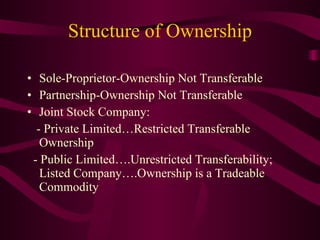

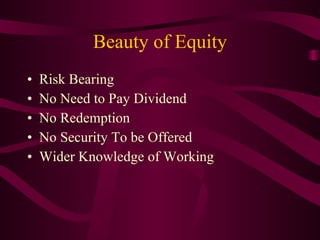

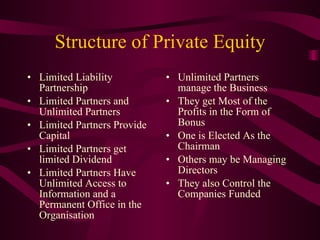

The document outlines the structure of ownership in various business forms, describing features of sole proprietorships, partnerships, and joint stock companies. It discusses funding types, including equity and debt funding, and highlights the relevance and increasing popularity of venture capital and private equity in financing businesses. Additionally, it touches on the roles of different funding agencies and the stages of financing, as well as the structure and dynamics of private equity partnerships.