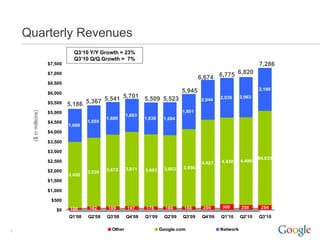

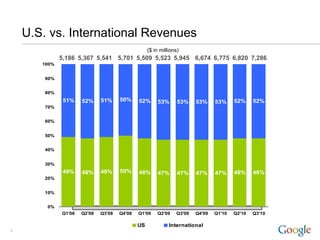

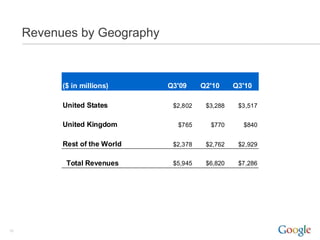

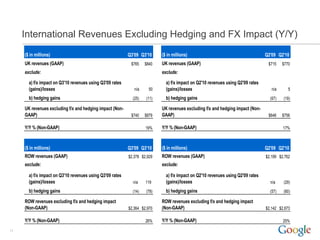

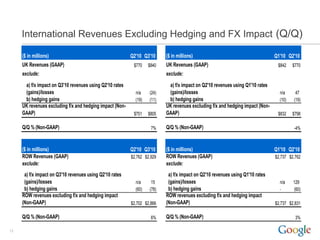

- Revenue grew 23% year-over-year and 7% quarter-over-quarter to $7.3 billion. International revenues were $3.8 billion.

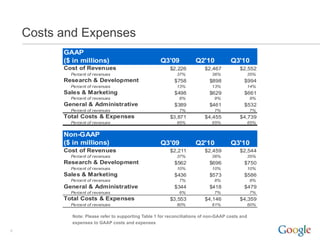

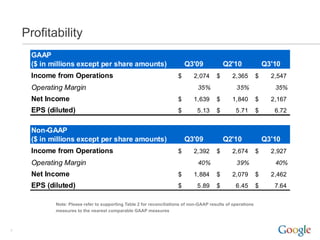

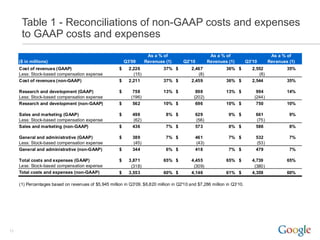

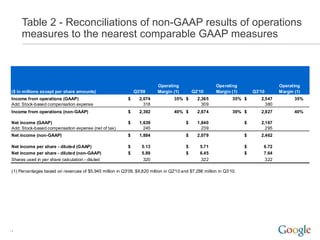

- Operating margins remained strong at 35% and the company continued investing heavily in growth through hiring and product development.

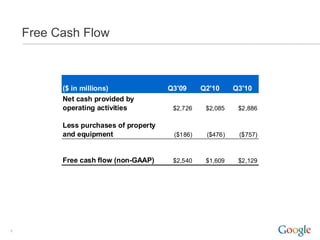

- Free cash flow increased 32% from the previous quarter to $2.1 billion, demonstrating strong cash generation.