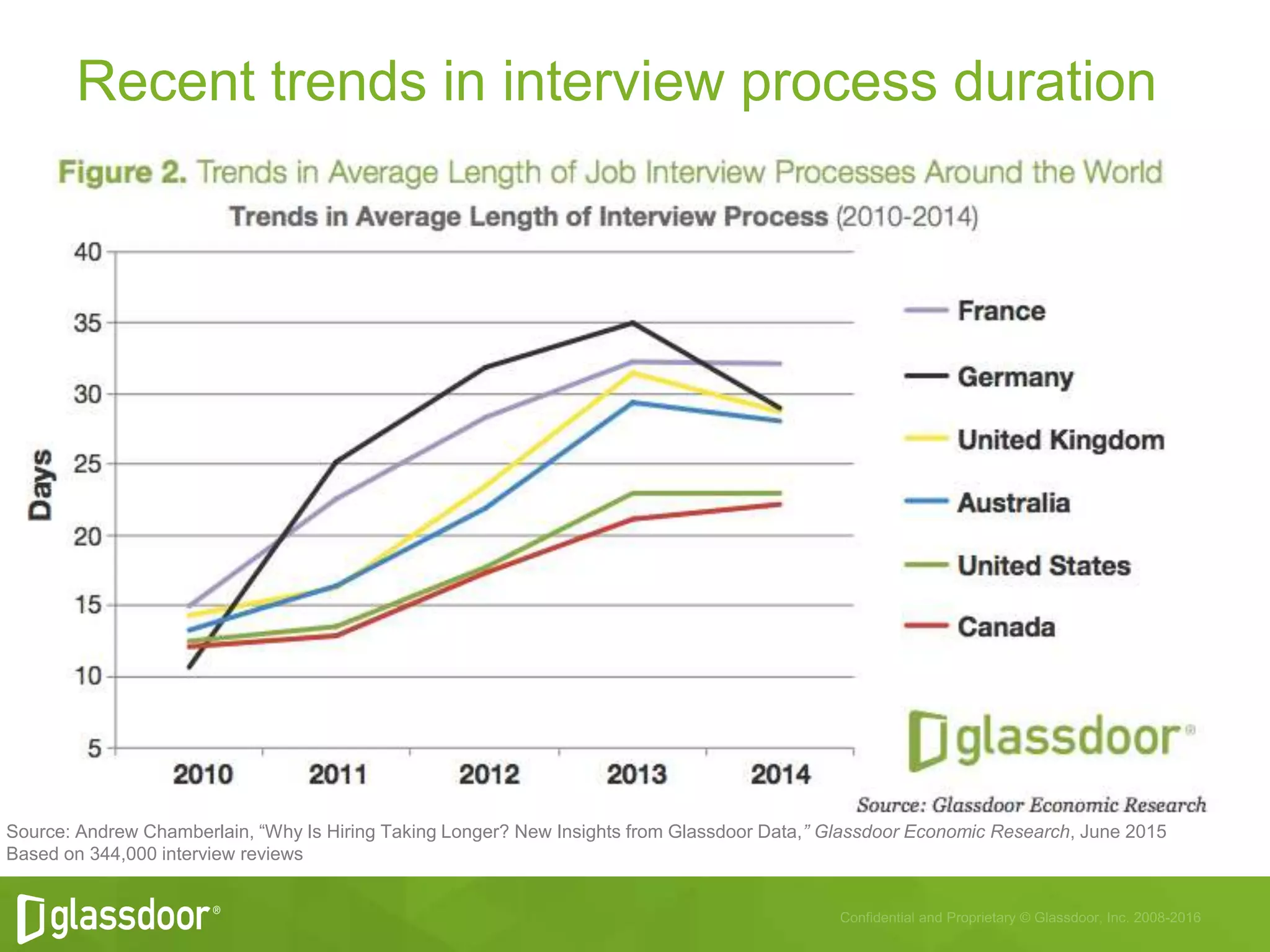

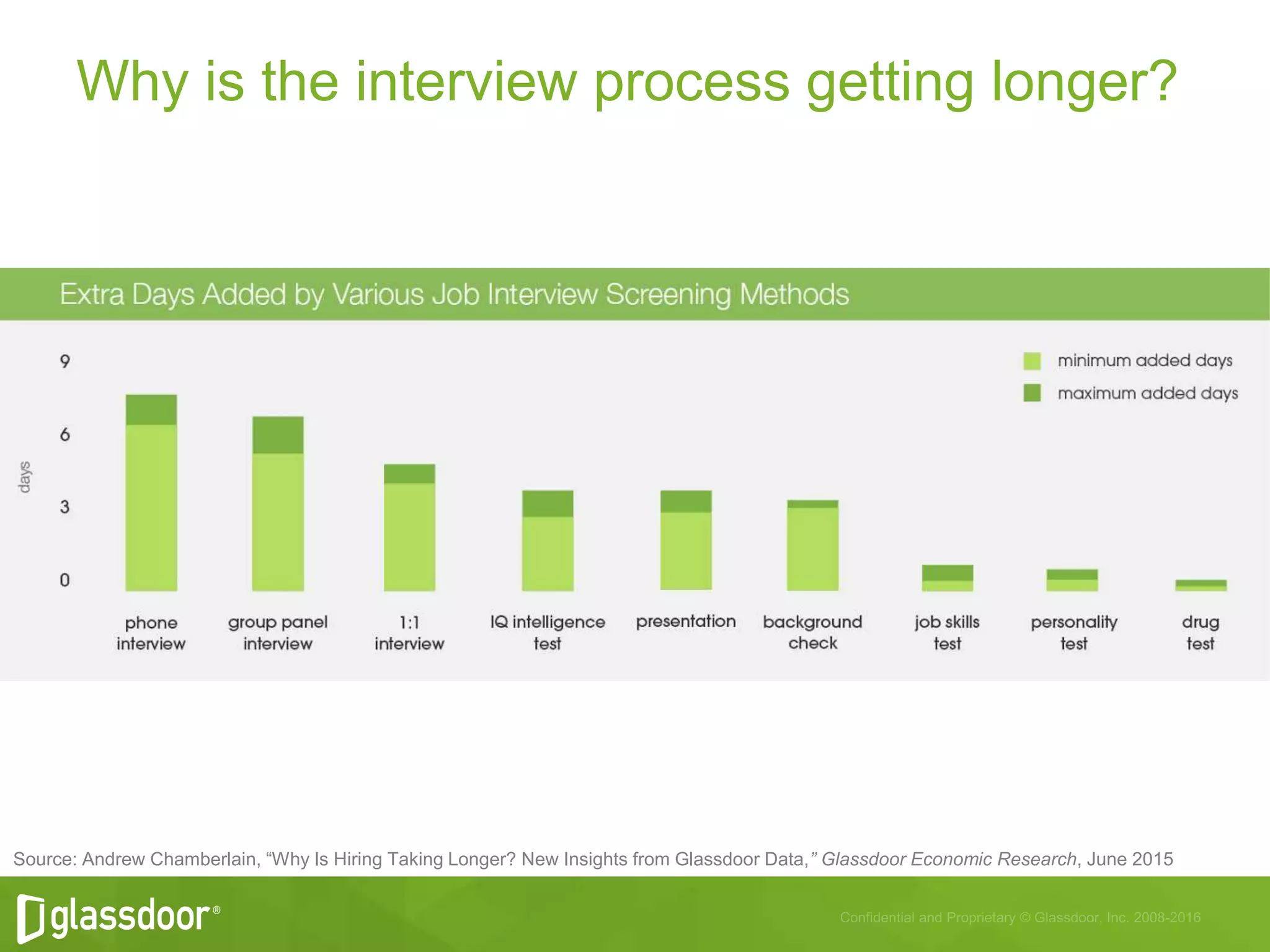

