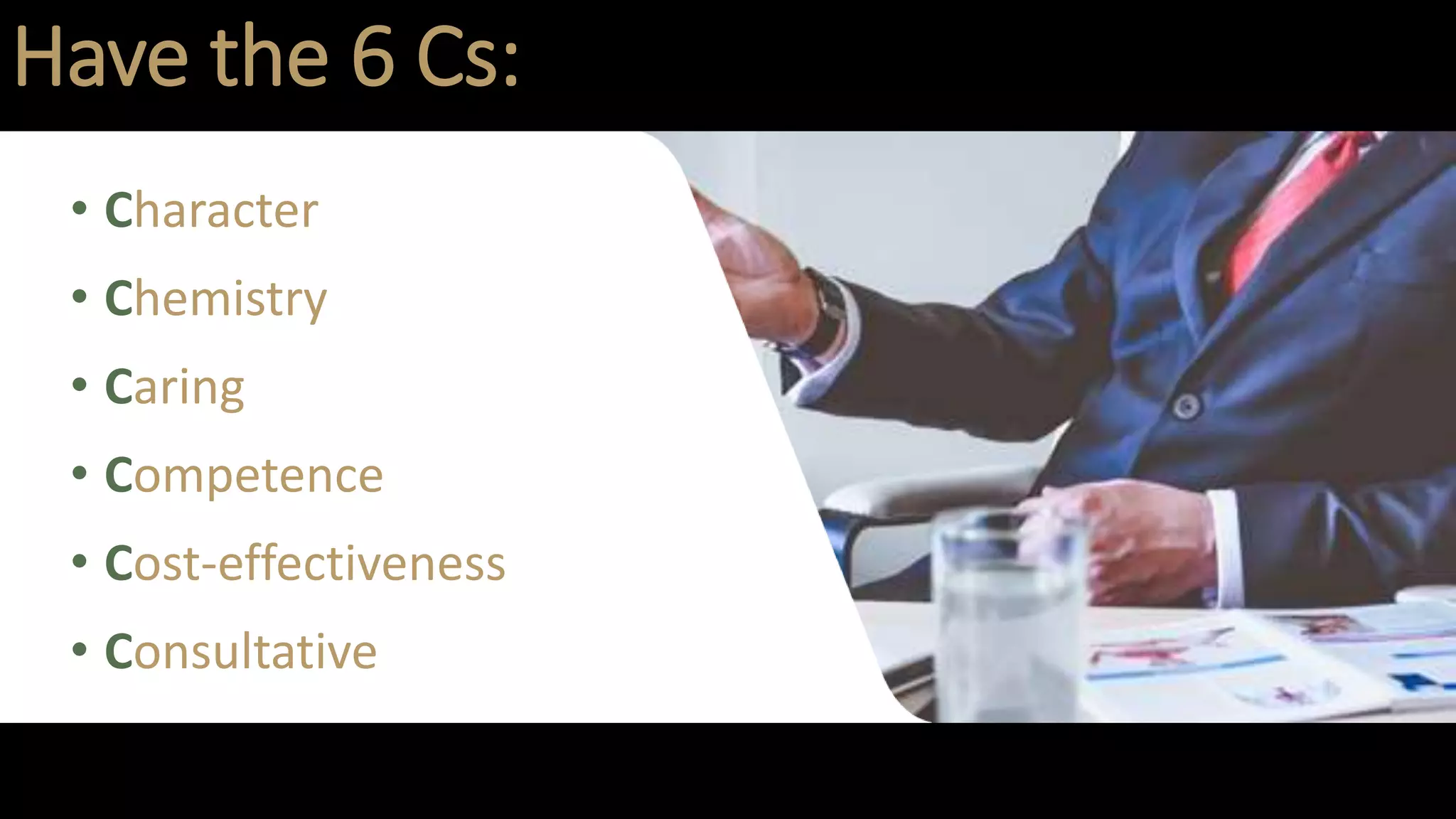

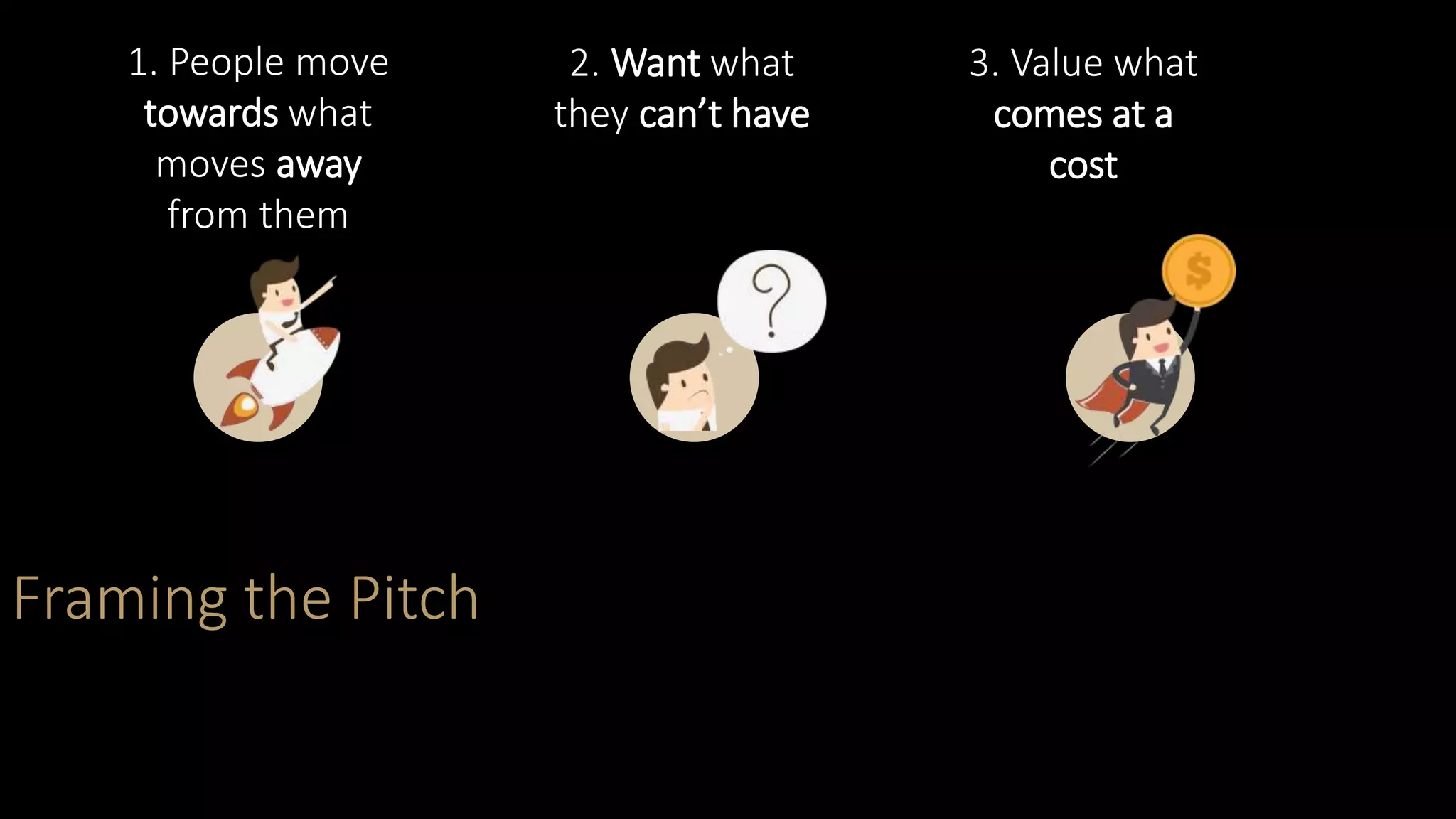

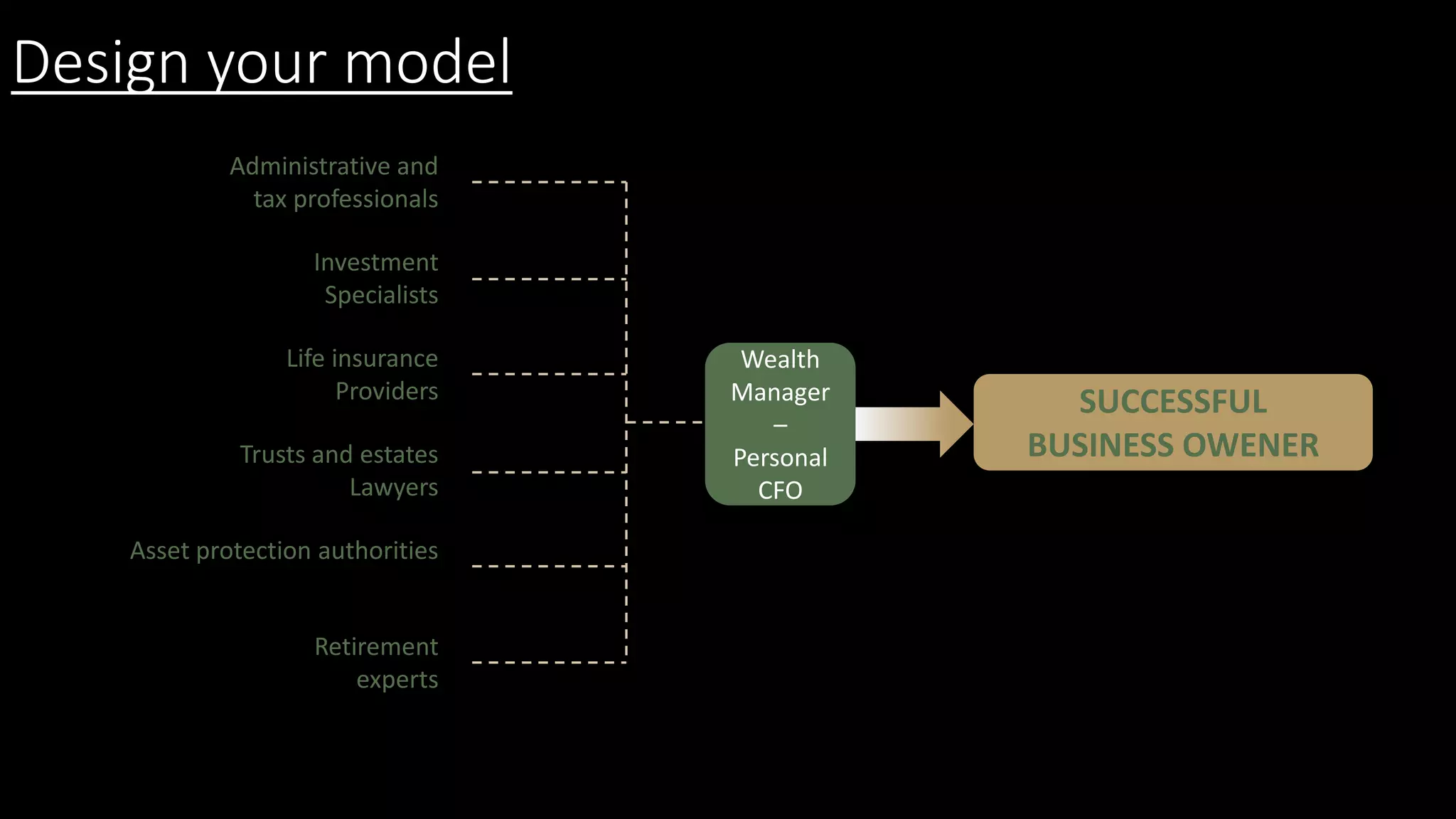

