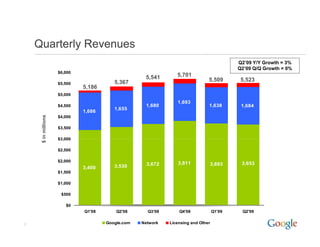

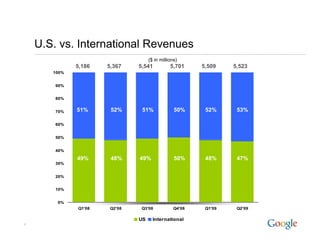

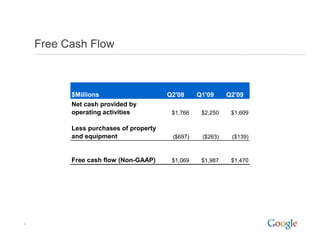

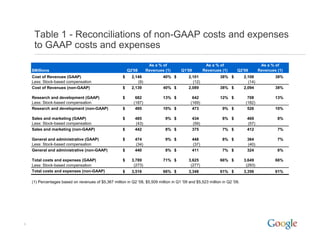

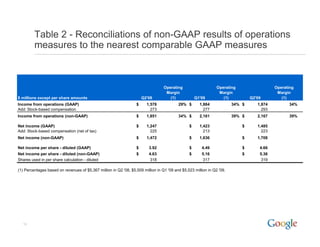

Google reported 3% year-over-year revenue growth in Q2 2009 to $5.5 billion. Revenues from Google properties grew 3% while network revenues increased 2%. International revenues reached $2.9 billion or 47% of total revenue. The company maintained operational efficiency through continued cost management while making key investments in search, ads, display, apps and mobile. Free cash flow was $1.47 billion after capital expenditures of $139 million.