Embed presentation

Download as PDF, PPTX

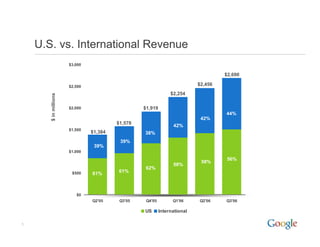

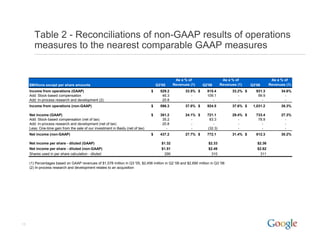

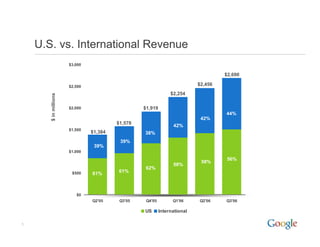

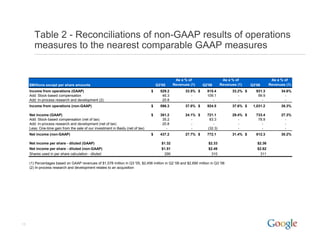

1) The document provides financial highlights from Google's Q3 2006 earnings call, including 70% year-over-year revenue growth and plans to acquire YouTube for $1.65 billion in stock. 2) Revenue growth was driven by increased monetization and traffic, with strong growth across advertisers. Operating income and net income reached record levels. 3) Google continued focusing on innovation and user experience while also forming new partnerships with companies like Fox, eBay, and Intuit.