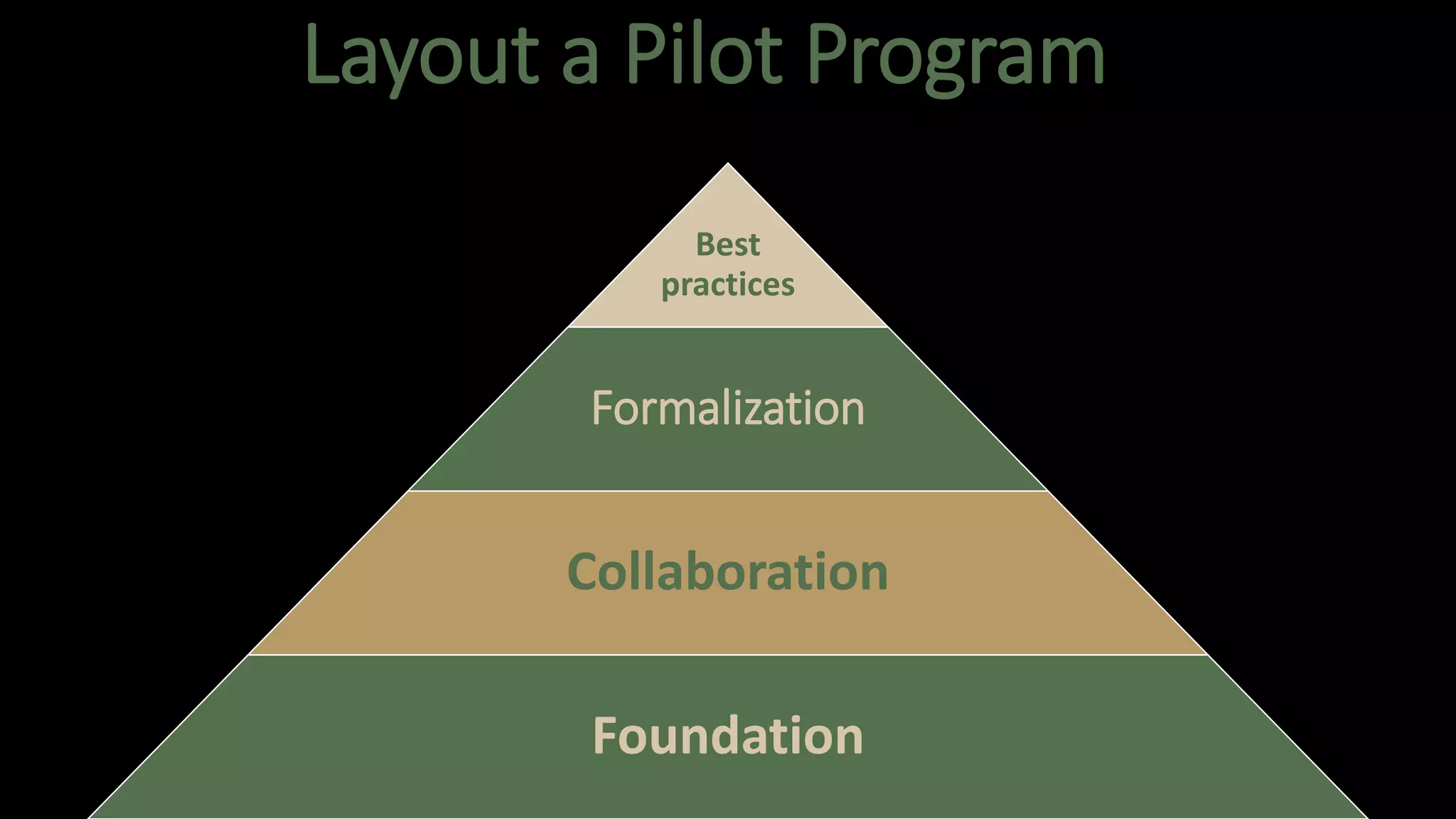

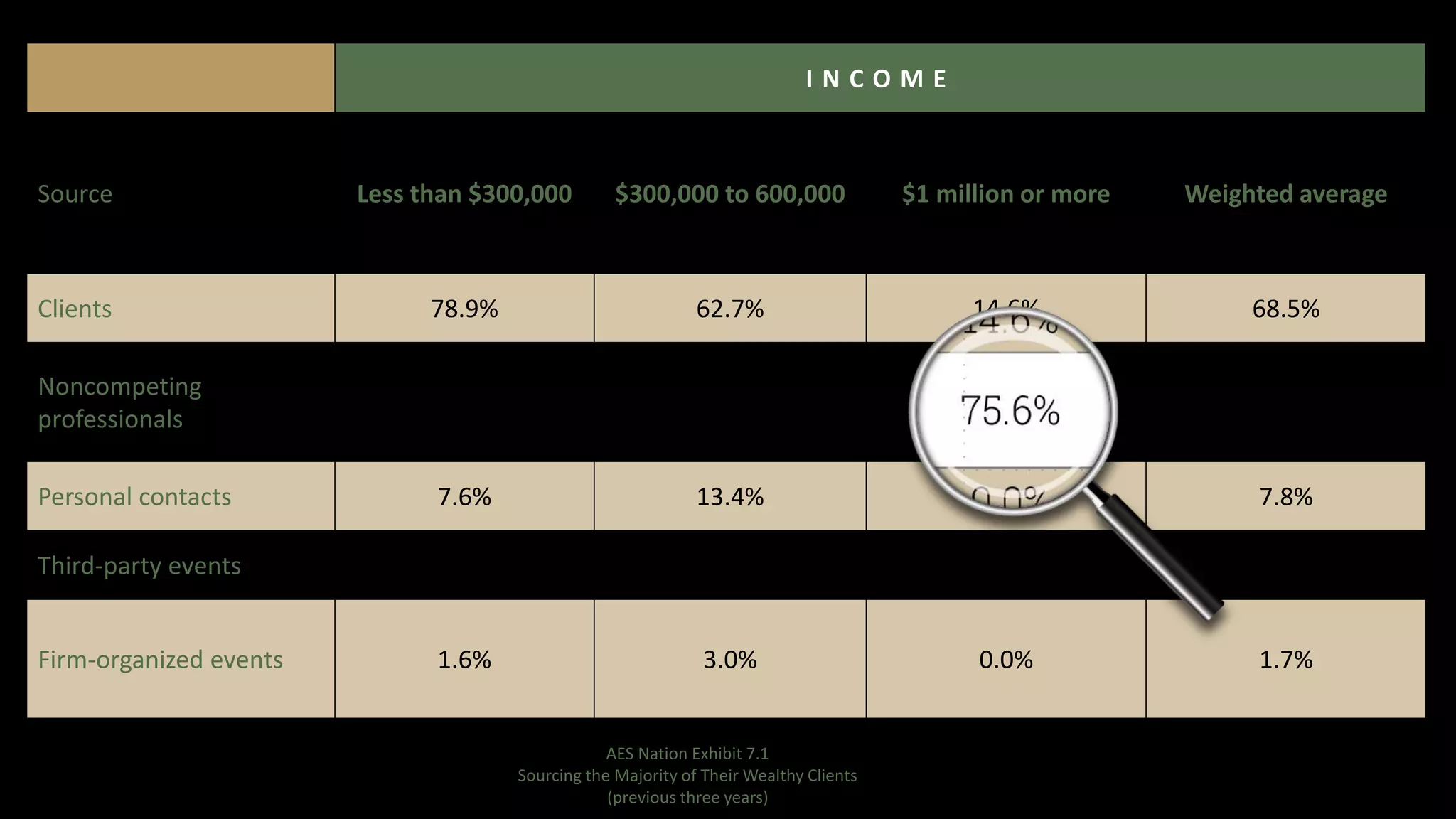

