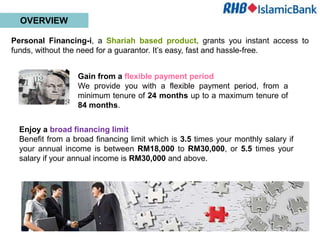

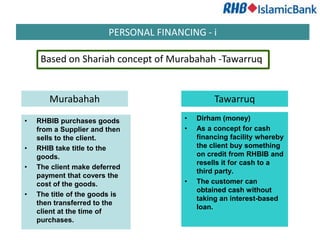

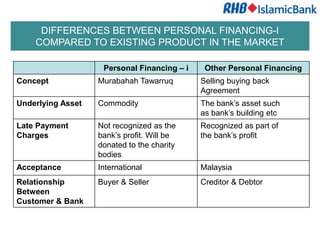

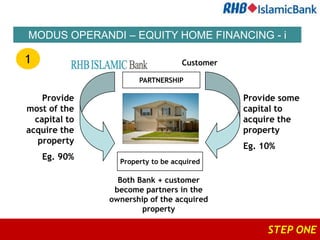

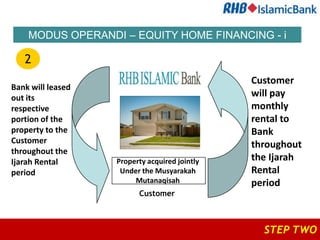

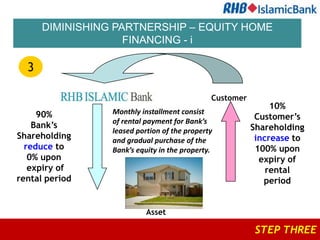

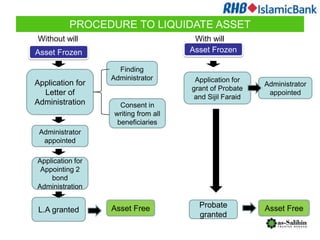

RHB Islamic provides Shariah-compliant banking services and products in Malaysia. It has over 15 years of experience in Islamic banking and manages over RM10.9 billion in assets. RHB Islamic offers various personal financing, home financing, deposit accounts, debit/credit cards, and investment products that comply with Islamic principles. The document provides details on their Personal Financing-i and Equity Home Financing-i products which are based on Murabahah and Musharakah Mutanaqisah contracts respectively. It also discusses their estate planning services which help properly distribute assets according to Islamic inheritance rules.