This document discusses Quintiles' third quarter 2014 earnings call. Some key points:

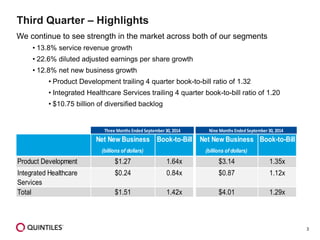

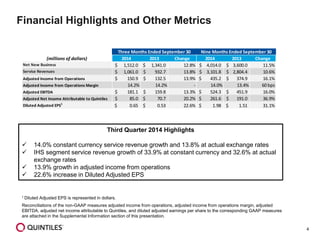

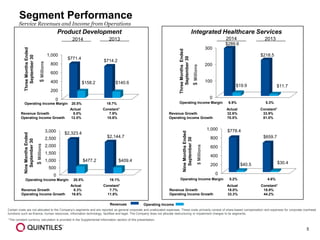

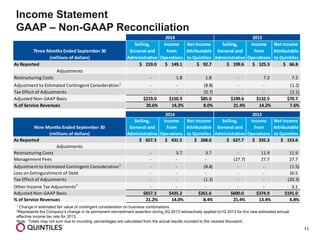

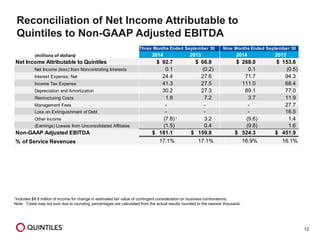

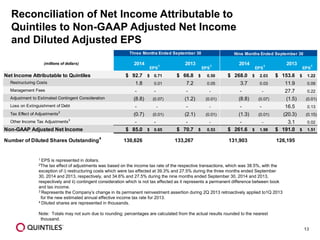

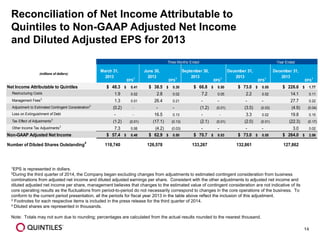

- Service revenue grew 13.8% and diluted adjusted earnings per share grew 22.6% compared to the third quarter of 2013.

- Net new business growth was 12.8% and the backlog was $10.75 billion.

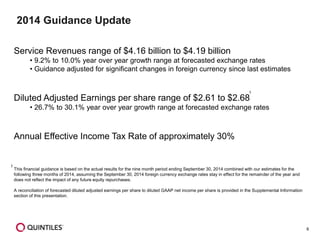

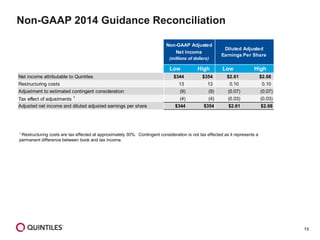

- Guidance for full year 2014 expects service revenue growth between 9.2-10% and diluted adjusted EPS growth between 26.7-30.1%.