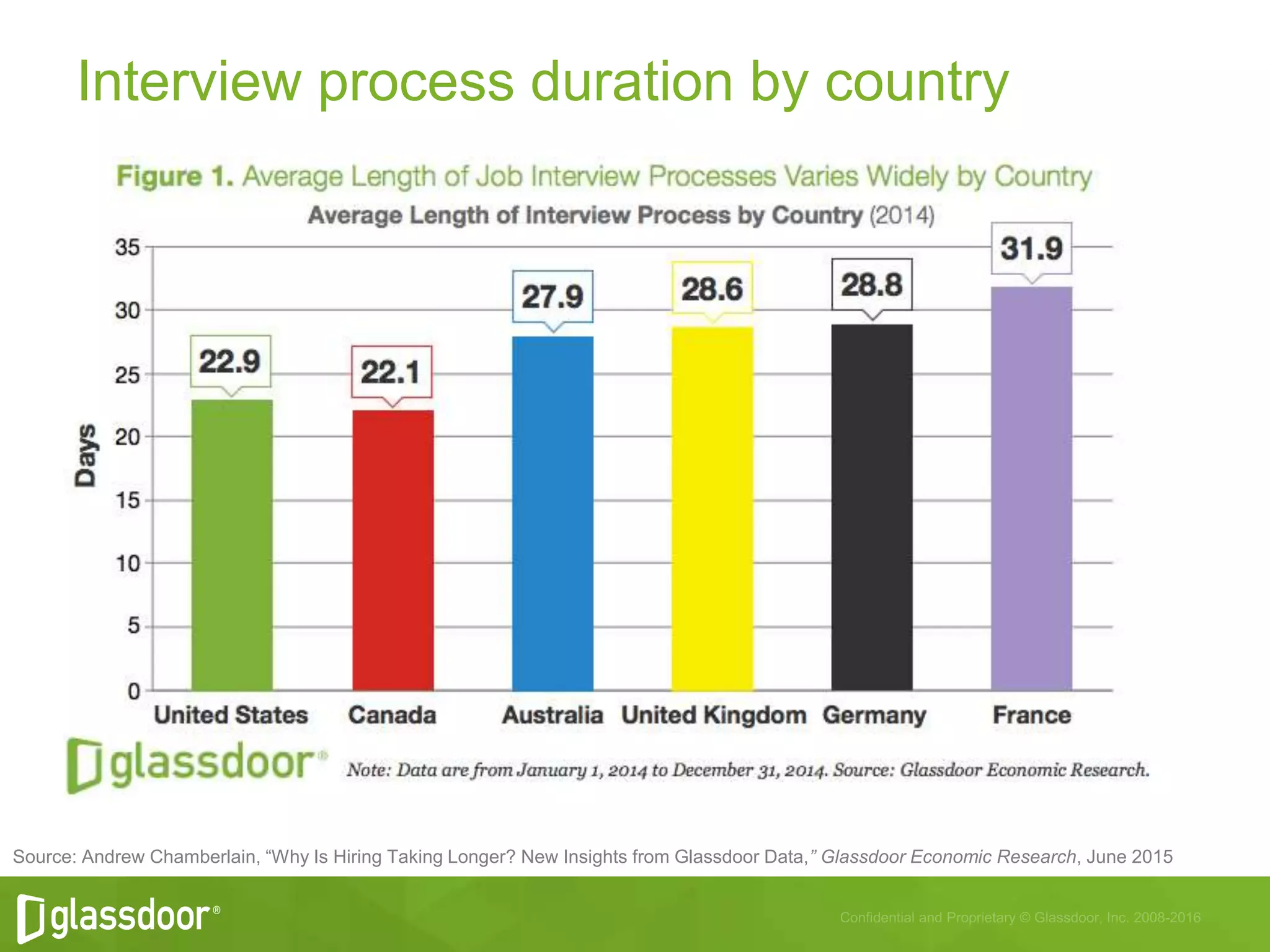

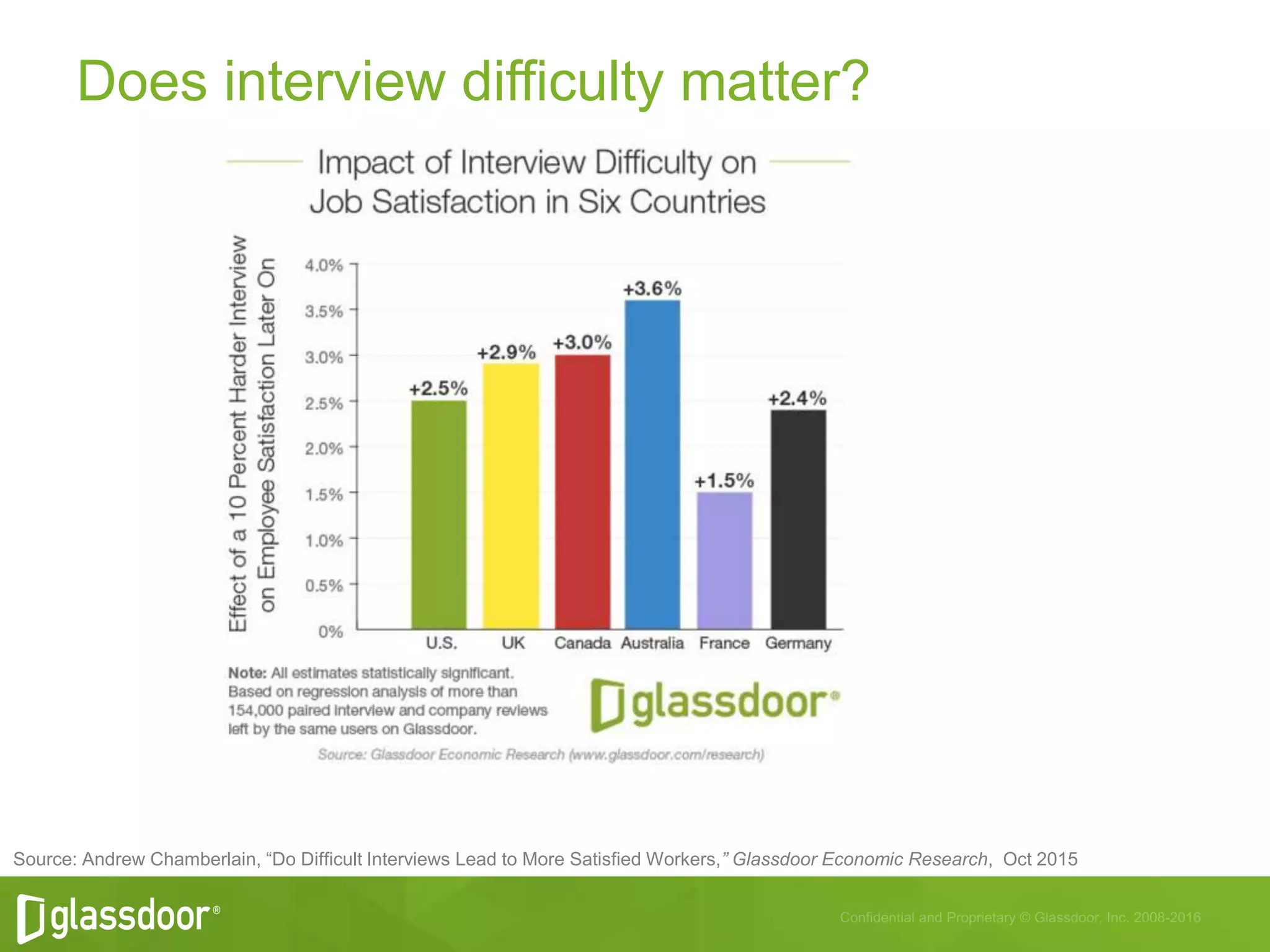

