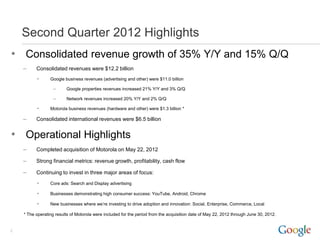

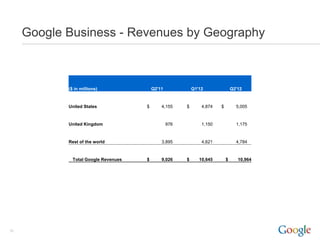

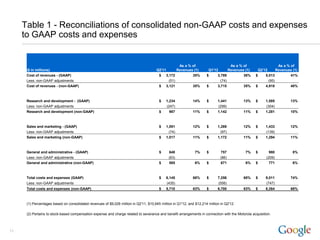

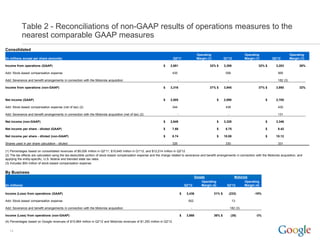

- Google reported strong revenue growth of 35% year-over-year and 15% quarter-over-quarter for Q2 2012, with consolidated revenues of $12.2 billion.

- Google business revenues grew 21% year-over-year and 3% quarter-over-quarter to $11 billion, while Motorola revenues were $1.3 billion following its acquisition in May 2012.

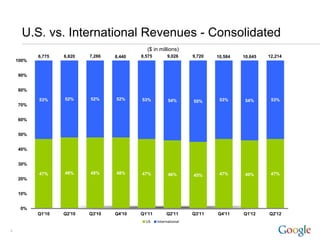

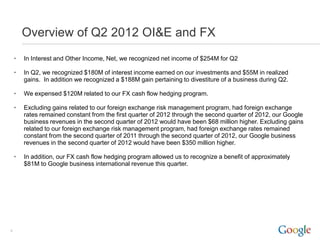

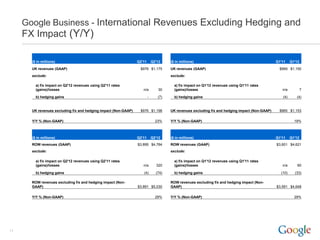

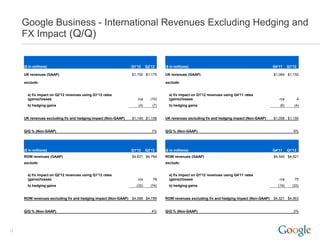

- International revenues grew and accounted for 47% of total revenues at $6.5 billion.