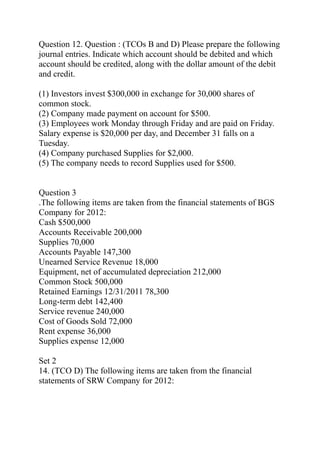

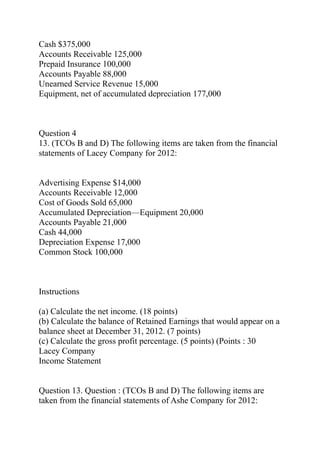

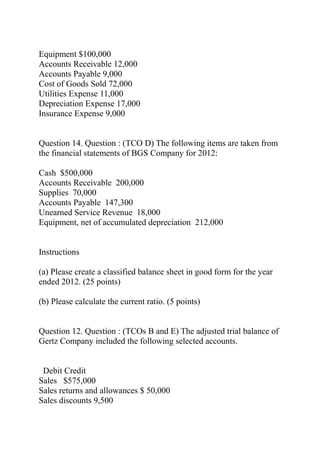

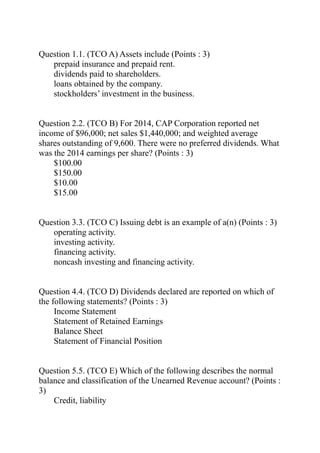

This document contains a midterm exam for an accounting course with 4 sets of multiple choice and problem-solving questions. It covers topics like internal controls, journal entries, financial statements, accounting equations, inventory costing methods, and more. The exam is available for purchase on the listed website that contains accounting course materials.