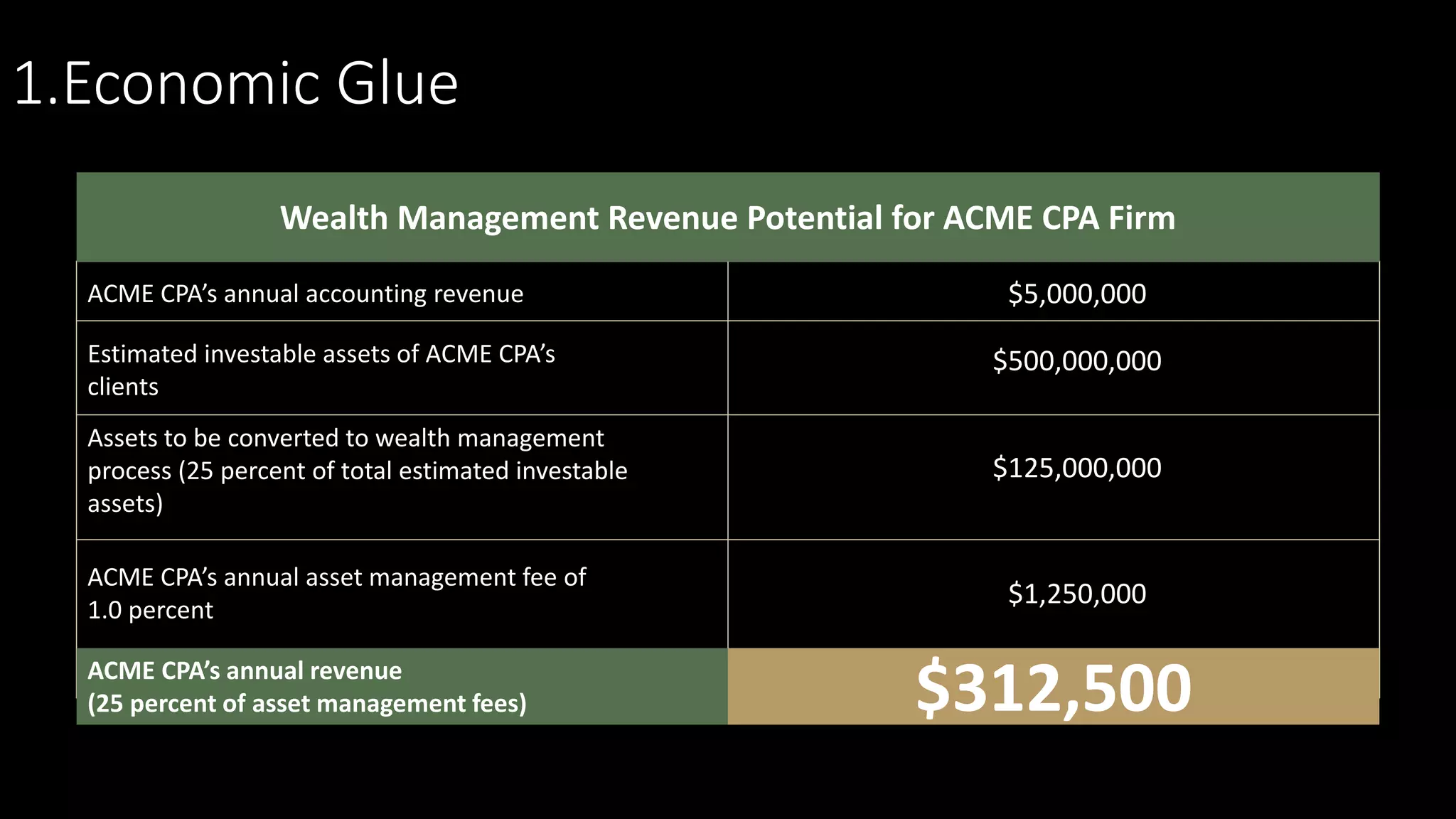

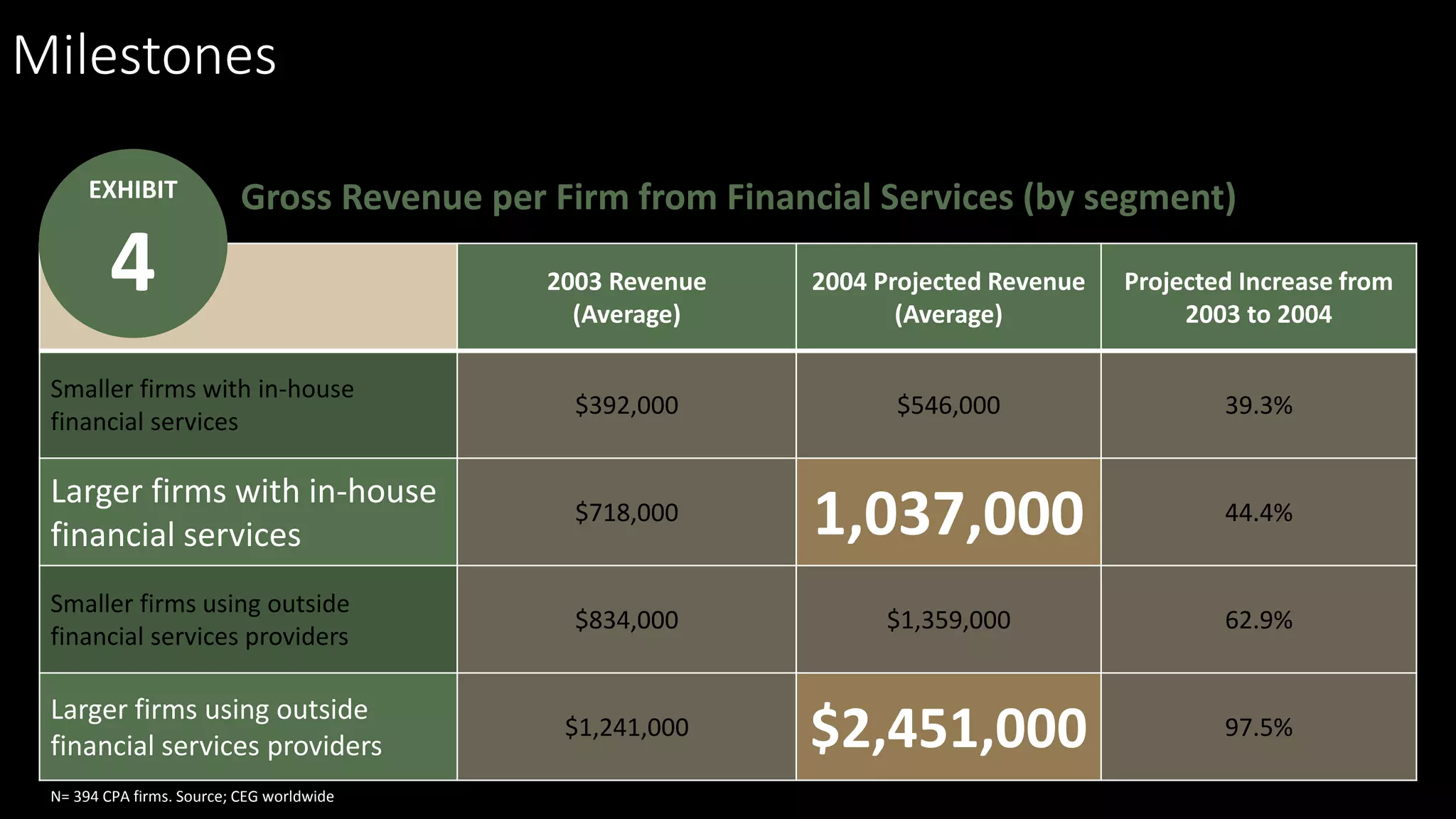

The document discusses strategies for law firms to enhance their business through non-competitive strategic alliances, emphasizing the importance of relationships with various professional stakeholders. It presents statistics on client sourcing among firms with different revenue levels and outlines best practices for collaboration, goal-setting, and integrating financial services. The findings indicate significant income potential for firms that effectively utilize these alliances in wealth management.