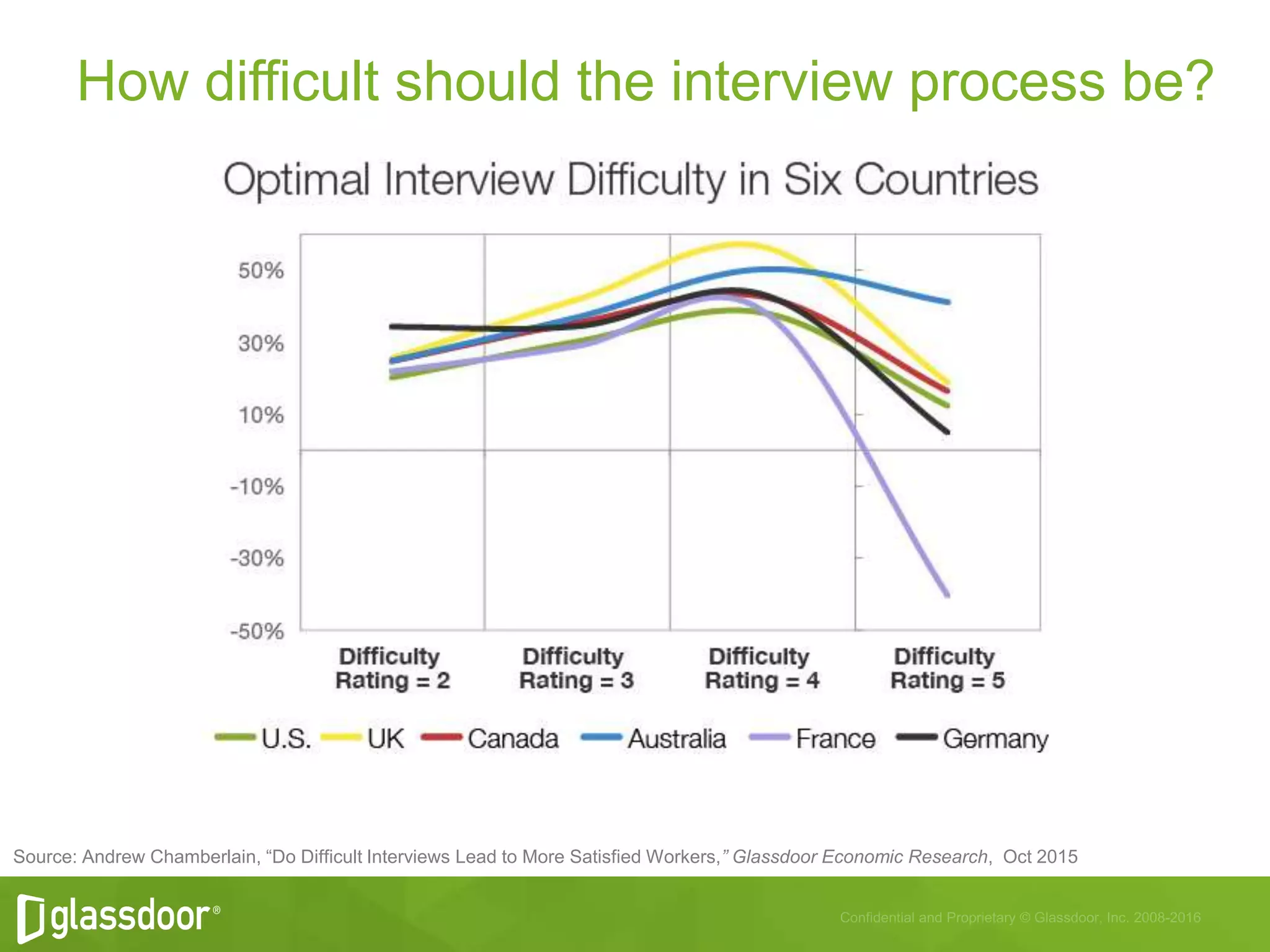

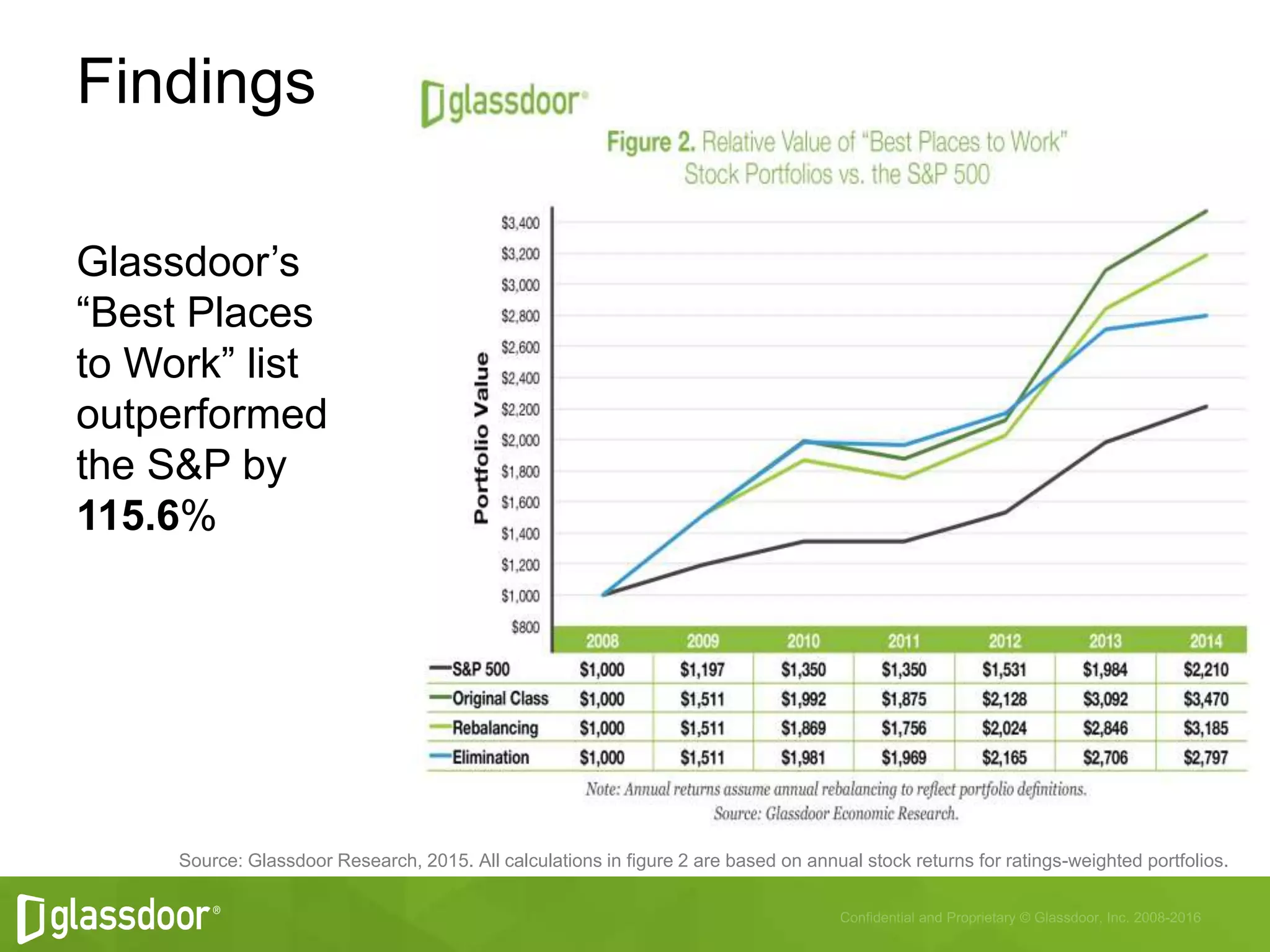

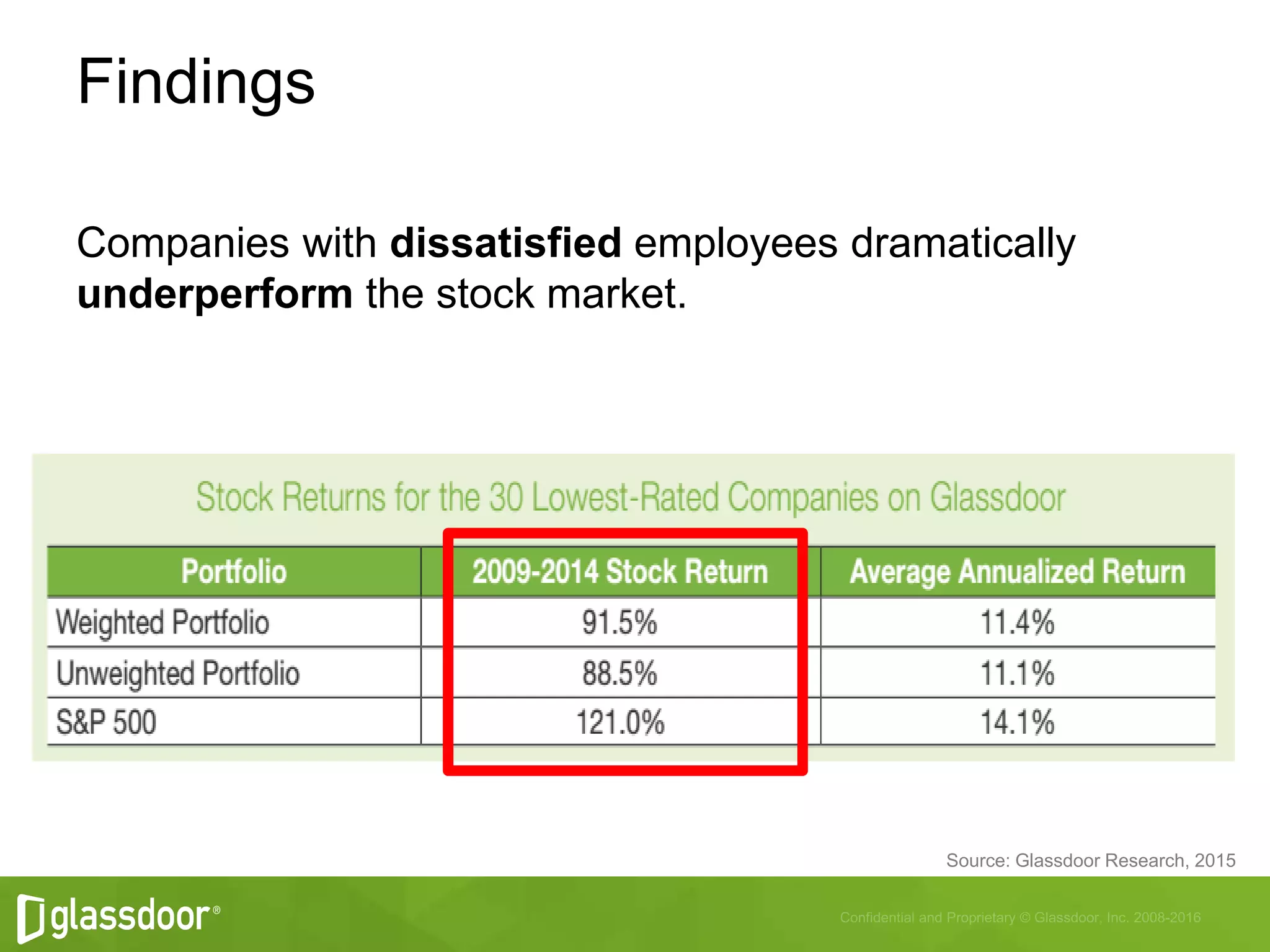

