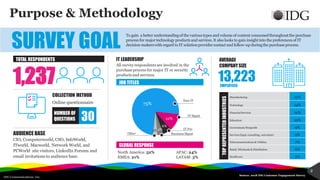

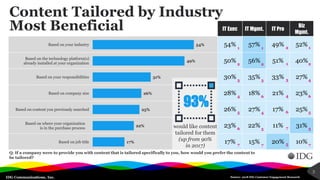

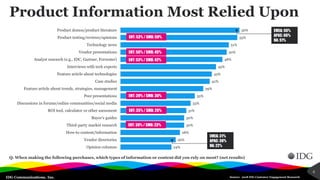

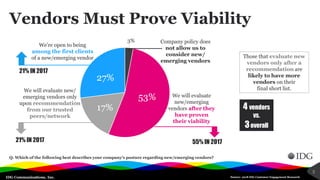

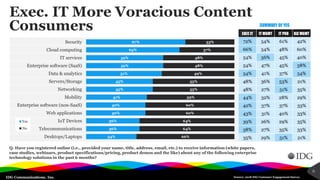

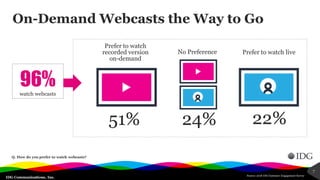

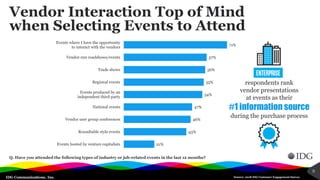

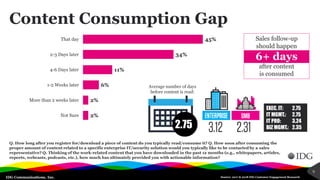

The document presents the findings of the 2018 IDG Customer Engagement Survey, which explores the content consumption patterns of IT decision-makers throughout their purchasing journey. It highlights preferences for tailored content, types of information relied upon during purchases, and the importance of vendor credibility. Key insights include a significant demand for personalized content and the methods through which decision-makers engage with vendors and information resources.