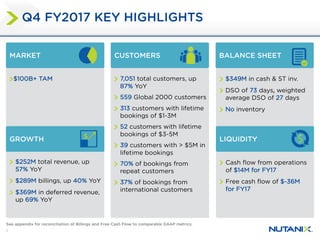

- The document is Q4 FYʹ17 Investor Presentation from Nutanix that provides financial results and key business highlights.

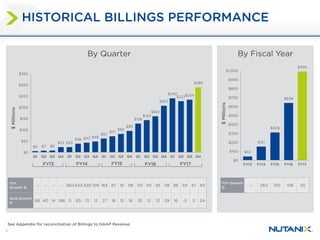

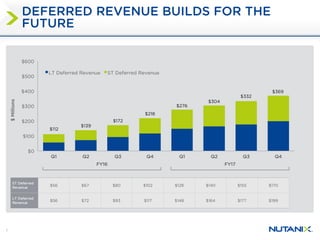

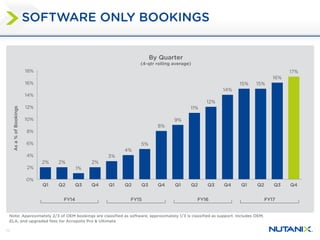

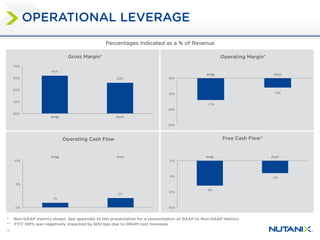

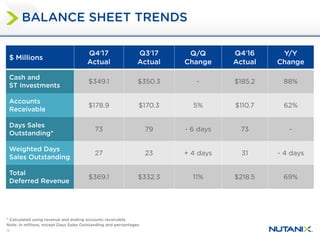

- Nutanix reported 57% year-over-year revenue growth to $252 million in Q4 FYʹ17, with billings growth of 40% and deferred revenue growth of 69%.

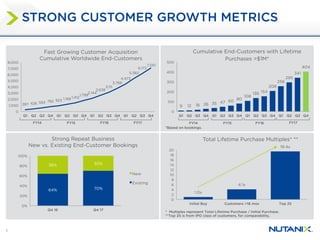

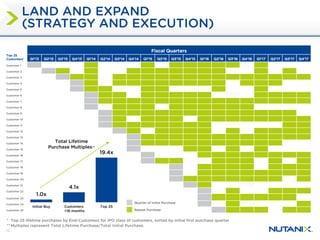

- Key metrics showed strong customer and sales growth, with total customers growing 87% year-over-year to over 7,000 and repeat sales comprising 70% of bookings.