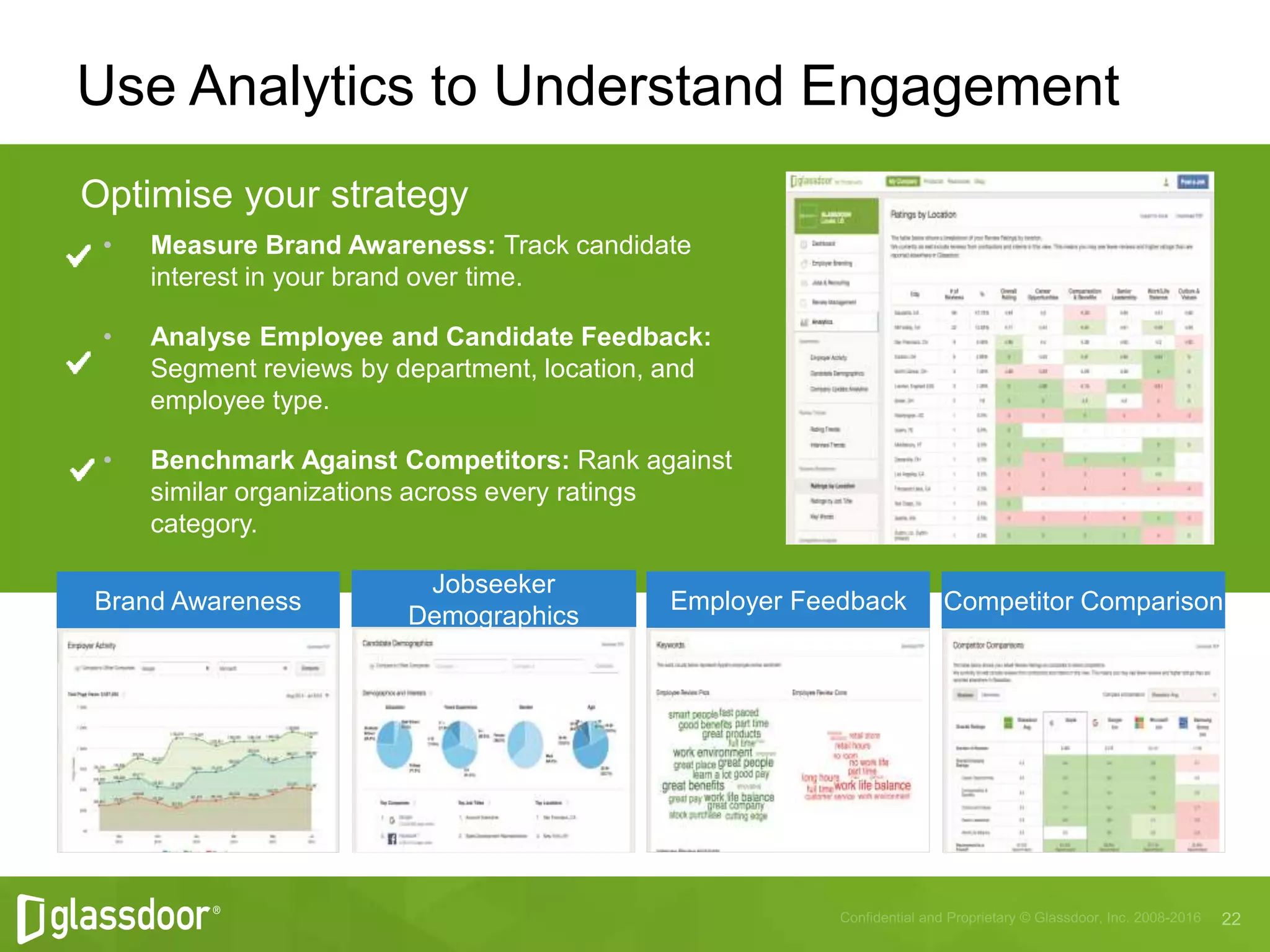

The document analyzes candidate and employee experiences using data from Glassdoor, emphasizing the importance of interview sources and process duration. It highlights that employee satisfaction significantly influences financial performance, with well-rated companies outperforming the market. Recommendations for organizations include improving sourcing, engagement strategies, and brand awareness through analytics.